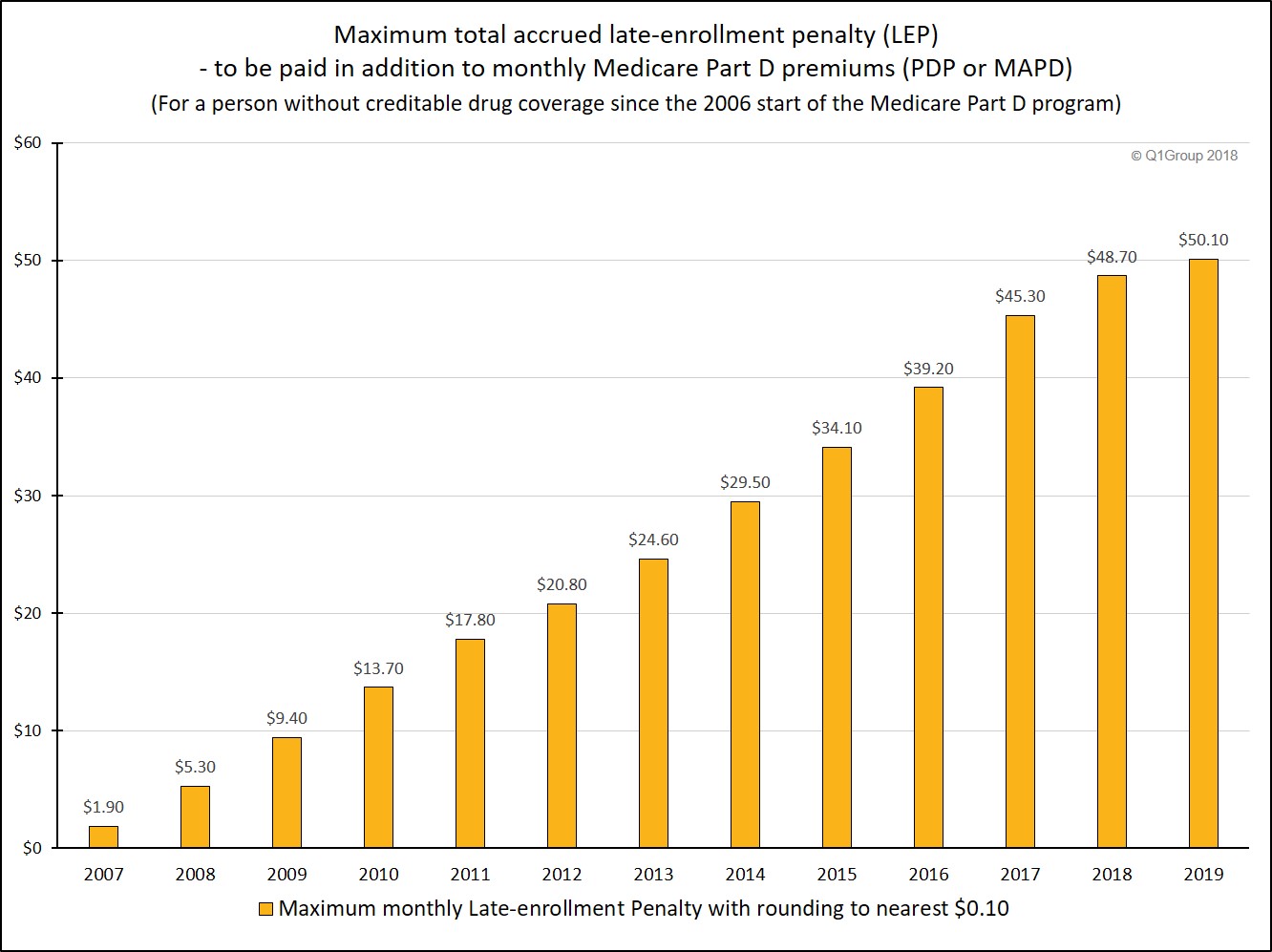

You could be accessed a late enrollment penalty on Part B andor Part. The national base premium 3306 in 2021 may change each year so your Medicare Part D late-enrollment penalty may vary from year to year.

