This person will receive physical exam results and test results. At least one special character.

Https Members Lacare Org V3app A 6713520d04184e211d060236412306190b091d12255c04240d1d510f0c1f4475060c1f5b1a0413001c1a370f1300010b40404326070c33001641050442197f563e0f060d00000000001a1b140c1c3a02071a25173a320b3a5c59574211794b1108124e0e060e060a7815010f5f52504443715f52330404435d07451365075259414551445f5956210b505d0f07010f553107073b0c06531d1706446e031200495847160a5215770d015857075c135e2513046448515c5e515e407f035941465b02465109587508560d081843011633040c34000c0a541e1644785c0054415f4c125d0b5b685a015c5d48071711245f5533030708080416447b565311520019070008537658265f57202343317537556757565850214a170e55542f465e22435a2a5d702d55582f52503037

Your doctors office hours may have changed due to COVID-19.

La care create account. Care Connect Online Member Portal eg. Pașaport simplu electronic pentru cetățeni români majori cu domiciliul în România valabil 10 ani Pașaport simplu electronic pentru cetățeni români majori cu domiciliul în străinătate valabil 10 ani Pașaport simplu electronic pentru cetățeni români minori cu vârsta sub 14 ani cu domiciliul în. At least one number.

Forgot your username or password. Care Health Plan and can be accessed only by authorized users for authorized business purposes only. Choose how you want to receive or enter your security code.

You always have control over this functionality through your Account Settings. Create a member log-in and make your first payment through LA. The password MUST CONTAIN.

The items that have an asterisk must be filled out in order to create your account. Care Connect Mail a check or money order to the address provided or Call our Member Services Department at the toll free number 1-855-270-2327 TTYTDD 711 to pay by credit or debit card. Create your Google Account.

Mentions Légales Cookies Politique externe des données CGU. Action Logement aide les salariés à se loger. Préparez votre RIB déjà transmis à votre caisse et votre carte Vitale puis cliquez sur Je crée mon compte.

Create a username for LHICare. Between 14 and 30 characters. We connect families with caregivers and caring companies to help you be there for the ones you love.

Members must be duly authorized to make account changes through the LA. We will use this address for things like keeping your account secure helping people find you and sending notifications. You may create your account using the register form.

By requesting a change to this account you certify that you are either the adult Member to whom the account belongs or the legal parentguardian of a Member and are authorized to make this change or a legally emancipated minor. Please call your doctor for the most up to date information. Changes initiated by individuals who.

Enter your username and password to login. Ce service est également disponible sur lapplication ameli pour smartphone et tablette disponible sur l App Store et Google Play. However each individual is solely responsible for selecting an appropriate care.

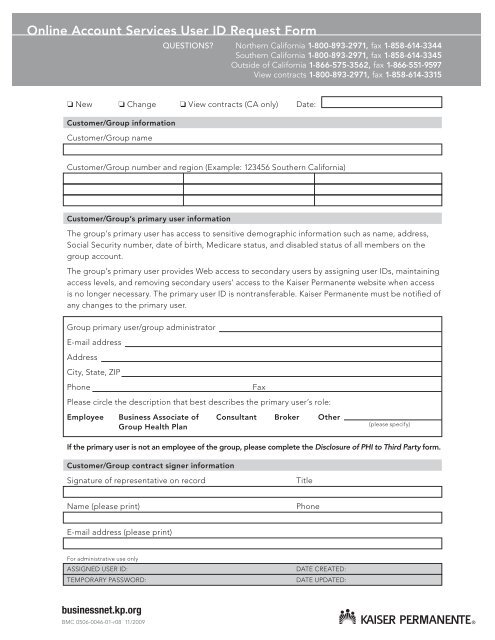

These statements have not been evaluated by the Food and Drug Administration. For additional security we need to verify your identity before you can sign in to the account. Customer Portal Access select one User View only Admin Make changes Indicate if your work injury care contact will have the ability to make changes to your Customer Portal account.

You can select User Login or Create Account. Join 10M users from around the world. Text maskedTwoFactorSMS Email maskedTwoFactorEmail.

At least one uppercase character. This product is not intended to diagnose treat cure or prevent any disease. Renseignez les informations demandées validez le formulaire vous êtes déjà dans votre compte ameli.

Faciliter le logement pour favoriser lemploi. 1-888-839-9909 TTY 711 24 hours a day. Care CoveredDirect Member Services.

If you have a child support case and have created a User Number and PIN in the IVR system by calling 888-LAHELPU 888-524-3578 you may select this option. If you do not meet the criteria above please select Create Account. Care Health Plan representatives are available 24 hours a day 7 days a week including holidays to help you.

Scalable secure cross-device and enterprise-ready team collaboration whiteboard for distributed teams. At least one lowercase character. This system and program are the property of L.

On the next page please read everything carefully when creating your account.