Right now in California we basically have AlieraCare InterimCare health sharing plans. The tax penalty was eliminated in 2017 by the Trump administration but the state of California has reinstated it for 2020.

Risks Of No Health Insurance In California Personal Financial

Risks Of No Health Insurance In California Personal Financial

Despite that93 percent of Californianshave health insurance the California Legislature voted Monday to tax California citizens who do not buy health insurance.

No medical insurance in california. UHC allows small employer groups to offer HMO PPO and HSA plans with full medium and narrow provider networks which is more flexible than most other California insurers. The law contains several exemptions that will allow certain people to avoid the penalty among them prisoners low-income residents and those living abroad. For background on this new law read our recent article.

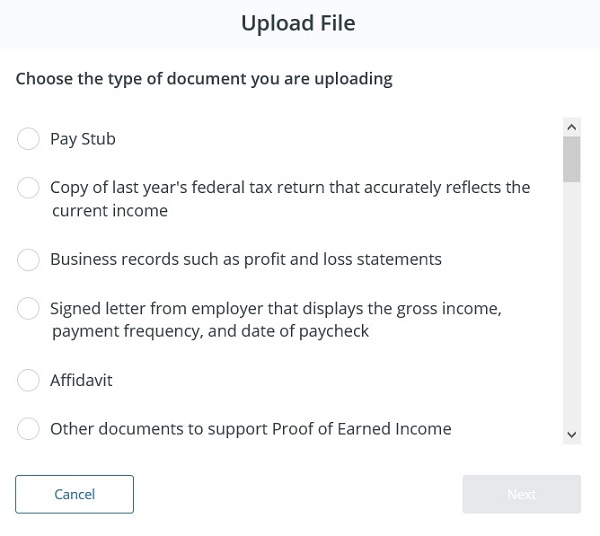

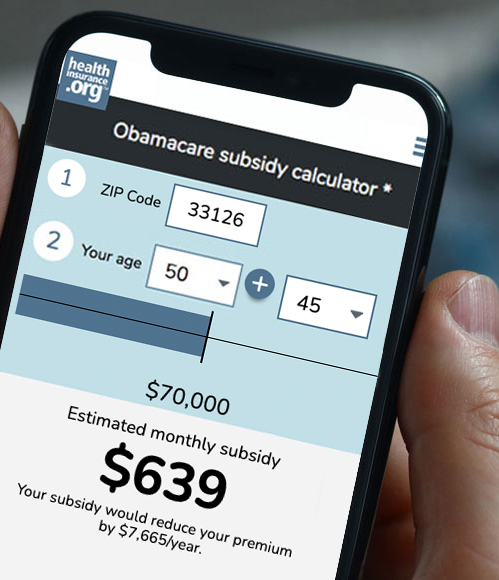

Californians Without Health Insurance Will Pay A Penalty Or Not. California residents who do not have health insurance in 2020 will have to pay a tax penalty in 2021. See the table below or use the Estimator Tool which will take you away from our page to the State of California Franchise Tax Board.

What is the penalty for not having health insurance. As we get more options well add their plans and rates into the rating engine. Read our blog to learn more.

Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act you may still need to pay a tax penalty in 2021 if you live in California and do not have health insurance. If you are uninsured for part of the calendar year you may still be exempt from a penalty so long as you are uninsured for less than three consecutive months. For now it is AlieraCare and you can quote them here.

California banned short term health insurance plans effective 912018. The options available to Californians without health insurance has changed significantly with the advent of the ACA law and Covered California. Starting in 2020 California residents must either.

Short-term health insurance in California Short-term health insurance plans are not available for purchase in California. According to the Affordable Care Act if you do not get health insurance coverage you will be penalized at tax time. People who purchase insurance.

What you need to know about Californias Individual Healthcare Mandate including potential financial penalties available exemptions and possible financial assistance. Most types of insurance including Medi-Cal Medicare and employer-sponsored coverage will satisfy Californias requirement. Lets look at the options and keep in mind that everyones situation is different and often complicated.

Californias lawmakers passed a bill in 2018 that prohibits the sale or renewal of short-term health insurance plans in California as of January 1 2019. UHC offers small and large group medical insurance plans but no coverage for individuals. Have qualifying health insurance coverage or pay a penalty when filing a state tax return or get an exemption from the requirement to have coverage.

How much is the 2020 California Tax Penalty for no health insurance. This penalty revenue will be used to fund health insurance subsidies to encourage more people to purchase health insurance and to provide health care to illegal immigrants. A new state law could make you liable for a hefty tax penalty if you do not have health insurance next year and beyond.

A taxpayer who fails to get health insurance that meets the states minimum requirements will be subject to a penalty. 2020 California Tax Penalty for No Health Insurance. Tax Penalty for No Health Insurance 2020.

UnitedHealthCare offers coverage in all 50 states and is a good fit for an employer with employees who reside in different states. But some of you need not worry. Small Business Medical Plans Covered California.

Covered California the states Affordable Care Act insurance exchange will allow residents to enroll in a healthcare plan through March 31 to avoid paying the individual mandate which can be. You can contact Covered California by phone at 800 300-1506 TTY. The sale of other non-ACA-compliant plans such as fixed indemnity products and critical illness plans continues to be allowed Read more about short-term health insurance in California.

If you are a Californian with no health insurance in 2020 you may face a tax penalty in 2021. If you do not have health insurance Covered California can help you determine if you qualify for Medi-Cal or federal subsidies and can provide you with coverage options and plan costs. Californians be warned.

In 2018 Senate Bill 910 was passed by California lawmakers which effectively banned the sale and renewal of all temporary health policies starting January 1 2019. To avoid a penalty for no health insurance you must have either a valid exemption or you must be enrolled on a qualified health plan.