TrOOP Facilitation Contractor Parts A B D Entitlement All Non-Medicare Rx Coverage Part D Entitlement All Part D and Non-Medicare Rx Coverage Supp. TROOP is simply the amount of money that you and others on your behalf spend on your medications.

What Happens After I Meet My 2020 Medicare Part D Plan S 6 350 Troop Threshold Total Out Of Pocket Drug Spending Limit

What Happens After I Meet My 2020 Medicare Part D Plan S 6 350 Troop Threshold Total Out Of Pocket Drug Spending Limit

Each Medicare Part D plan has a TrOOP limit that is there to regulate the amount of out-of-pocket costs you have through your drug plan in a year.

What is troop in medicare. Total Out of Pocket Threshold TrOOP for Medicare Part D in 2021 Catastrophic coverage begins after Part D enrollee reaches the TrOOP threshold of 6550 during one calendar year. This article gives you a quick summary. While MOOP applies to Original Medicare-covered services with Medicare Advantage Plans TrOOP applies to prescription drug coverage whether thats from Medicare Advantage Prescription Drug plans or stand-alone Medicare Part D plans.

Hospital Medical Drug Coverage Medicare Beneficiary Database MBD Drug Coverage Part D Entitlement Active Inactive Drug Coverage Part D Entitlement Diagram 1. This amount resets to zero at the start of each year. This will increase to 5100 in 2019.

