Videos you watch may be added to the TVs. This additional cost is something to consider.

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

With an EPO you typically dont need a referral to see a specialist which makes it more flexible than an HMO.

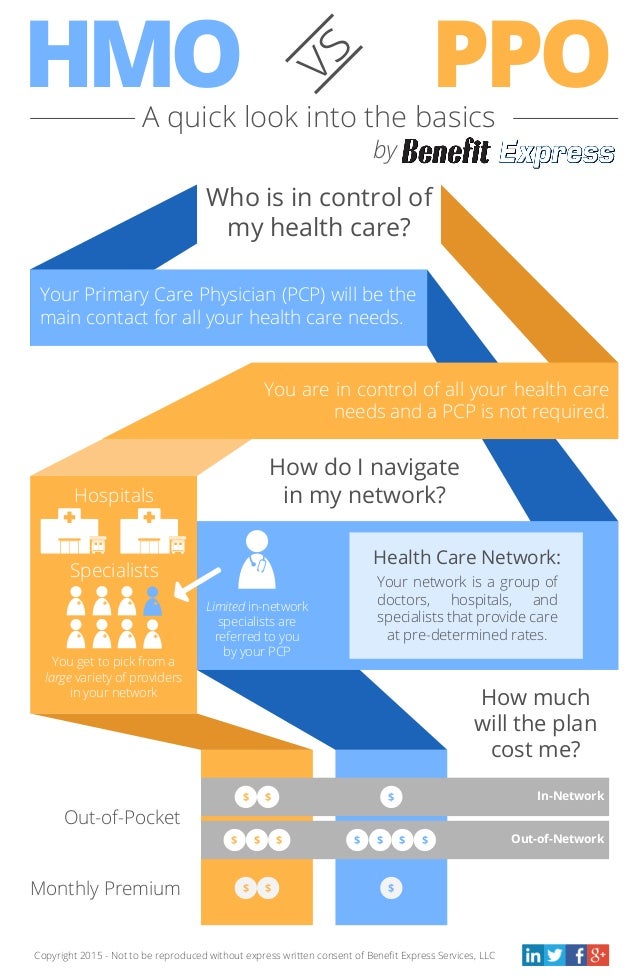

What is the difference between hmo and ppo health plans. HMOs and PPOs are distinct healthcare plans and networks and each provides members with quality care and benefits. An HMO offers no coverage outside of the network but patients typically enjoy lower premiums. The Independent Benefit Advisors can help choose between an HMO PPO EPO HDHP POS.

An exclusive provider organization EPO plan is situated between an HMO and PPO in terms of flexibility and costs. However like an HMO there are no out-of. With a PPO the trade-off for receiving a little bit of coverage outside of your network is usually a higher monthly premium.

As mentioned previously the three main differences between an HMO and a PPO are the costs plan networks and the need for a primary care physician. However there are a few other details that differentiate these two coverage options such as the need to file claims. Like an HMO a PPO plan has network providers that will be covered under your plans benefits.

The differences however are distinct but the major difference suffices in the size of the plan network cost our ability to see specialists and coverage for out-of-network services. But the major differences between HMO and PPO plans are based on the cost size of the plan network your ability to see experts and coverage for out-of-network services. Out-of-pocket medical costs can run higher with a PPO health plan as well so they are a more expensive option than an HMO.

5 Zeilen HMO Versus PPO. The cost of health insurance is an important differentiator between an HMO and a PPO. With a PPO you have the flexibility to visit providers outside of your network.

There also may be some differences in. HMO and PPO are both powerful plans of Medicare Advantage plan offering major discounts on health plans to their subscribers. All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care.

But to choose the most convenient plan you must understand the major differences first which are the cost size of network out-of-network coverage and ability to see healthcare specialists. Tap to unmute. HMO stands for health maintenance organization.

Both HMO and PPO plans rely on using in-network providers. However PPO plans offer flexibility by covering out-of-network providers at a higher cost. Historically health plans with more restrictive network rules have had lower cost-sharing requirements while health plans with more permissive network rules have required members to pick up a larger part of the bill via higher.

An HMO insurance is a Health Maintenance Organization while PPO stands for Preferred Provider Organization. The main differences between them usually pertain to cost network size ability to see specialists and out-of-network coverage. Understanding the different health plans is tricky.

The differences besides acronyms are discrete. You can also see doctors outside of the PPO. PPO stands for preferred provider organization.

PPO stands for Preferred Provider Organisation while HMO is a Health Maintenance Organization. HMO vs PPO Insurance Plans. With an HMO you do not need to file claims since.

They also have their own pros and cons. However visiting an out-of-network provider will include a higher fee and a separate deductible. How can each plan benefit you and your family.

The difference between them is the way you interact with those networks. As mentioned above Differences between HMO Health. With a PPO health insurance plan you have more flexibility in choosing a doctor or hospital.

If playback doesnt begin shortly try restarting your device.