409 rânduri The premiums are for a silver plan in which the insurer pays about. The Second Lowest Cost Silver Plan or SLCSP is the Silver Plan that offers the second lowest monthly premium cost in your area.

What S A 1095 A Slcsp From Covered California

What S A 1095 A Slcsp From Covered California

Learn more at MarylandHealthConnectiongovtaxes.

Monthly premium amount of second lowest cost silver plan. To claim the exemption follow the instructions for IRS Form 8965. Individual Couple Dependent Children Under Age 26 Dependent Children Ages 26-29 Child Only Under 21 County Individual Children Couple Children Individual Children Couple Children. A plan has a rate area which is a geographic region in a state that determines the plans rate.

Benchmark Plan is the Second Lowest Cost Silver Plan available to the family through the states health benefit exchange. The cost of this plan is used as a baseline in order to determine cost assistance limits. Second-Lowest Cost Silver Plan Premium.

Get your second lowest cost Silver plan SLCSP premiums needed to complete your income tax form. On the marketplace the second-lowest cost silver plan actually has a 585 monthly premium. Second Lowest Cost Silver Plan SLCSP Worksheet 1 Use this tool to complete your Form 1095-A Part III Household Information Column B Monthly Premium Amount of Second Lowest Cost Silver Plan.

Its better to use the real numbers because you could be. You will need to know the SLCSP when youre calculating the Premium Tax Credit on your annual income taxes. Second lowest cost Silver plan SLCSP The second-lowest priced Marketplace health insurance plan in the Silver category that applies to you.

In most cases youll find your SLCSP premium on Form. Figure out your premium tax credit Figure out your premium tax credit. The applicable SLCSP premium is the second lowest cost silver plan premium offered through the Marketplace where you reside that applies to your coverage family described earlier.

This question refers to form 8962 Turbo Tax can help you complete a form 8962 if you have received a letter from the IRS asking for an update. It may not be the plan you enrolled in. For 2018 the DC Health Link Benchmark Plan is the Kaiser Permanente DC Silver 600035Dental plan and.

In California dependent children under age 19 would be automatically enrolled in Medi-Cal if the household income is. If you received a 1095-A from DC Health Link that did not include the monthly premium amount for the Second Lowest Cost Silver Plan SLCSP the calculator below will help you get these values. Older adults often pay higher premiums and a higher percentage of their income for ACA health plans compared with younger adults.

But even at higher incomes a bronze plan or even a gold plan might be available with no monthly premiums. Find the difference between what the government says you should pay and what youd actually pay. Youll enter this information on Form 8962Premium Tax Credit.

If the second lowest cost Silver plan premiums really were 000 ha or the 001 that HR Blocks forums suggest you use instead then you would get no subsidy at all even if you qualified for one. You need to know your second lowest cost Silver plan SLCSP premium to figure out your final premium tax credit. A plan has a rate which is the amount that a consumer pays as a monthly premium in dollars.

A rate area is a tuple of a state and a number for example NY 1 IL 14. Benchmark Plan costs vary based on the age of each enrollee at the time of enrollment or renewal. The SLCSP premium is not the same as your enrollment premium unless you enroll in the applicable SLCSP.

The Premium Tax Credit is calculated as follows. Calculate the Household Income. If coverage was considered unaffordable for you you may qualify for an exemption from the fine sometimes called the penalty or individual mandate.

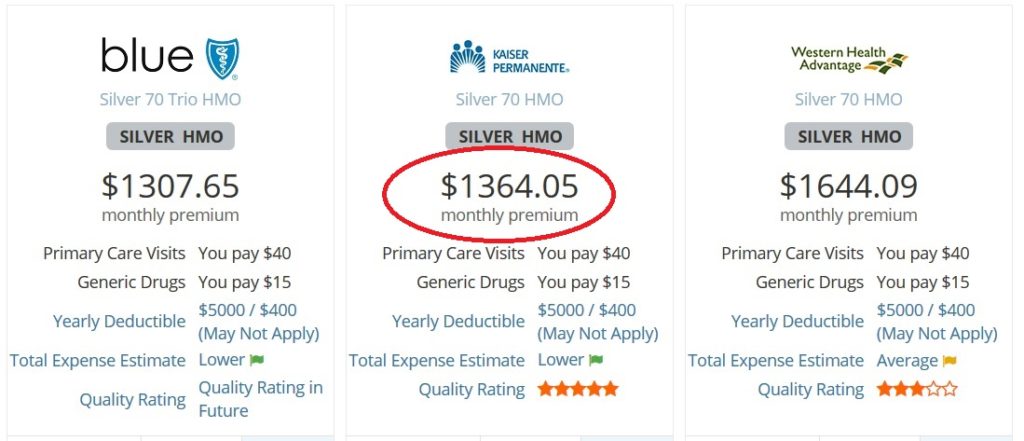

For IRS Form 8962. The Second Lowest Cost Silver Plan in their pricing region has monthly premiums of 813 a month or 9756 per year. 2019 Monthly Premiums for Second Lowest Cost Silver Plans SLCSP by Coverage Family Type Coverage Type.

To determine your final premium tax credit for the year you need to know the premium for the second lowest cost Silver plan SLCSP that was available to you in that year. For 2021 and 2022 the American Rescue Plan ARP has reduced the percentage of income that people have to pay for the second-lowest-cost silver plan the benchmark plan lowering it to 0 for enrollees with fairly low incomes. There are two additional CSV files in this directory besides slcspcsv.

You do not have to select the Second Lowest Cost Silver Plan to qualify for the credit. Second Lowest Cost Silver Plan Calculator. Use the calculator below to find the second-lowest cost.

The Premium Tax Credit is based on the Second Lowest Cost Silver Plan SLCSP that is available in the area in which the individual taxpayer lives. Get started Figure out your premium tax credit. If the second lowest cost silver plan is higher than monthly enrollment premiums do I have to pay the difference to the IRS.

You will use your completed Form 1095-A to fill out Form 8962 on your federal tax return. The average monthly premium for a benchmark plan the second-lowest-cost silver plan in 2020 is 388 for a 27-year-old enrollee and 1520 for a family of four. Second Lowest Cost Silver Plan Tax Tool.