What are out-of-pocket expenses. The OOPM is different for every type of plan.

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

Your health insurance plan states that you will pay 20 every time you visit the doctor regardless of the reason flu blood pressure check well-woman exam etc.

Does out of pocket maximum include deductible. The out-of-pocket limit doesnt include. Those post-deductible charges add up which is where the out-of-pocket maximum comes in. Once you spend this much on in-network services your insurance covers 100 of.

If you are a current BCBSTX member you can see what your plans OOPM is within Blue Access for Members. If the family out-of-pocket maximum is met the plan takes over paying 100 of everyones covered costs for the rest of the plan year. Your out-of-pocket maximum or limit is the most you will ever have to pay out of your own pocket for annual health care.

Out-of-Pocket Maximum Individual vs. It typically includes your deductible coinsurance and copays but this can vary by plan. Not all plans include copays so this will only be an out-of-pocket cost if your plan does.

When this maximum is met any dollar over that amount will be 100 covered by your insurance provider. That includes things like your deductible copays and coinsurance. In contrast your out-of-pocket limit is the maximum amount youll pay for covered medical care and costs like deductibles copayments and coinsurance all.

Medical care for an ongoing health condition an expensive medication or surgery could mean you meet your out-of-pocket maximum. They also apply to your out-of-pocket expenses over a calendar year. Copays count towards your deductible.

