Also called a Spend Down program ones excess income the amount that is determined as ones cost of share is used to cover medical bills. Once one has paid his or her share of cost Medi-Cal will kick in for the month.

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

Are age 19 through 64.

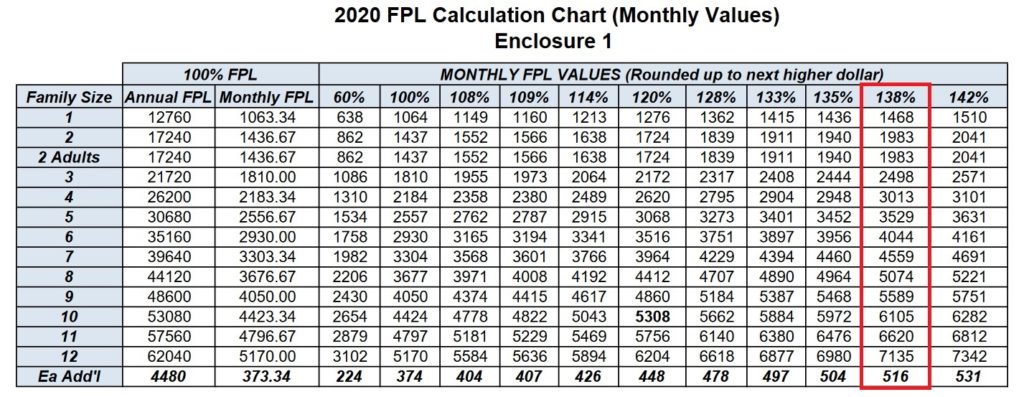

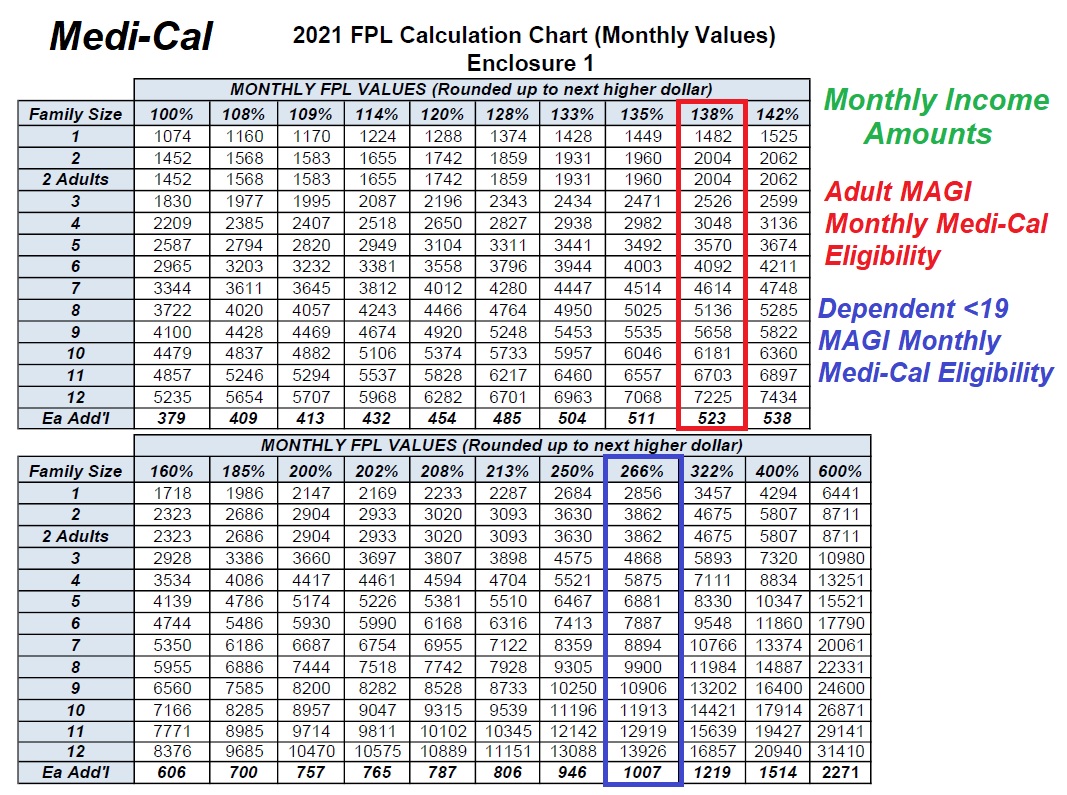

Medical wage limit 2020. The unshaded columns including the 100 column display 2020 FPL values as published by the Department of Health and Human Services. For each extra dependent child add. Inclusion of pay rates for other grades 2.

Medicare provides the chart below to show the yearly 2019 income thresholds associated with adjusted Part B premiums. Income numbers are based on your annual or yearly earnings. For this you will need to upload documents showing income and expenses.

Wage band Previous rate 1 April 2020 to 31 March 2021 Age 25 and over National Living Wage 872. Covered California listed the single adult Medi-Cal annual income level 138 of FPL at 17237 and for a two-adult household at 23226. File married and separate.

Please implement the new awards from that date. Health Initiative Program Medi-Cal for Adults Medi-Cal for Pregnant Women Medi-Cal for Kids 0-18 Yrs Household Size Program Eligibility by Federal Poverty Level for 2020 Medi-Cal and Covered California have various programs with overlapping income limits. Add the extra child rate for each child you have to the couple combined rate in the table.

Age 21 to 24. Salary scales for doctors and dentists in training have been increased by 20 to basic pay from 1 April 2020. 183 per week 792 per month 9500 per year.

This will let you know if you might qualify for a medical card or GP visit card. There are no income limits to be eligible to contribute to an HSA although you do need to enroll through your employer and have a high-deductible health insurance plan in order to qualify. This will give you the amount your income should be below to qualify to keep the card.

Most consumers up to 138 FPL will be eligible for Medi-Cal. Have annual household income at or below the Medicaid standard see income chart below. The IRS announced on May 20 2020 that they are increasing the HSA contribution limits again.

