With an EPO you typically dont need a. PPO or Preferred Provider Organization health plans are generally more flexible than EPO Exclusive Provider Organization plans and have higher premiums.

Epo Health Insurance Plan What You Need To Know My Calchoice

Epo Health Insurance Plan What You Need To Know My Calchoice

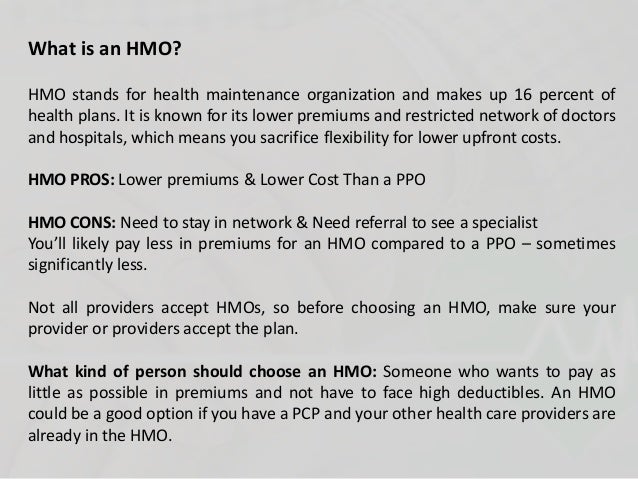

The Health Maintenance Organization is regulated under the HMO laws and regulations.

Is an epo better than a ppo. This reduces costs so your monthly payments will be lower. Typically higher especially for out-of-network care. Costs are kept low because providers charge a fee that has been negotiated with your EPO plan ahead of time.

So if youre younger healthy and have money to deposit into an HSA an HDHP may be right for you. And then theres the preferred provider wrinkle. While HMO and PPO plans are the 2 most common plans especially when it comes to employer-provided health insurance there are other plan types you should know about including EPO and POS plans.

If you or your dependents utilize a lot of specialists or require regular hospitalization a PPO may be better for you. Depending on the carrier you enroll with for example it may be able to cover alternative procedures like. The HMO is determined on a capitated basis whereas the EPO is based on the services provided.

The main downside of a PPO is that youll pay higher monthly premiums. HDHPs will typically have lower monthly premiums but higher out-of-pocket costs in general. Although this feature can be a big help it can also be a wash financially by the time you pay all of your premiums for the year.

Only for out-of-network claims. A PPO comes with higher monthly premiums compared to what youd pay with an HDHP. The payment of the PPO insurance is a little higher than the EPO insurance.

But in exchange you get lower co-pays deductibles and out-of-pocket maximums. A Blue Dental EPO plan only covers services from in-network PPO dentists. For some however an HMO health maintenance organization or PPO preferred provider organization might be a better fit.

You must stay within the EPO. EPO health plans are often more affordable than PPO plans if you choose a doctor or specialist in your local network. Youd also likely pay smaller co-payments to see specialists as opposed to other plans.

Yet because of the overall lower in-network costs PPO premiums tend to rise high. When considering their coverage the EPO is better suited for the rural areas. EPO insurance offers a number of benefits to patients in search of quality health care.

But in a PPO the provider list is generally smaller than. An EPO is a much smaller network and does not have a wide variety of health care providers. PPO insurance also covers at least some of the cost from visiting out-of-network providers unlike an EPO.

However if you choose to get care out of your plans network your medical care may not be covered. Both kinds of health plans have a network of providers you can work with to get the best rates. This comparison explains how.

PPO coverage typically extends further than that of other common health insurance plans. Higher premiums didnt necessarily correlate with better out-of-network coverage says Caroline Pearson a vice president at Avalere Health a. The EPO works like the PPO except for the fact that you are unable to go off the network aside from true emergency situations.

The more a plan pays for out-of-network care the higher your monthly payments will be. A health plans network is the set of healthcare providers e. An exclusive provider organization EPO plan is situated between an HMO and PPO in terms of flexibility and costs.

A PPO has a broad network of professional providers that operate with their own rules and regulations. The PPO typically has a lower maximum out-of-pocket cost than an HDHP. Premiums may be higher with PPO than an EPO but this varies by.

POS plans made up 12 percent and EPO plans 7 percent. When comparing the premiums the EPO has a lower premium than the HMO. Preferred provider organizations PPOs cover care provided both inside and outside the plans provider network.

A PPO plan wont cover as much of the cost with an out-of-network doctor so youll still pay a higher price to go out of network but you at least wont pay the entire bill out of pocket. The one exception is emergencies which are often covered even if they are out of your network. EPO stands for exclusive provider organization and doesnt cover any out-of-network care.