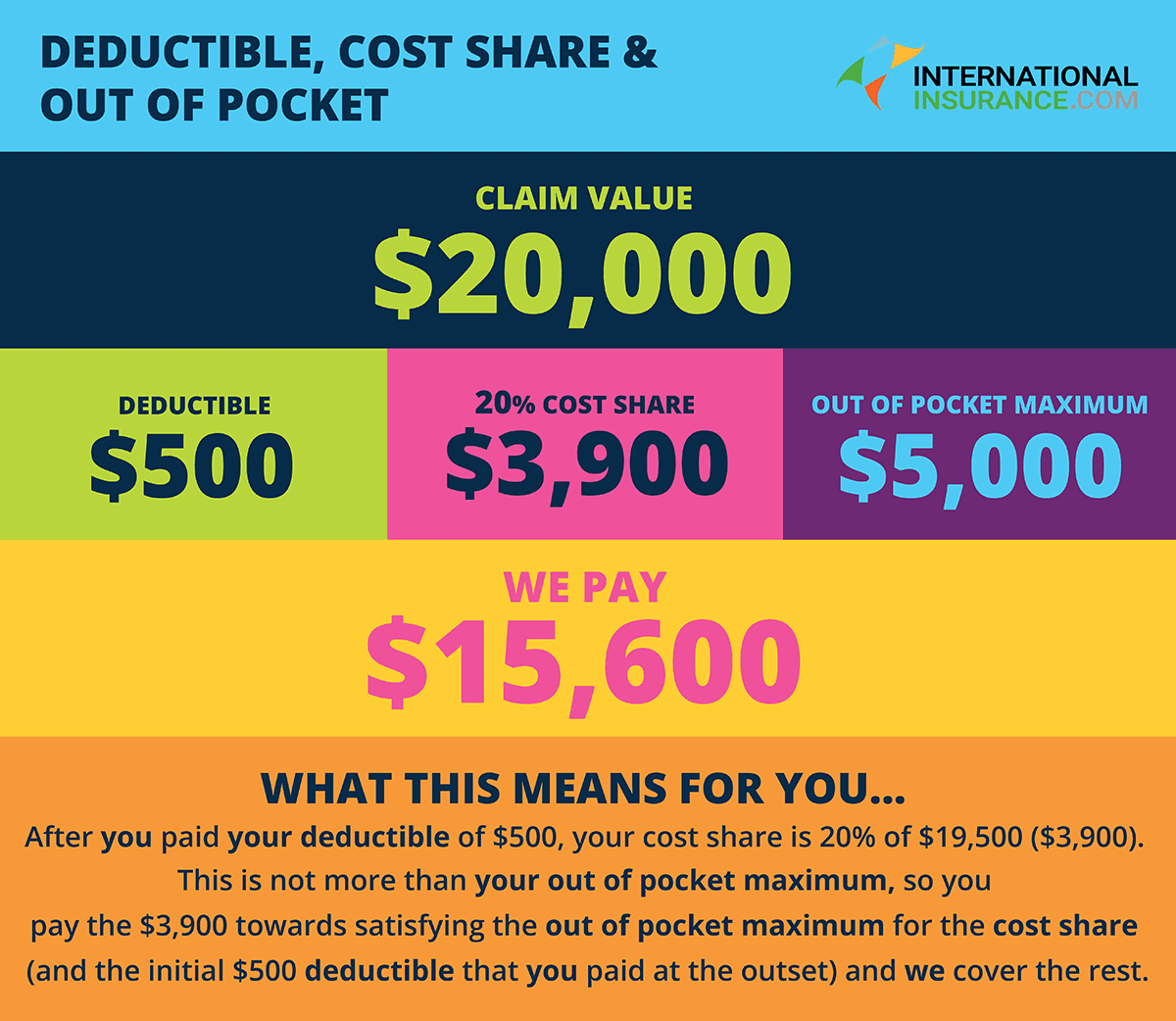

Both your deductible and out-of-pocket maximum only include certain expenses. In health insurance your out-of-pocket expenses include deductibles coinsurance copays and any services that are not covered by your health plan. However it does include your deductible copays and coinsurance payments for the year.

If your plan covers more than one person you may have a family out-of-pocket max and individual out-of-pocket maximums. The insurance company also sets a maximum amount that youll have for medical expenses on your own called an out-of-pocket maximum. Here are some examples of 2020 insurance plans that qualify as an HDHP and allow you to contribute to an HSA.

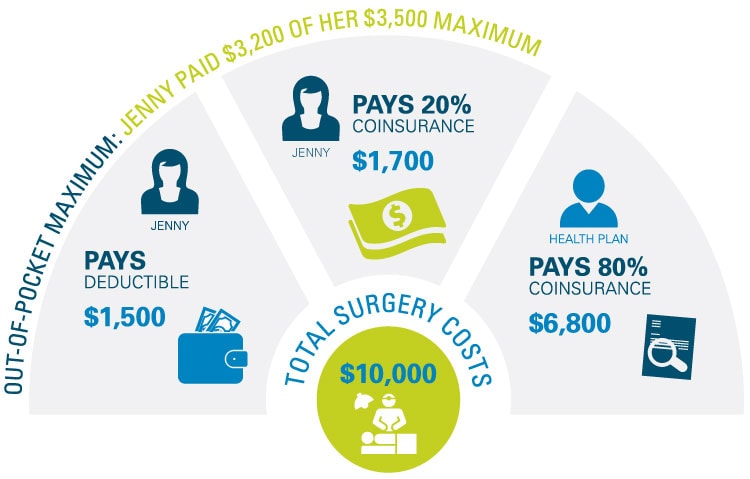

Yes your deductible is counted towards your out-of-pocket maximum. For example lets say you purchase an insurance plan with a 4000 out-of-pocket maximum. People generally reach their out-of-pocket maximums during a year with high medical costs.

This may include costs for deductibles coinsurance and copays. Once you reach your out-of-pocket max your plan pays 100 percent of the allowed amount for covered services. What you pay toward your plans deductible coinsurance and copays are all applied to your out-of-pocket max.

The out-of-pocket maximum also called OOPM is the most you will have to pay out of your own pocket for expenses under your health insurance plan during the year. Out-of-pocket maximumlimit The most you have to pay for covered services in a plan year. Deductible 1400 Coinsurance 40 OOP Max 6900.

Out-of-pocket costs for each individual go toward meeting the family out-of-pocket maximum. The out-of-pocket maximum does not include your monthly premiums. After you spend this amount on deductibles copayments and coinsurance for in-network care and services your health plan pays 100 of the costs of covered benefits.

The difference is that once you hit your maximum your will no longer have to worry about any other out-of-pocket expenses. Similarly to your deductible your out-of-pocket maximum establishes a spending limit. Does not exceed out of pocket max.

Out-of-pocket maximums usually differ between an individual and a family so make sure to familiarize yourself with your particular plan and options. Your deductible is part of your out-of-pocket costs and counts towards meeting your yearly limit. This limit includes the deductible copays and coinsurance you will continue to pay after you reach the deductible.

Neither one includes your monthly premiums. Deductible 3000 Coinsurance 10 OOP Max 4000. How do I track what Ive paid.

Exceeds minimum deductible does.