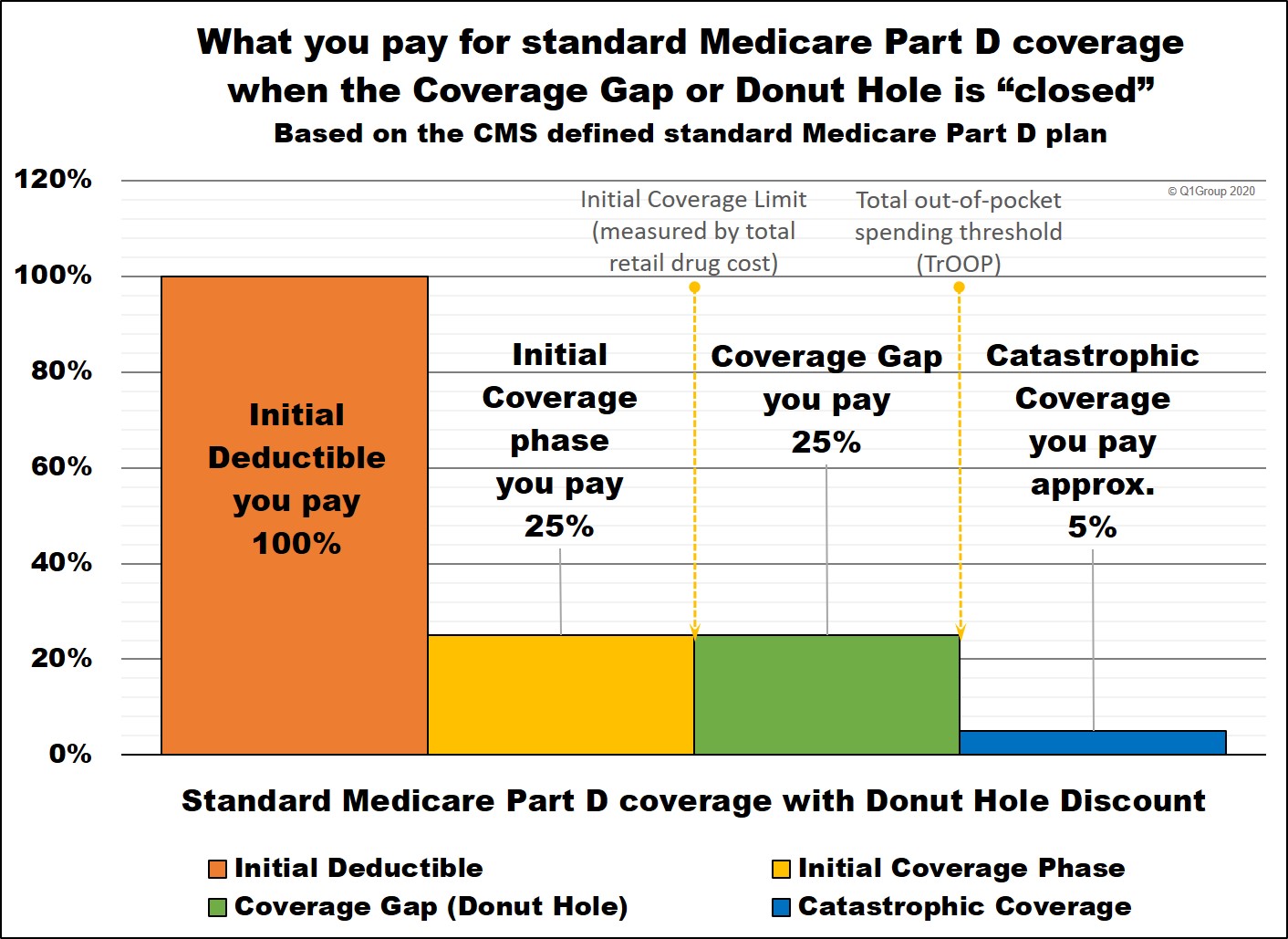

This allows the beneficiary to receive reduced cost-sharing at the pharmacy. The new Medicare law creates a distinction between all enrollee out-of-pocket expenditures and those that will be counted toward the annual Part D out-of-pocket thresholdthe latter are known as true out-of-pocket TrOOP expenditures. The Medicare Part D Donut Hole has historically been a coverage gap in Medicare Part D plans where you were responsible for a higher share of drug costs after your total drug costs reach a certain limit each year.

While this is the principal purpose of COB within the contexts of Medicare Parts A and B COB also serves an additional function within the Part D context. TrOOP or your total out-of-pocket cost is the total amount you will spend in a year on your formulary drugs before exiting the Coverage Gap or Donut Hole and entering the Catastrophic Coverage of your Medicare Part D prescription drug plan. TrOOP includes not only your actual out-of-pocket costs for formulary drugs but also the drug costs that someone may have incurred on your behalf for.

Each Medicare Part D plan has a TrOOP limit that is there to regulate the amount of out-of-pocket costs you have through your drug plan in a year. In general TrOOP includes all payments for Medications listed on your plans formulary and purchased at a Network or participating Pharmacy. TrOOP ¾The Medicare Prescription Drug Improvement and Modernization Act of 2003 as stated in 1860D-2 requires the tracking of True-Out-Of-Pocket TrOOP expenditures for Medicare beneficiaries enrolled in Part D in order to meet the eligibility for catastrophic coverage.

