Coverage is affordable if the employee does not pay more than 24450 per month for the lowest-priced self-only plan. The Health Insurance Marketplace Calculator is based on the Affordable Care Act ACA as signed into law in 2010 and subsequent regulations issued by.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

ObamaCare Cost Assistance To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level.

Affordable health care calculator. The Affordable Child Care Benefit replaces the Child Care Subsidy on the basis of amendments made to the Child Care Subsidy Regulation. But you can also just use the subsidy calculator at the top of this page note that as of early April. The purpose of this subsidy calculator is to provide Americans with the ability to quickly determine if they are eligible for subsidized health insurance under the Affordable Care Act.

HealthCaregov directs consumers to The Henry J. For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four. Health Care Tax Tips.

The Health Insurance Marketplace Calculator is based on the Affordable Care Act ACA as signed into law in 2010 and subsequent regulations issued by Health and Human Services HHS and the Internal Revenue Service IRS. The Health Insurance Marketplace Calculator is based on the Affordable Care Act ACA as signed into law in 2010 and subsequent regulations issued by Health and Human Services HHS and the Internal Revenue Service IRS. This subsidy calculator is provided by My1HR a licensed Web Based Entity WBE which is certified by the Centers for Medicare and Medicaid Services CMS to connect consumers directly with the federal health insurance Exchange at HealthCaregov.

In general under the employer shared responsibility provisions an applicable large employer ALE member may either offer affordable minimum essential coverage that provides minimum value to its full-time employees and their dependents or potentially owe an. The categories are based on how you and the health plan share the total costs of your care. The Health Insurance Marketplace Calculator is based on the Affordable Care Act ACA as signed into law in 2010 and subsequent regulations issued by Health and Human Services HHS and the Internal Revenue Service IRS.

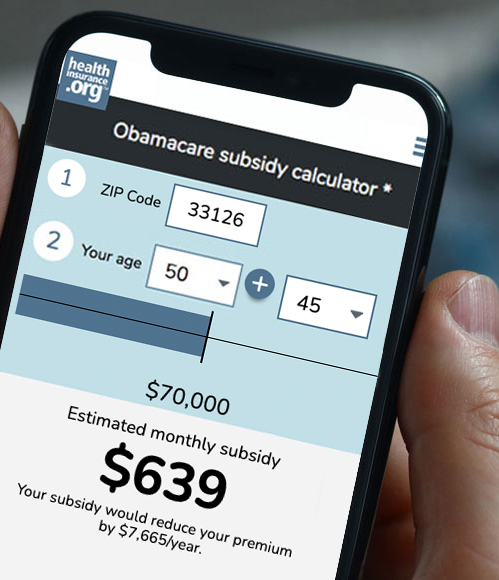

The calculator below provides estimates only you wont know your exact credit until you apply for the Marketplace. We are nationally recognized experts on the Affordable Care Act ACA and state health insurance exchangesmarketplaces. Enter your state an estimate of your 2014 annual income whether you.

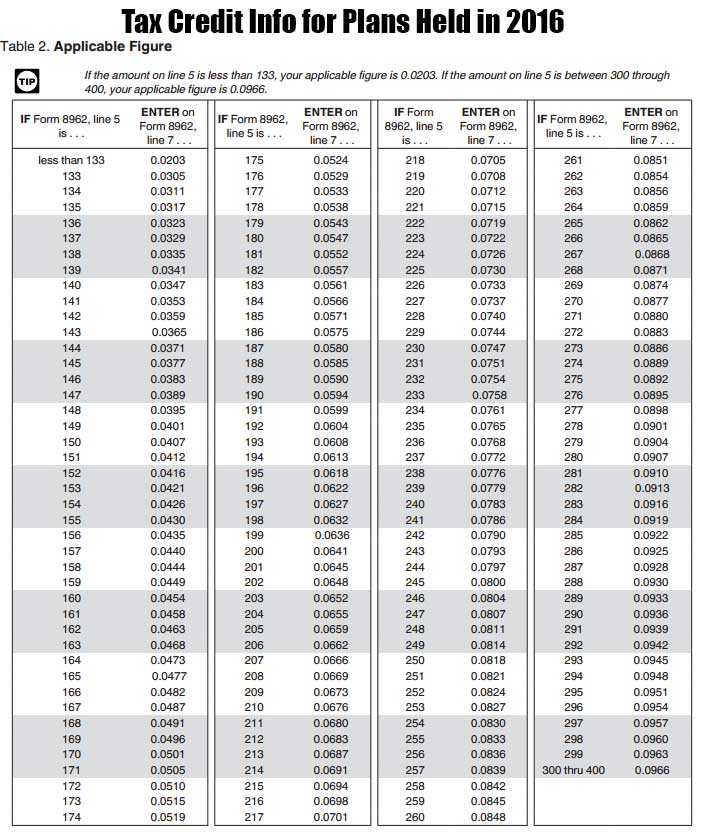

Subsidies or premium tax credits are based on three things. Your income the price of the benchmark plan and how much the Affordable Care Act requires you to pay toward your health insurance. The types of assistance offered under the Affordable Care Act are.

Our calculation is based upon the federal poverty level data provided by the government annually. Calculation 30000 x 978 12 For employees hired at a later time during the year affordability is based on their annual wages and how many months of coverage you offered them for the year. The discount on your monthly health insurance payment is also known as a premium tax credit.

List of Tax Provisions. Learn more about us. Our ACA affordability calculator will help you maintain affordable coverage under the Affordable Care Act and avoid IRS penalties in 2021.

ACAwise will calculate whether the percentage of employee contribution from the household income to the health plan is affordable. Enter the required information into the fields below then calculate your results. Generally speaking categories with higher premiums Gold Platinum pay more of your total costs of health care.

The Health Insurance Marketplace Calculator is based on the Affordable Care Act ACA as signed into law in 2010 and subsequent regulations issued by Health. Kaiser Family Foundations subsidy calculator. How does ACA Affordability Calculator work.

Select the coverage year enter the employees pay type and your employees monthly contribution to the health plan. If you have questions or comments on this service please contact us. Use the ObamaCare subsidy calculator below to get an idea of what kind of cost assistance you are eligible for under the Affordable Care Act when you buy a health insurance marketplace plan.

Affordable Care Act ACA Calculator Details. Legal Guidance and Other Resources. Application Processing Dates We are currently processing applications submitted online through My Family Services up.

The calculator includes subsidy increases for 2021 in the American Rescue Plan Act ARP of 2021. How Do You Figure Out Your 2021 Obamacare Subsidy. When you compare plans in the Marketplace the plans appear in 4 metal categories.

Bronze Silver Gold and Platinum. Premiums displayed in the calculators results are based on actual exchange premiums in 2018 dollars. How the American Rescue Plan Act will.