Benefit Plans A B F G and N are Offered Plan F also has an option called a high deductible Plan F. The chart below shows the average cost of Medicare Supplement Insurance Plan F for each state in 2018.

Which Is Better Medicare Supplement Plan F Or Plan G The End Zone

Which Is Better Medicare Supplement Plan F Or Plan G The End Zone

In fact Medigap Plan F is the only Medigap policy that provides coverage for all nine basic benefit areas.

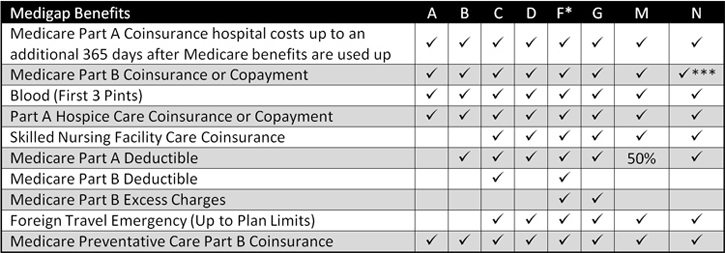

Plan f coverage chart. However Plan G does not cover the Medicare Part B deductible. Your Medicare benefits are. Medigap Benefits Click to view expanded chart Covered Under Plan F Purpose of Coverage.

Medigap Plan F has the highest monthly premiums. However this could not be the case in another area. Plan F was less expensive in Iowa New Mexico and South Carolina in 2018 and more expensive in New York Connecticut and North Dakota.

Medigap plans F and G offer similar coverage. Plan F is a very comprehensive plan helping cover expenses that original Medicare doesnt. Benefits from high deductible Plan F will not begin until out-of-pocket expenses exceed 2180.

Then your Plan F supplement pays your deductible and the other 20. Some plans may not be available. Your drugs tier.

Medicare Part A Hospital ServicesWhat Plan F Pays Per Benefit Period 2 Hospitalization 2. Some supplement companies may also offer high-deductible plans. This includes your deductibles coinsurance.

12 rânduri With this option you must pay for Medicare-covered costs coinsurance. If a dash is in the column the benefit is not covered by the plan. When you look down the Medicare chart of the plan coverage below you see that Plan F covers every deductible and co-pay for every Medicare-approved service.

Below is a chart that shows the extensive coverage chart that Supplement Plan F provides. Medicare Plan G has lower monthly premiums than Plan F. But we at Integrity Senior Solutions will no longer make a Plan.

Review the chart below for all the details of Plan F coverage or explore other Medicare Supplement plans. With Plan F you pay your premium for the plan and Plan F picks up every deductible and co-pay. Massachusetts Minnesota and Wisconsin have different Medigap plan standards.

The reason is quite simple. Medicare Part B first pays 80. Plan F covers that for you.

Example if the Plan F premium in your area is 140 but the Plan G premium is 100 you end up spending 480 more over a 12-month period in premiums with Plan F just to have the Part B deductible of 198 covered. According to CMSgov the annual high-deductibles for Plan F is 2370 in 2021. This includes durable medical.

Private insurers may offer a high deductible version of Plan F which means that a person must reach the 2021 deductible of 2370 before the plan begins to pay. In some states both plans offer a high deductible. If you feel this deductible is too high you might consider the more affordable Plan G.

Each covered drug is in 1 of 5 drug tiers. Plan F coverage also includes your other doctor visits for illnesses and injuries. Comparison of Plan F and Plan G.

When you fill a prescription the amount you pay depends on the coverage stage youre in. Outline of Medicare Supplement Coverage. Some doctors charge a 15 excess charge beyond what Medicare pays.

This high deductible plan pays the same benefits as Plan F after one has paid a calendar year 2180 deductible. This deductible is the same for. The better option depends on the monthly premium difference between Plan G and Plan F in your area.

How to read the chart. Part A coinsurance and hospital costs up to an extra 365 days after Medicare benefits are used up. If youre admitted to the hospital for more than 90 days you pay 682 in coinsurance for each lifetime reserve coverage day you have.

If a check mark appears in the column this means the MediGap policy covers the benefit up to 100 of the Medicare-approved amount. Medicare Part A coinsurance and hospital costs Medicare Part B coinsurance or co-payment First three pints of blood. The chart below shows the differences between the tiers.

Below is a chart that shows the average cost of Medicare Supplement Insurance Plan F by age. Plan F also pays the 20 for a long list of other Part B services. Every company must make Plan A available.

Each tier has a copay or coinsurance amount. Based on our analysis Medicare Supplement Insurance Plan F premiums in 2018 were lowest were lowest for beneficiaries at age 64 14655 per month and highest for beneficiaries at age 82 23653 per month. Furthermore Plan G has the same comprehensive coverage as Plan F.

Only applicants first eligible for Medicare before 2020 may purchase Plans C F and high deductible F. Your plan has different stages of drug coverage. One thing you must know however although Medicare Plan F is the most comprehensive policy that means it is also the most expensive as compared with the other options.

The descriptions of benefits of each of these plans are in the table below. Plan F 1 G High Deductible Plan G1 K 2 L 2 and N This chart shows the benefits included in each of the standard Medicare supplement plans.