If youre retired have Medicare and have group health plan coverage from a former employer generally Medicare pays first. There are local medicare insurance agents that can help you along the road.

Medicare Supplement Plans Medigap Senior Healthcare Direct

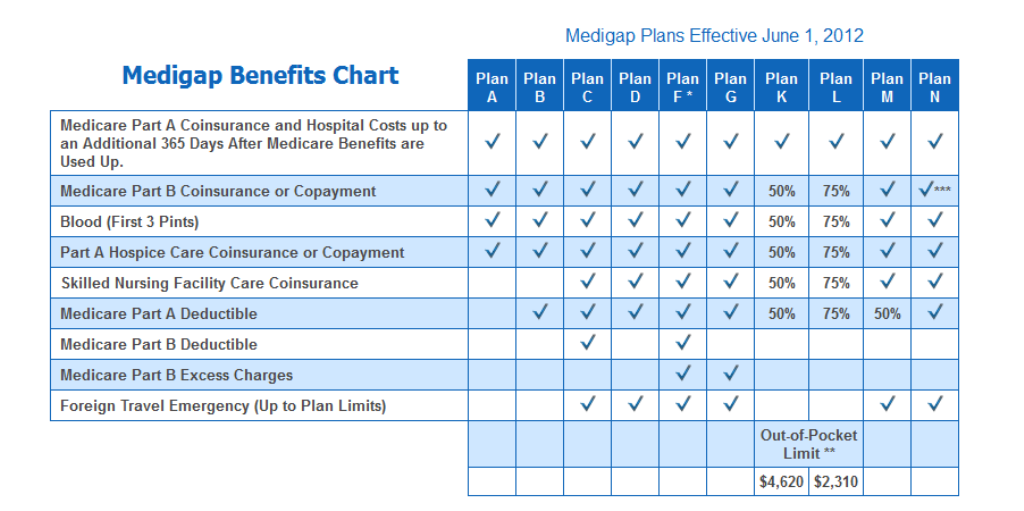

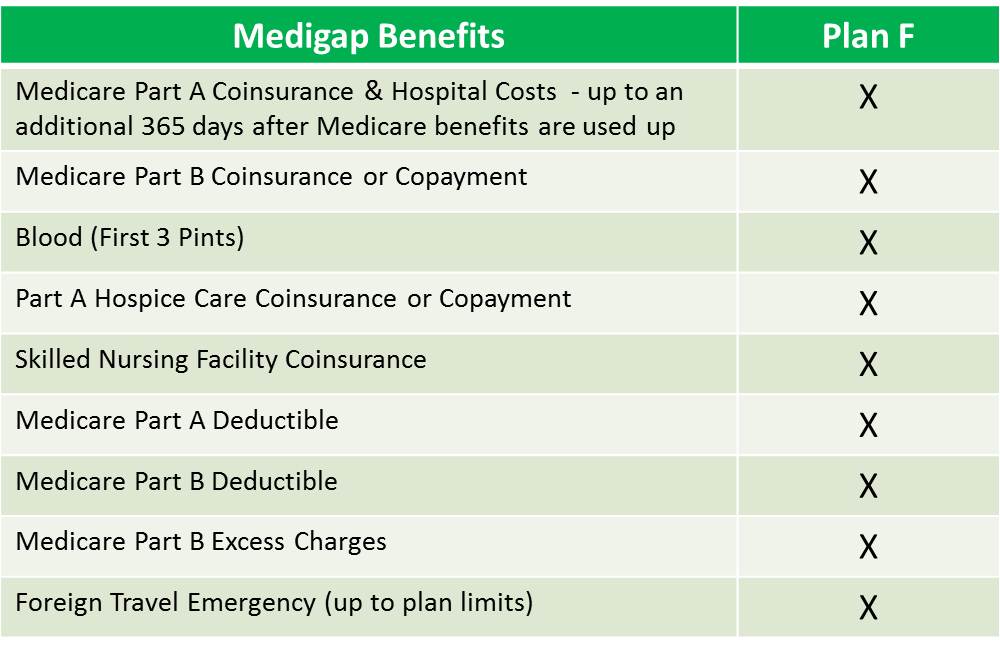

Original Medicare has deductibles copayments and coinsurance so you face significant out-of-pocket costs if you dont have other coverage.

Help with medicare supplement plans. Whats Medicare Supplement Insurance Medigap. Read about Medigap Medicare Supplement Insurance which helps pay some of the health care costs that Original Medicare doesnt cover. 2 days agoIn Houston a 60-year-old making 32000 can get a midlevel ACA silver plan for 88 a month compared with either 284 for traditional Medicare plus a Medigap supplement and a prescription.

Used in combination with your Original Medicare coverage Medicare Supplement plans can help you pay for healthcare costs like coinsurance deductibles and copayments. Your retiree coverage pays second. This could mean that you dont get the treatment you need or you have to pay thousands of dollars for it.

Medicare supplements are there to help fill in any gaps that appeared in Medicare that are sold by some private companies. And youll automatically qualify for Extra Help paying for your Medicare drug coverage Part D. Note If you dont get Medicare drug coverage or Medigap when youre first eligible you may have to pay more to get this coverage later.

The biggest difference between Medicare Advantage and Medicare Supplement plans is that Medigap is an add-on to Original Medicare and Medicare Advantage is separate. Whether you want Medicare Part C D or a Medicare Supplement Plan we have the answers. How to buy a Medigap policy Step 1 Decide which plan.

District of Columbia DC Medicare supplement plans also known as Medigap policies help pay for healthcare costs that Medicare doesnt cover. A B D G K L M and N. While Medicare in general tends to cover the cost of quite a lot there are still some things missing.

