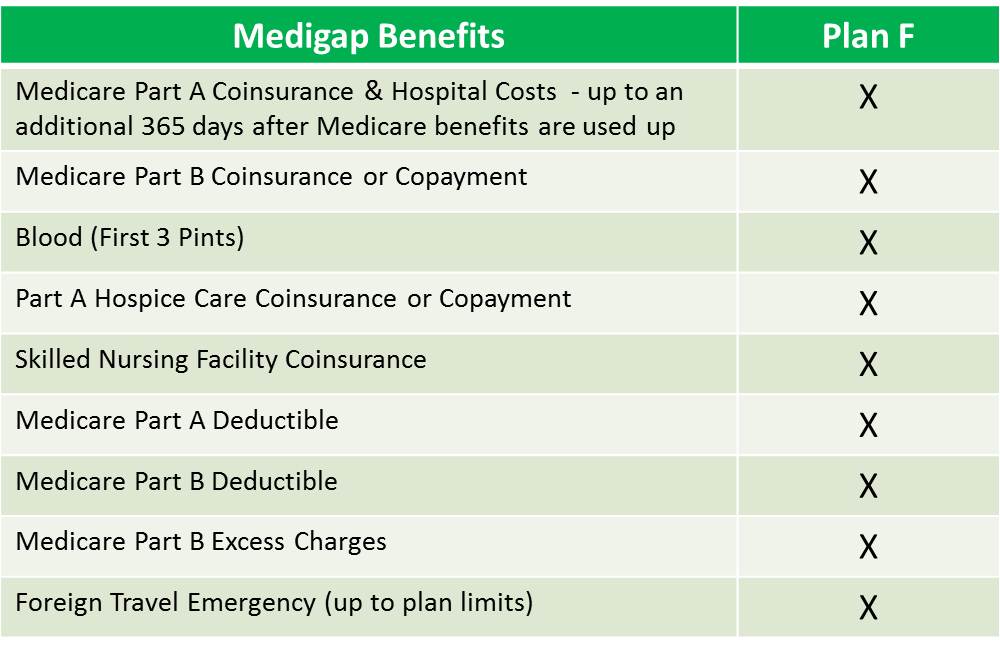

Medicare Supplement Plans F and G are identical with the exception of one thing. Plan F covers the following.

Medicare Supplement Plan F 7 Essential Facts You Must Know Clear Medicare Solutions

However once the Part B deductible for Plan G is paid for you essentially have Plan F.

What is medicare supplement f. Deductibles for both Medicare Part A and Part B. The reason why many people like Medicare Supplement Plan F is due to the fact that it is hassle-free. A Medicare Supplement Insurance Medigap policy can help pay some of the remaining health care costs like.

Dental care vision care including eyeglasses hearing aids long-term care private nursing. There are no claims paperwork to file and the policy virtually pays everything. Medicare Supplement Plan F is one of the most popular Supplements in the nation.

Medicare Supplement Plan F or Part F is the most comprehensive supplemental insurance policy and covers 100 of the major gaps left by Medicare. Beginning January 1 2020 Medicare Supplement plans that cover the Part B deductible are no longer offered to new Medicare enrollees. What is Medicare Supplement Plan F The Medicare supplement insurance Plan F covers all the cost-sharing for Medicare Part A and B services.

Like many other Medigap policies Plan F also covers Part B copayments and the deductible. Medicare Supplement Plan F is the most comprehensive private insurance policy available to go with Medicare Part A and Part B. It pays 100 of the costs that Medicare would normally bill to you.

Its important to note that Medicare supplements are not standalone policies. Part B excess charges. You pay for your Medicare Part B and Medigap separately.

Also referred to as Medigap Plan F it covers Medicare deductibles and all copays and coinsurance. This means that the 9 basic benefits of Plan F will be the same no matter where you live or what Medicare Supplement Insurance company you buy it from. Medigap is Medicare Supplement Insurance that helps fill gaps in Original Medicare and is sold by private companies.

In addition to covering your out-of-pocket costs Plan F travels well. Part B coinsurance or copayment. Because Medicare Supplement Plan F and Plan C cover both Part A and Part B deductibles they wont be available for these.

Blood first 3 pints. The plan covers 100 of Part B coinsurance or copayment. Plan F covers Medicare Part A coinsurance and also pays for 365 days of hospitalization after Part A coverage ends.

This means that when you have Medicare Supplement Plan F you will not pay any deductibles. Just as the rest of the parts F deals with drugs administrated in the clinic but has nothing to do with retail prescriptions. Medicare Plan F is the most comprehensive of the 10 standardized supplements sold by Health Net of California.

Currently Medicare Supplemental Plan F also known as Medigap Plan F has been the most popular of the supplemental plans because if its comprehensive coverage for parts that are not covered by Medicare alone. This means that you will have to pay 183 annually before Plan G begins to cover anything. Plan F pays for Medicare Part B coinsurances.

Plan F is one of two Medicare Supplement plans that covers Part B excess charges what some doctors charge above what Medicare pays for a service. Medicare Supplement Insurance is the only plan to provide coverage for each of the following 9 benefit areas. This only applies to people who became eligible for Medicare January 1 2020 and later.

What Is Medicare Supplement Plan F. Original Medicare pays for much but not all of the cost for covered health care services and supplies. Thus you only pay the monthly premium and have no other out-of-pocket expense.

Medicare Plan F is the most comprehensive Medicare supplement plan. Although Health Net does not offer Plan F to everyone or in all areas see above where offered the plan covers the following. If you or your spouse did.

What is medicare plan F. So how is Medicare Supplement Plan F affected. You must have both Medicare Parts A and B.

Medicare Supplement Insurance Plan F is standardized by the federal government. That means you could see a doctor with little to no money out of your own pocket. Plan F is simply one of the Medigap policies that is available and is currently the most popular plan.

There is nothing unique about Plan F but it is notably the most comprehensive plan available. Lets do a brief review of what plan F covers. Some Medicare Supplement insurance plans can still cover the Medicare Part A deductible but not the Part B deductible.

It pays the out-of-pocket costs associated with Parts A and B including deductibles and the 20 coinsurance after the Part B deductible and more. You will pay no copays. Medicare Supplement Plan F.

Important Facts About Medicare Plan F. Medicare Supplement Plan F covers. Plan G does not cover the Part B deductible the Part B deductible for 2018 is 183.

Plan C is the other. This applies whether you qualified for Medicare because of age end-stage renal disease or disability. Like other Medicare supplement plans Plan F typically doesnt cover.