Restrictions apply to out-of-network services. They have different costs for premiums and services but the same great benefits.

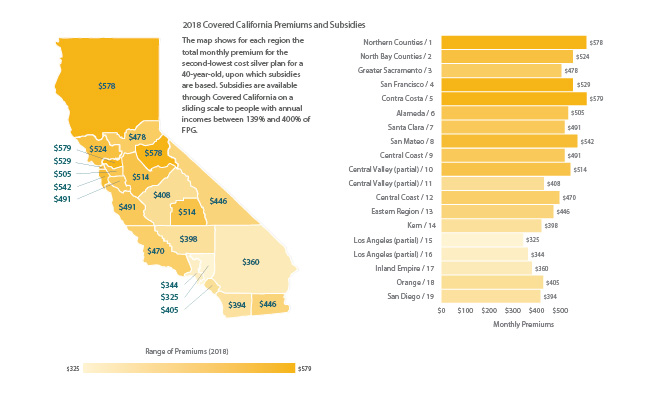

What Will Covered California Silver Plans Cost In Your Area In 2018 California Health Care Foundation

What Will Covered California Silver Plans Cost In Your Area In 2018 California Health Care Foundation

If you get a bill from your health insurance plan or family dental plan please follow the instructions on the bill for making a payment.

Covered california monthly premium. In an example used by Covered California in its promotional campaign an Oakland couple making 77580 a year both 45 years old pay the full monthly premium of 1271 for a silver plan outside. In California dependent children under age 19 would be automatically enrolled in Medi-Cal if the household income is below 266 of the federal poverty line. Your monthly premium costs are lower as a result.

Covered California Silver Plans are a popular choice for many people. Out-of-network services are only covered for urgent or emergency care. In addition the ARP includes substantial additional premium subsidies for coverage purchased through Covered California for 2021 and 2022.

The only way to get premium tax credits is to buy from Covered California. You can only claim the net premium - the portion you actually pay after the subsidy - as an expense. The IRS pays your premium tax credit directly to your health insurance plan.

The APTC is calculated according to income family size and rating region based on the cost. Lower monthly premium if you qualify for financial help. Call 888 413-3164 or.

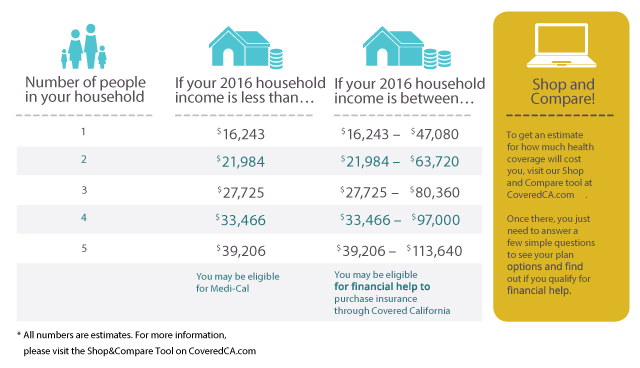

If you bought from Covered California it will send you a tax form called the Form 1095--A by January 31 2016. Out-of-network services are covered usually at a higher cost. An estimated 23000 Covered California enrollees whose annual household income falls below 138 percent of the federal poverty level FPL which is less than 17237 for an individual and35535 for a family of four.

Enjoy flexibility in selecting your doctors and hospitals in your plans network. Californians earning up to 150 of the Federal Poverty Line 19140 for a single person in 2021 qualify for an Enhanced Silver 94 Plan for 1 per month. Now that you are signed up for updates from Covered California we will send you tips.

Speak with a Covered California certified agent. Now you need to pay your monthly premium for your coverage to start. Covered California Health Plans Our health plans come in four metal tiers.

See in-network specialists without getting a referral first with monthly premiums that are usually lower than those of PPO plans. See in-network specialists without getting a referral first with monthly premiums that are usually lower than those of PPO plans. In California premium assistance is only available to consumers who purchase a health plan through Covered California.

Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act. If you are a low- or moderate-income Californian you may get help buying insurance from Covered California through monthly subsidies that lower your premium costs so that you pay less for top-quality brand-name insurance. A federal tax credit which can be paid in advance to lower the cost of monthly plan premiums or claimed during tax filing process.

Pay Your Monthly Premium Congratulations on enrolling in a health insurance plan through Covered California. Lower monthly premium if you qualify for financial help. Learn more about who qualifies for a subsidy.

The majority of our customers get financial help. Covered California Monthly Premium Rates Item Preview remove-circle Share or Embed This Item. The proposed rates negotiated with Covered California and filed Thursday with regulators and subject to their final review mean those who receive a subsidy to help purchase coverage will pay an average of 6 percent more if they renew in the same plan next year which translates to an estimated monthly premium of 123 after tax credits.

The Second Lowest Cost Silver Plan in their pricing region has monthly premiums of 813 a month or 9756 per year. That is considered affordable. Lower health plan premiums via new and increased subsidies help individuals and families Any uninsured individual or family can use this SEP to apply for 2021 health care coverage To help your IFP off-Exchange IFP clients take advantage of these new premium subsidies help them switch to a Health Net IFP Covered California plan.

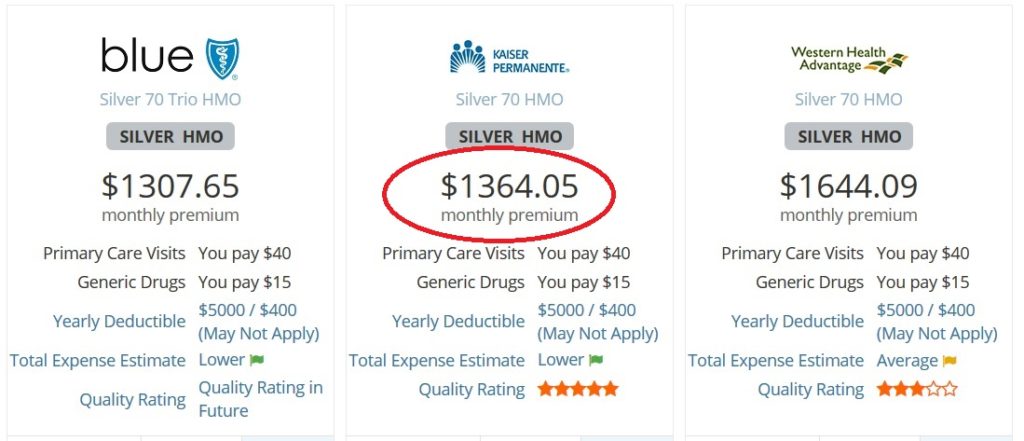

More often than not they provide the best bang for your buck The affordable monthly premiums mid-size deductibles and discounted fees for commonly-needed medical services make Silver Plans an attractive option for those who are trying to balance cost with benefits. Its the only place where you can get financial help when you buy. They will see their premiums for the benchmark plan lowered to 1 per member per month.