EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO. Well there are several technical differences between HMO and EPO.

Hmo Vs Ppo Which Plan Is Best For You

Hmo Vs Ppo Which Plan Is Best For You

An EPO or exclusive provider organization is a bit like a hybrid of an HMO and a PPO.

Hmo ppo and epo. When considering their difference the HMO can be termed as an insured product which means that the insurance. An HMO is a health maintenance organization a PPO is a preferred provider organization and an EPO is an exclusive provider organization. Anzeige Welche Leistungen sind im HMO-Modell inbegriffen.

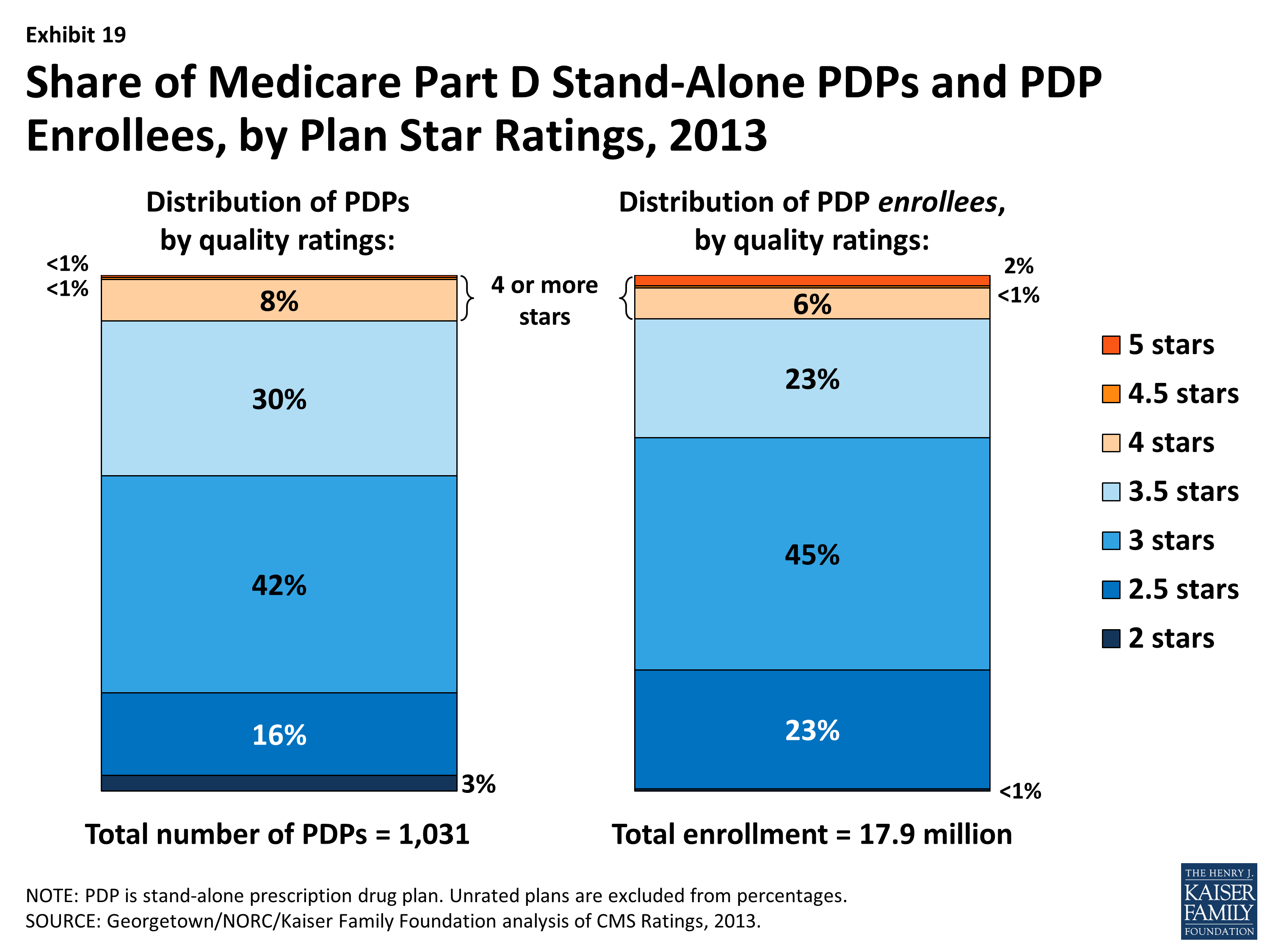

An Exclusive Provider Organization EPO is a lesser-known plan type. Premiums are higher than HMOs but lower than PPOs. While these names may be somewhat confusing they describe how you will get your health care from physicians and hospitals.

HMOs often provide integrated care and focus on prevention and wellness. HMO PPO EPO and POS Plan Features. Health maintenance organization HMO preferred provider organization PPO point of service POS and exclusive provider organization EPO plans are all types of managed healthcare.

POS and EPO plans are options provided by some employers and health insurers but theyre not nearly as common as HMOs PPOs and HDHPs. HMO stands for Health Maintenance Organization and EPO stands for Exclusive Provider Organization. Finden Sie es direkt auf Comparis heraus.

PPO preferred provider organization is a type of health plan that contracts with medical providers such as hospitals and doctors to create a network of participating providers. HMOs health maintenance organizations are typically cheaper than PPOs but they tend to have smaller networks. Anzeige Welche Leistungen sind im HMO-Modell inbegriffen.

Difference Between HMO and EPO HMO vs EPO HMO and EPO are both health insurance schemes. A provider network can be made up of doctors hospitals and other health care providers and facilities that have agreed to offer negotiated rates for services to insureds of certain medical insurance plans. Finden Sie es direkt auf Comparis heraus.

This is why PPOs tend to have higher premiums and deductibles when compared to HMOs and EPOs. Lets take a look at the features of each type of plan. Was beinhaltet das HMO-Modell.

Finden Sie es heraus. Each type of health insurance system will offer different options as you obtain services and the services are received through a network. Although all of these are managed care plans each is distinguished through varying structures for accessing providers and specialists premium costs levels of cost sharing flexibility and more.

This means you will have to pay for out-of-network service completely out-of-pocket. HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs. Like a PPO you do not need a referral to get care from a specialist.

Was beinhaltet das HMO-Modell. On the other hand the EPO plans have lower monthly premium than the PPO but higher than the HMO plans. You need to see your primary care physician before getting a referral to a specialist.

Some of these plans provide more flexibility in which providers you can while see while others might require you to get permission or pre-authorization from the insurance company before you can have a medical procedure. Understanding the differences between these options is an important first step to determining which kind of plan is right for your company and employees. They may or may not require referrals from a primary care physician.

There are a number of different types of networks with HMO PPO EPO and POS being some of. PPOs preferred provider organizations are usually more expensive. Meanwhile HMOs and EPOs do not cover out of network visits except in emergencies.

Like HMOs EPOs cover only in-network care but networks are generally larger than for HMOs. Finden Sie es heraus. Exclusive provider organization plans EPO The two most common health plans have been generally HMOs and PPOs but HDHPs have become a lower-cost health insurance option for employers over the past decade.

An HMO may require you to live or work in its service area to be eligible for coverage. Difference between PPO HMO and EPO COST OF COVERAGE In terms of cost the PPO plans are offered at highest premium and also have higher deductibles. PPO HMO EPO exclusive provider organization and POS point of service plans have different benefits and costs.