Regardless of the reason for wanting braces if you dont have the right dental insurance that covers braces for adults the cost alone might hold you back from getting the. How do I find dental insurance that covers braces.

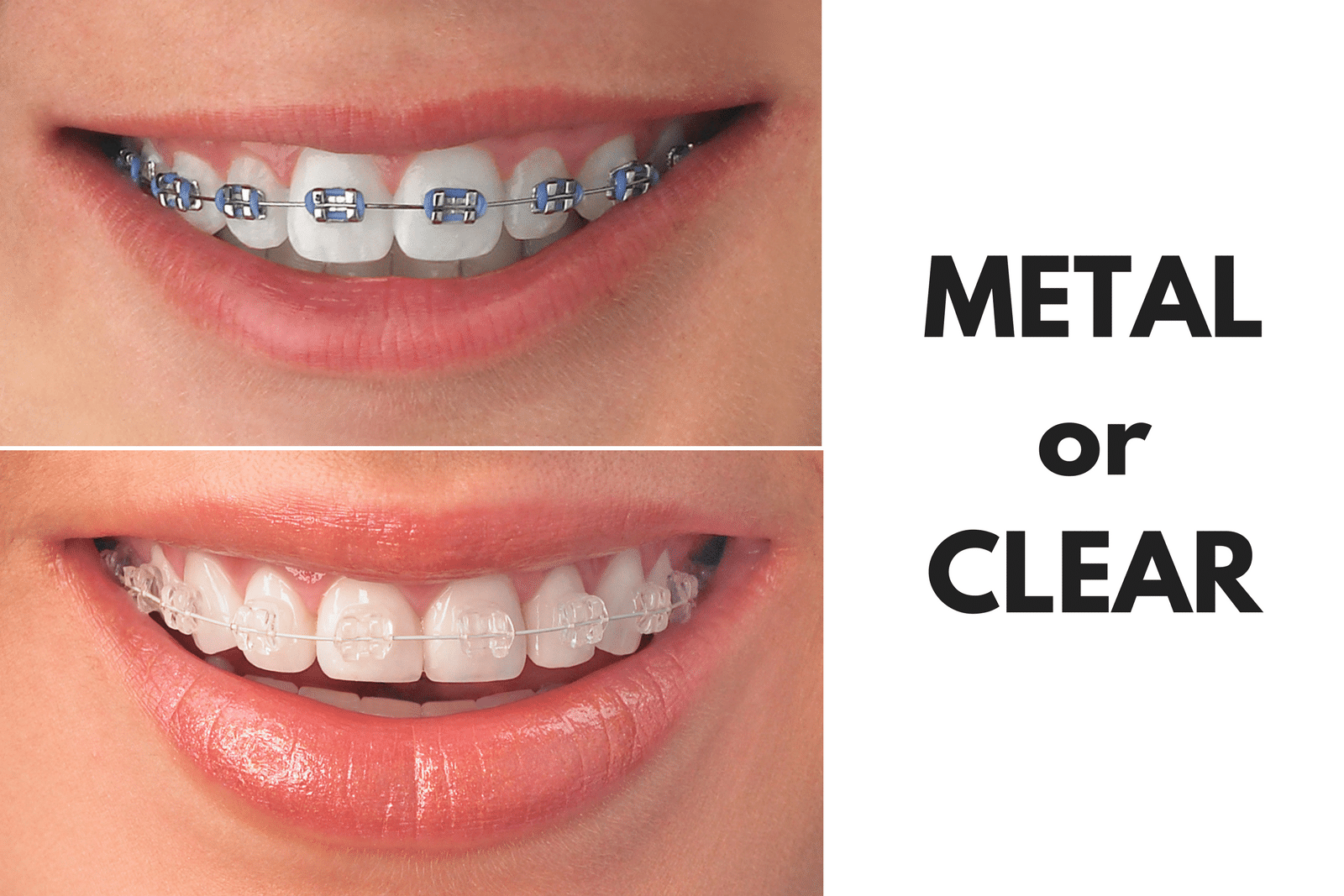

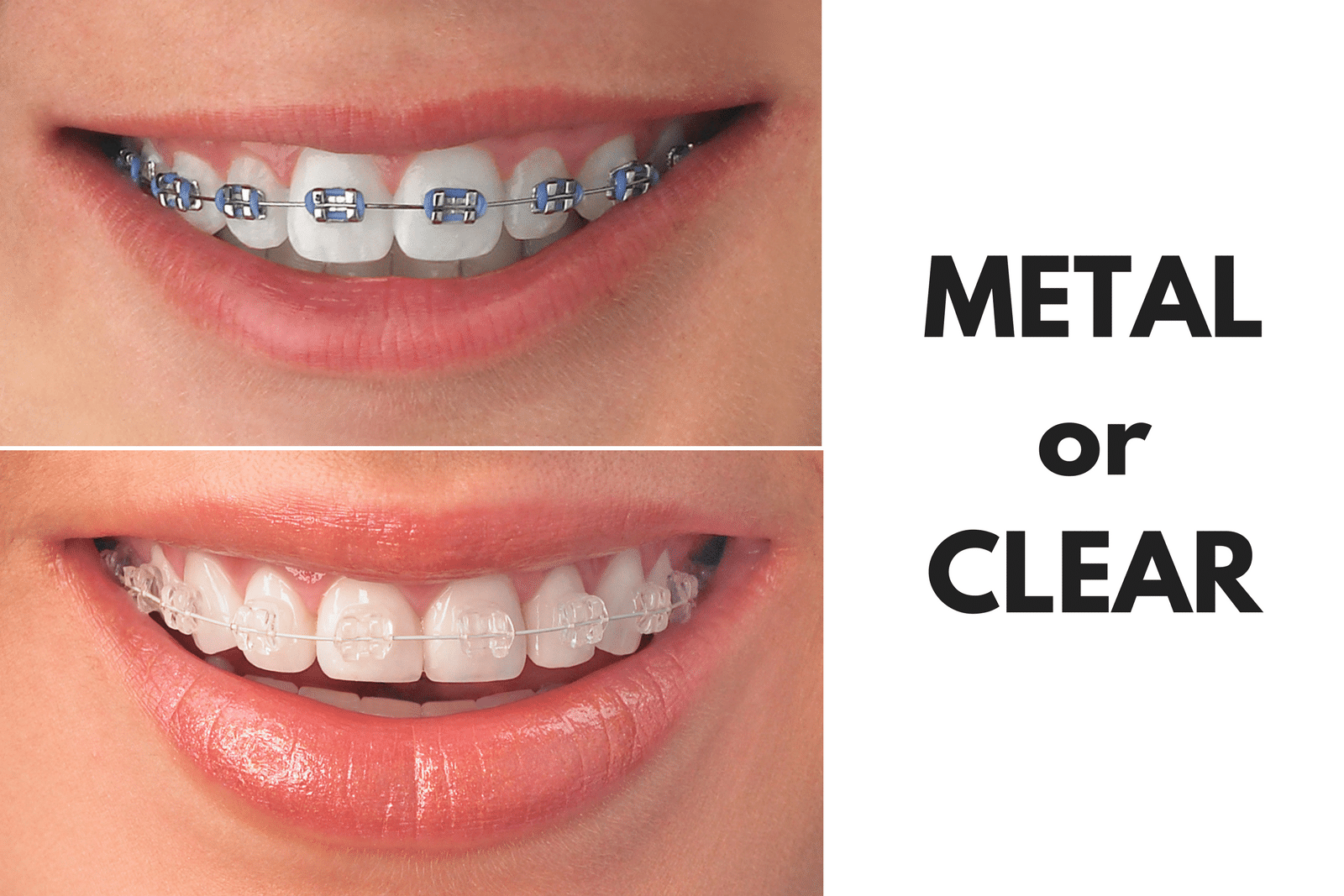

Should I Get Metal Or Clear Braces Io Dentistry

Should I Get Metal Or Clear Braces Io Dentistry

And you might need braces to fix a problem with your teeth or your bite in order to make it easier to chew your food.

Do i need dental insurance to get braces. Total Year-Round Dental Coverage Our braces insurance also covers treatment needed before braces such as habit appliances and expanders as well as post-treatment retainers that will help maintain your new smile. It can be discouraging if youre not on dental insurance for braces. Dont put essential dental procedures on hold while you wait for insurance to kick in.

Under the Affordable Care Act ACA most insurance companies offer dental insurance covering braces for children as per the ACA regulations. Otherwise you could be waiting months for coverage to begin a procedure. Orthodontic Coverage in Dental Insurance Orthodontic insurance can provide many benefits aside from braces.

If you think that braces are in your future either for yourself your spouse or your children you may be interested in having dental insurance that includes orthodontia. Although dental insurance for braces for adults may not be an option you may need braces for the first or even second time. Dental insurance specifically orthodontics coverage can offset the high cost of orthodontic treatment for families or individuals.

In most cases DentalSave members qualify for a 25-percent discount on braces. You can get dental coverage in one of two ways. We reviewed 11 top orthodontic insurance providers to.

If your dentist typically charges 7000 for metal braces then you can expect to spend about 5250 when you have a DentalSave plan. The average cost of teeth cleaning before braces is the same as that of the expense of teeth cleaning at any time. Dental insurance may help manage orthodontic care costs.