Medically needy individuals have a single-household monthly limit of 883 and 1813 for a family of four. Increases to national salary scales from 1 April 2020 1. Citizen or meet Medicaid immigration requirements.

Some categories of people are exempt from the means test including people entitled to a medical card under EU Regulations. The weekly income limit for a couple is 1050. From 1 November 2020 the weekly income limit for a single person over the age of 70 is 550.

File joint tax return. As of 2021 for those living in the community the MNA is 600 for an individual and 934 for a married couple. A full assessment is carried out later in the application process.

The weekly income threshold for couples jumps 150 or over 16 per cent. Medical card holders may also be exempt from paying school transport charges and State exam fees in publicly-funded second-level schools. 2020 to 2021.

If your income changes or theres a change of circumstances you must tell us. It is based on basic income and expenses information. To see if you qualify based on income look at the chart below.

169 per week 732. Household Size Annual Monthly Twice-Monthly Bi-Weekly Weekly. For example payslip proof of social welfare payment childcare costs etc.

Are not entitled to Medicare. As a result of Budget 2020 the weekly income limit has been increased by 10 per cent or 50 for single people to 550. Medical card holders pay the Universal Social Charge on their income if it is over the exemption limit but there is a reduced rate.

The monthly limit for a one-person household is 517 and 1048 for a family of four. Doctors and dentists in training with effect from 1 April 2020. You may be eligible for Apple Health for Adults coverage if you.

120 per week 520 per month 6240 per year. The DHCS 2020 FPL income chart lists a higher amount of 17609 for a single adult and 23792 for two adults. Age 18 to 20.

AIAN Limited Cost Share all income levels The unshaded columns display 2020 FPL values to determine eligibility for premium tax credits and cost sharing reductions for health plans effective in 2021. Children under six have an income limit of 1617 and 1468 for kids under the age of 19. File individual tax return.

Contributions are also 100 tax deductible at all income levels.