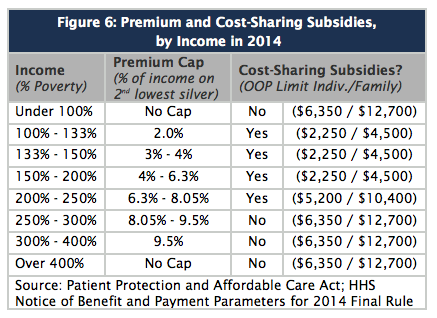

Minimum and maximum income for ObamaCare cost assistance are based on the Federal Poverty Level for the previous year. In 2021 Obamacare subsidies begin if your health plan cost is greater than 85 of your household income towards the cost of the benchmark plan or a less expensive plan the benchmark plan is the second-lowest silver plan.

Don T Fall Off The Affordable Care Act Subsidy Cliffs Root Of Good

Don T Fall Off The Affordable Care Act Subsidy Cliffs Root Of Good

Obamacares subsidy cliff eliminated for 2021 and 2022 The subsidy cliff has been temporarily eliminated.

What is the maximum subsidy for obamacare. Have a household income from one to four times the Federal Poverty Level FPL which for the 2020 benefit year will be determined based on 2019 poverty guidelines In 2020 the subsidy range in the continental US. With the cost-sharing subsidy your out-of-pocket maximum cant exceed 8150 for individuals and 16300 for two or more people in 2020. The average subsidy amount in 2020 was 492month which covered the large majority of the average 576month premium note that both of these amounts are lower than they were in 2019.

So if the plan is 5000 your subsidy is 35244. 978 of your income. The maximum healthcare subsidy is around 7000 - 8000.

Instead we cancelled our insurance outright. Obamacare Subsidy Eligibility Obamacare offers subsidies also known as tax credits that work on a sliding scale. The COVID-19 stimulus bill set to be approved by Congress this week will extend short-term economic relief to tens of millions of Americans through a.

Is from 12490 for an individual and 25750 for a family of four at 100 FPL to 49960 for. The average healthcare subsidy under Obamacare is roughly 5000 per person. According to Connect for Health Colorados subsidy calculator you qualify for a subsidy of 688month and the lowest-priced plan is 211month after the subsidy is applied.

Most people are eligible for subsidies when they earn 400 or less of the federal poverty level. How do you know if you qualify for a premium subsidy on your ACA policy. Fortunately subsidy clawback limits apply in 2022 if you got extra subsidies.

See the Federal Poverty Guidelinesfor more details. For 2020 your maximum deductible is the same as the out-of-pocket maximum. 00978 50000 4890.

Next year the subsidies are more generous and will allow even more families to qualify for low cost health insurance in California. The benchmark plan second-lowest-cost silver plan is about 430month which amounts to 98 percent of your income. When you enroll in a silver plan the insurer will automatically enroll you in coverage and apply the subsidy to it.

At the lowest income level the max subsidy we could have qualified for was about 5282 which would have resulted in lower insurance costs with better coverage. They limit the amount you pay in monthly premiums to a percentage of your annual income. For 2022 coverage see our page on the maximum income for ObamaCare for 2021 - 2022.

23 Families of four with a household income between 26500 and 106000 can also qualify for premium subsidies. Well make it easy. Obamacare promises you wont pay more than 978 of your income a year or 464746 for the second-lowest Silver plan.

Your subsidy is the cost of the plan minus 464746. For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare. Again subsidies have increased for 2021 and will remain larger in 2022 due to the American Rescue Plan.

Rate and Comment on the Answer Cancel reply. And a family out-of-pocket maximum of 17100. The Affordable Care Law is still in force for year 2020.

CoveredCA APTC and subsidies for year 2020. The other 16 available plans have premiums that range upward from there reaching as high as 4438month. 9500 - 4890 4610.

Fortunately the HealthCaregov exchange figures it all out for you. Unlike the premium tax credit you cant defer the subsidy or receive it directly. 9 Zeilen Highest eligible income.

In 2021 However your liability is capped between 100 and 400 of the FPL. Less Than 700 FPL. It is important to mention that Alaska and Hawaii are unique states and they have separate charts of their own.

The discount on your monthly health insurance payment is also known as a premium tax credit. How much do you have to make to get Obamacare subsidies. The income limit for ACA subsidies in 2021 for individuals is between 12880 and 51520.

For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify. For 2022 those making between 12880 - 51520 as an individual or 26500 - 106000 as a family of 4 qualify. For 2020 your out-of-pocket maximum can be no more than 8150 for an individual plan and 16300 for a family plan before marketplace subsidies.

Youll make additional payments on your taxes if you underestimated your income but still fall within range.