Understanding The Part D Late Enrollment Penalty

Understanding The Part D Late Enrollment Penalty

A person does not have to pay a Part D late enrollment penalty if they qualify for Extra Help.

Part d late enrollment penalty. That may be added to a persons monthly Part D premium. The Part D Late Enrollment Penalty. Multiply 03306 by the number of months you are late enrolling 03306 X 10 2021 Part D penalty 331mo rounded to the nearest ten cents 330mo.

If you enroll in a Medicare Prescription Drug Plan when youre first eligible for Medicare you wont be subject to a late-enrollment penalty. Part A Late Enrollment Penalty Medicaregov Part B Late Enrollment Penalty Medicaregov Part D Late Enrollment Penalty Medicaregov. The Part D late enrollment penalty is a penalty thats addied in addition to the national base benefificary Part D premium.

Dont go anywhere in this. Medicare Part D 021Part D Late Enrolment Penalty 044Are you new to Medicare and considering delaying enrollment in Part D. Whats the Part D late enrollment penalty.

Currently the late enrollment penalty is calculated by multiplying 1 of the national base beneficiary premium 3274 in 2020 by the number of full uncovered months that you were eligible but didnt enroll in Medicare drug coverage and went without other creditable prescription drug coverage. Part D late enrollment penalties For each month you delay enrollment in Medicare Part D you will have to pay a 1 Part D late enrollment penalty LEP unless you. The constant factor will be that you were 10 months late in this example but what will change is the Part D national base premium.

The penalty is assessed monthlyand for life. When do I owe a Part D late enrollment penalty. You owe a late enrollment penalty if you do not have creditable prescription drug coverage 63 days or more past your Initial Enrollment Period.

The late-enrollment penalty is a monthly add-on premium calculated as 1 of the current national base beneficiary premium 3306 in 2021 multiplied by the number of uncovered months rounded to the nearest ten cents. If you were without Part D or creditable drug coverage for more than 63 days while eligible for Medicare you may face a Part D late enrollment penalty LEP. How to avoid a Late Enrollment Penalty LEP when you are first eligible for Medicare.

Can someone with Medicare appeal a Part D late-enrollment penalty. That means that as the. When enrolling for Medicare Part D the best strategy is to get it right when youre first eligible.

The late enrollment penalty also called the LEP or penalty is an amount. The amount is 1 for every month you went without coverage when first eligible. The final amount is rounded to the nearest 10 and added to your monthly premium.

You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over theres a period of 63 or more days in a row when you dont have Medicare drug coverage or other. Watch this video to learn about the potential penalties. This is a Medicare program that helps those with a.

Medicare beneficiaries may incur a late enrollment penalty LEP if there is a continuous period of 63 days or more at any time after the end of the individuals Part D initial enrollment period during which the individual was eligible to enroll but was not enrolled in a Medicare Part D plan and was not covered under any creditable prescription drug coverage. The monthly premium is rounded to the nearest 10 and added to your monthly Part D premium. A person enrolled in a Medicare drug plan may owe a late enrollment penalty if he or she.

Part D late enrollment penalty The late enrollment penalty is an amount thats permanently added to your Medicare drug coverage Part D premium. The penalty is calculated by multiplying 1 of the national base beneficiary premium 3306 in 2021 times the number of full uncovered months you didnt have Part D or creditable coverage. Part D late enrollment penalty formula Now that you know both variables you can calculate your total late enrollment penalty.

Each year the late enrollment penalty is recalculated based on the years base premium amount. For example you turn age 65 on July 4. In most cases if you dont sign up for Medicare when youre first eligible you may have to pay a higher monthly premium.

More information on Medicare late enrollment penalties. The purpose of the LEP is to encourage Medicare beneficiaries to maintain adequate drug coverage. Have creditable drug coverage Qualify for the Extra Help program.

Since the national base beneficiary premium may increase each year the penalty. Late enrollment penalty 1395w114 Premium and cost-sharing subsidies for low-income individuals 1395w114a Medicare coverage gap discount program 1395w115 Subsidies for part D eligible individuals for qualified prescription drug coverage. Part D late enrollment penalty NBBP x Months without drug coverage x 1 So if you went six months.