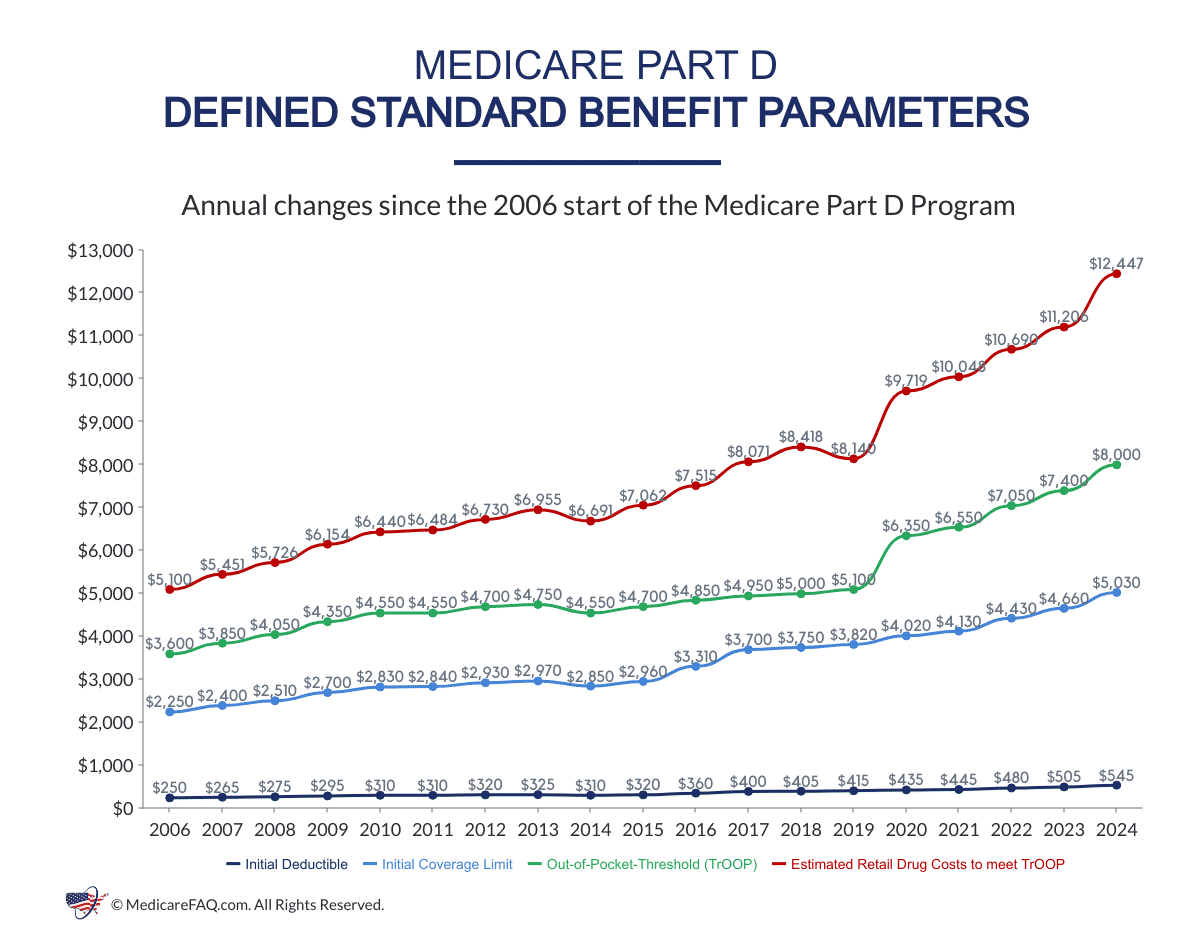

For 2020 the Centers for Medicare and Medicaid Services have set the TROOP at 6350. The TrOOP amount includes your annual deductible amount. TrOOP is the annual Total out-of-pocket costs and was also known before as True out-pf-pocket costs.

PFFS plans are a type of Medicare Advantage Part C plan. Part D plans also have a uniformed maximum true out of pocket expense also known as the total out of pocket expense TrOOP which is set by Medicare. If you have a Medicare Part D plan you do have a special MOOP limit called the TrOOP short for True Out-of-Pocket limit.

While it may sound similar to MOOP it is not the same thing. TrOOP stands for True Out-Of-Pocket costs. Your MOOP is the maximum out-of-pocket cost for medical services that youre expected to pay over the course of a year in your Medicare Advantage plan.

In other words its the limit to how much you will spend in out-of-pocket costs for medical services in a calendar year. Medicare defines TrOOP as whatever amount you pay out-of-pocket for your prescription medications that count toward your prescription drug plans out-of-pocket threshold. TrOOP Accumulation and Coordination of Benefits Process Once a beneficiarys TrOOP limit is reached the beneficiary enters the catastrophic coverage phase of the Medicare Part D benefit.

It is important to point out that your premiums for your Part D plan do not count toward your TROOP. The TrOOP is the amount a beneficiary must spend to exit the donut hole and enter into the Part D Catastrophic phase. The drug plan keeps track of each members TrOOP costs.

A PFFS plan is offered by a private insurance company that contracts with Medicare. To prevent Medicare from paying primary when it is the secondary payer. TrOOP Costs Medicare Prescription Drug Coverage Revised November 2011 True out-of-pocket TrOOP costs are the expenses that count toward a persons Medicare drug plan out-of-pocket threshold of 4700 for 2012.

It provides the mechanism for support of the tracking and calculating of beneficiaries true out-of-pocket TrOOP. Data Exchanges with COBC. If you have a Medicare Part D plan you do have a special MOOP limit called the TrOOP short for True Out-of-Pocket limit.

The maximum TrOOP for 2018 is 5000. Once youve reached your TrOOP limit youll exit the donut hole and enter catastrophic coverage. TrOOP costs determine when a persons catastrophic coverage will begin.

What are True Out-of-Pocket costs TrOOP. This includes payments that you made and payments that were made by others on your behalf.