The patch installation will start. If mailed it must be post-marked no later than enter date.

If you reject COBRA continuation coverage before the due date you may change your mind as long as you submit a completed Election Form.

Cobra forms 2020. The model notices explain that there may be advantages to enrolling in Medicare before or instead of electing COBRA. The revised model notices provide additional information to address COBRAs interaction with Medicare. If your COBRA coverage is extended to 29 months due to disability your cost will increase to 150 of the applicable full cost rate for the additional 11 months of coverage.

2021 Retiree and VSDPLTD Enrollment Form. The Consolidated Omnibus Budget Reconciliation Act COBRA gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss reduction in the hours worked transition between jobs death divorce and other life events. COBRA enrollment form 2020-21.

2021 Enrollment Form for Active Employees. The forms necessary for establishing eligibility for COBRA premium assistance. Under COBRA you must pay 102 of the applicable cost of your COBRA coverage.

The HR Office should contact the eligible employee spouse or domestic partner to obtain the information necessary to complete the form. Close the cobra Appointment Manager. 2020 Retiree and VSDPLTD Enrollment Form.

Make sure that you have the activation data at hand since they will be needed during the update. 2020 Enrollment Form for Active Employees. 2020 COBRA Group Continuation Coverage for Dental and Vision Plan Premiums Please refer to the Benefits Administration Manual BAM COBRA Section 400 for complete instructions on the completion and submission of COBRA documents.

Click to view pdf or doc Plan year July 1 2020 through June 30 2021 Use this form to enroll in COBRA insurance coverage available to UK employees which allows you to continue your group health dental and vision insurance on an individual basis when you or your dependent s become ineligible for University. HMOCPO Provider Selection Enrollment and Change Form 22840. On May 1 2020 the DOL released the first updates to its model COBRA Notices since 2014.

All paths and settings valid now will be retained. COBRA costs will change periodically. Employer Group Information Form small group IL Small Group EGI.

This Election Form must be completed and returned by mail or describe other means of submission and due date. Delinquent Filer Voluntary Compliance Program DFVCP Audit Quality. Bei der Umsetzung von cobra CRM 2020 wurden selbstverständlich bewährte Funktionen weiter optimiert.

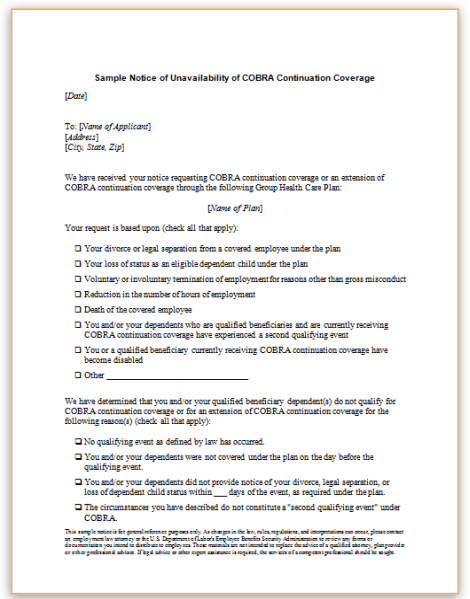

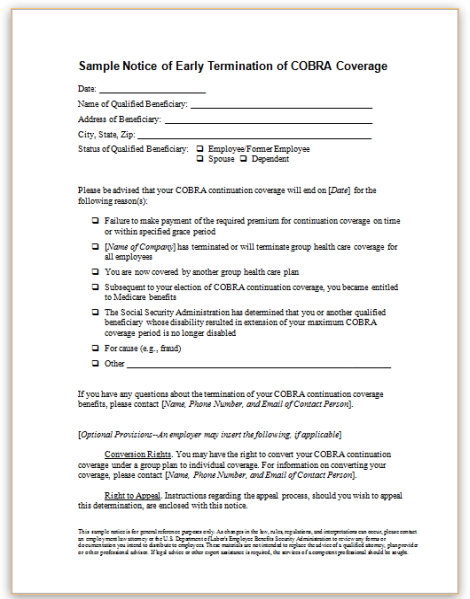

Extended CoverageCOBRA Change Request Form. Model Notice in Connection with Extended Election Period. MS Word PDF.

Model General Notice and COBRA Continuation Coverage Election Notice. If you dont submit a completed Election Form by the due date shown above youll lose your right to elect COBRA continuation coverage. Morsani College of Medicine 2020-2021 USF Health Morsani College of Medicine 701223 Housestaff x ----- ----x ----- ---- -----X NA NA NA-----COBRA Election Form X X COBRA 2020-2021 GME Business Office ___ MA ___.

Dabei werden sämtliche bisherigen Pfade und Ein-. STATE-SPONSORED DENTAL PLANS Delta Dental. It also highlights that if an individual is eligible for both COBRA and Medicare electing COBRA.

Also available in Spanish MS Word PDF. COBRA notice forms either as amended or as a separate document must include. 700 will serve as the COBRA continuation enrollment form for COBRA enrollments in the basic vision plan.

Also available in Spanish MS Word PDF. Also available in Spanish MS Word PDF. Double click the patch file.

This means that you cannot specify new paths during a patch installation. 2020 Benefit Program Selection BPS Form. Die Patch-Datei haben Sie aus unserem Kundenportal heruntergeladen oder auf anderem Wege von cobra oder Ihrem Fachhändler erhalten.

Current COBRA rates are included with this notice. Instructions are provided below. The Vision Plan Enrollment Authorization form STD.

Under COBRA group health plans must also provide covered employees and their families with certain notices explaining their COBRA rights. Vollständig neu programmiert erstrahlt die Funktion nun in einem neuen Antlitz und bietet die Möglichkeit Stichwörter. MS Word PDF.

Bei einer Patch-Installation wird Ihre vorhandene cobra 2018-Version auf Version 2020 aktualisiert. 2020 Benefit Program Selection BPS Form. Submission Guidelines for Small Group Health Coverage 23162.

The models are for the i general or initial notice provided to employees and covered spouses within the first 90 days of coverage under the group health plan and ii the election notice provided to qualified beneficiaries within 44 days of the qualifying event resulting in a loss of coverage. Setzen Sie bereits mit Erfolg unsere praktische Stichwort-Funktion ein durch die Adressen mithilfe verschiedener Stichwörter übersichtlich kategorisiert werden können. The premiums shown below are 102 percent of current total premiums.

Enter the social security number date of birth. MS Word PDF.