The average cost of a basic dental cleaning if you dont have dental insurance is about 118 not including required dental X-rays. But limitations or restrictions on coverage may apply. This plan may include braces as well as other types of dental appliances such as space maintainers and retainers.

Our best dental insurance plans with no waiting period roundup reviews cost coverage caps and more. Cases like this might need a retainer. But orthodontia is pricey and finding dental insurance that covers braces for adults can be challenging.

3 For example sometimes teeth move as you get older shifting previous orthodontic work. Many adults turn to orthodontics to correct a number of problems that may only come up later on in life. Some states require all dental insurers licensed in the state to provide coverage for childrens braces.

Depending on the plan you choose you may have a range of discounts on the cost of braces. The teeth cleaning cost including exams and. Several factors can affect the cost of orthodontic care including the recommended type of treatment and whether you have dental insurance.

If you plan to get insurance your best bet is to purchase a policy before not after you need major work. So if you dont have adult coverage dont give up there are options to help you afford the treatment you need. Average Cost of Dental Insurance that Covers Braces The average cost of dental insurance depends on several factors.

What if youre uninsured and you already know you need major dental work soon. 5 Many Humana dental insurance plans offer discounts on adult and child orthodontic care. With your annual premium you can have peace of mind that youll receive coverage for the orthodontic treatment you need year-round.

Once you have a DentalSave plan you get a discounted rate for all of your dental needs including orthodontics. Nonetheless more plans are now offering orthodontic benefits for adults. There is nothing unique or special about this one.

You can modify your dental insurance to make it inclusive of orthodontic treatment. If you have an employer that offers dental insurance you can choose a dental. However this does not include coverage for adult braces.

And even if youve had them as a child adult teeth can shift particularly if you dont wear a retainer each night.