HealthMarkets Medicare insurance agents are nationwide and can help you explore your options to find the right coverage. When choosing between Medicare supplements and Medicare Advantage plans its wise to see the big picture. SHIPs were established to help beneficiaries with plan choices billing problems complaints about medical care or treatment and Medicare rights.

What is a Medicare Supplement insurance plan. Youll need to meet certain income and resource limits. With a supplement plan your healthcare costs will first be covered by Original Medicare and any leftover may be covered by Medigap.

A Medicare Supplement insurance plan also known as Medigap helps beneficiaries cover some of the costs not included with Original Medicare. If you have Medicare and full Medicaid youll get your Part D prescription drugs through Medicare. Qualify for extra help from Medicare to pay the costs of Medicare prescription drug coverage Part D.

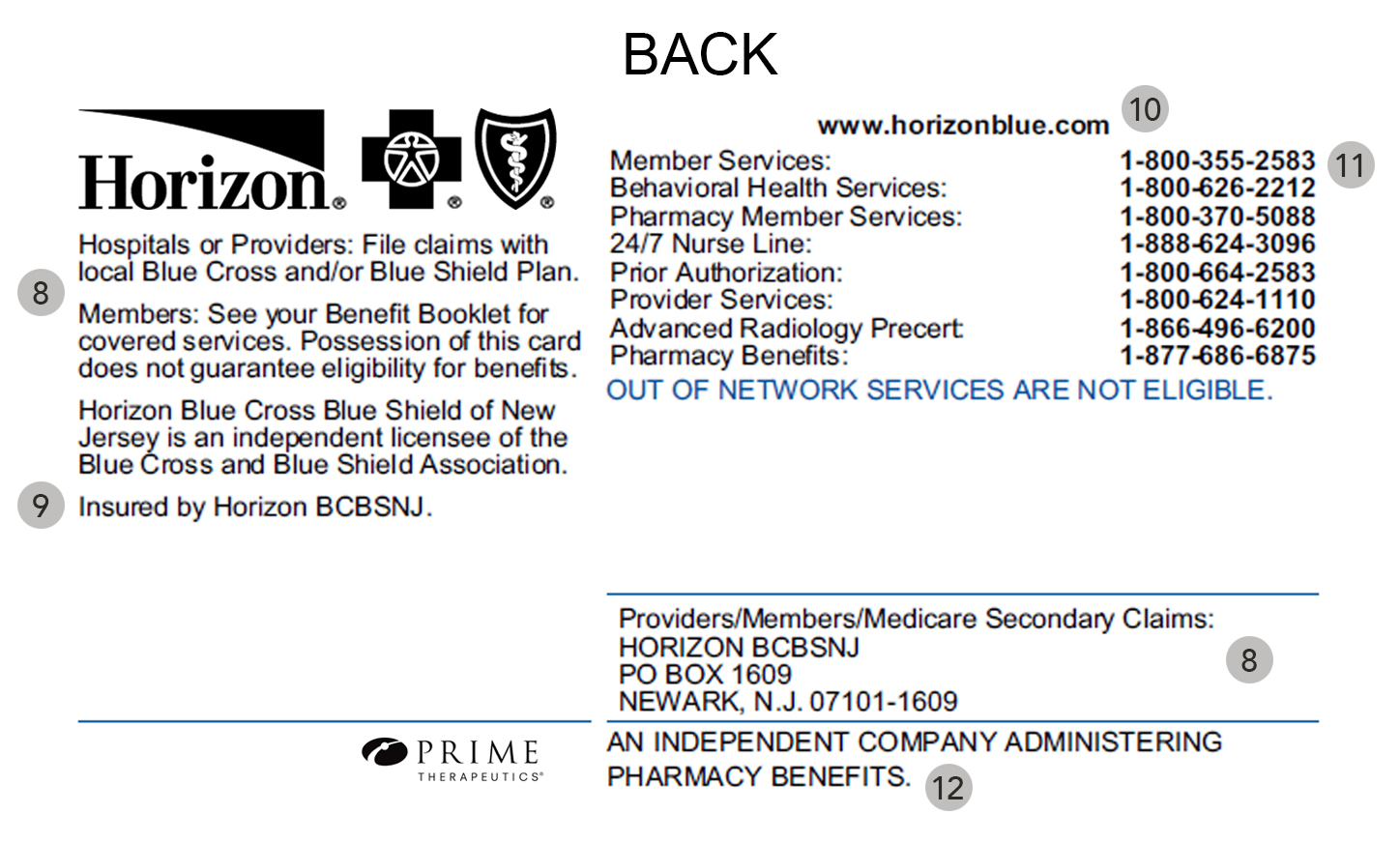

You can get your Medicare coverage through Original Medicare or a Medicare Advantage Plan Part C. In addition the Medicare Rights Center staffs a hotline at 800-333-4114 to help answer your Medicare questions. Add other insurance like Medicare Supplement Insurance Medigap Medicaid or employee or union coverage to help pay your out-of-pocket costs like your 20 coinsurance.

Medicare Supplement Insurance Medigap is extra insurance you can buy from a private company that helps pay your share of costs. And your State Health Insurance Assistance Program SHIP provides free Medicare counseling in person or over the phone. The 8 Medicare Supplement plans available to new beneficiaries in 2020 are.

But first you must understand the difference between the two options. PACE Program of All-inclusive Care for the Elderly is a MedicareMedicaid program that helps people meet health care needs in the community.

/Anthem-8f83a86e14b94fa5a570b5f83374df3d.jpg)