These policies help reduce Medicares out-of-pocket. Once you enroll in both Part A and Part B then you have the option to add a Medicare Supplement plan to give yourself additional coverage.

Medicare Supplement Archives Medicare Plan Finder

Medicare Supplement Archives Medicare Plan Finder

If you have to endure a lengthy hospital stay a Medicare supplement plan can save you money.

How do medicare supplement plans work. A Medicare Supplement Insurance Medigap policy can help pay some of the remaining health care costs like. That means that Medicare will be used first to pay for any Medicare-approved costs for any healthcare supplies and services. All plans include coverage for blood work at varying levels.

Medicare supplemental insurance or Medigap plans are policies that private insurance companies sell to people with traditional Medicare. How do Medicare Supplement plans work. A Medicare Supplement plan fills the gaps that exist in Original Medicare.

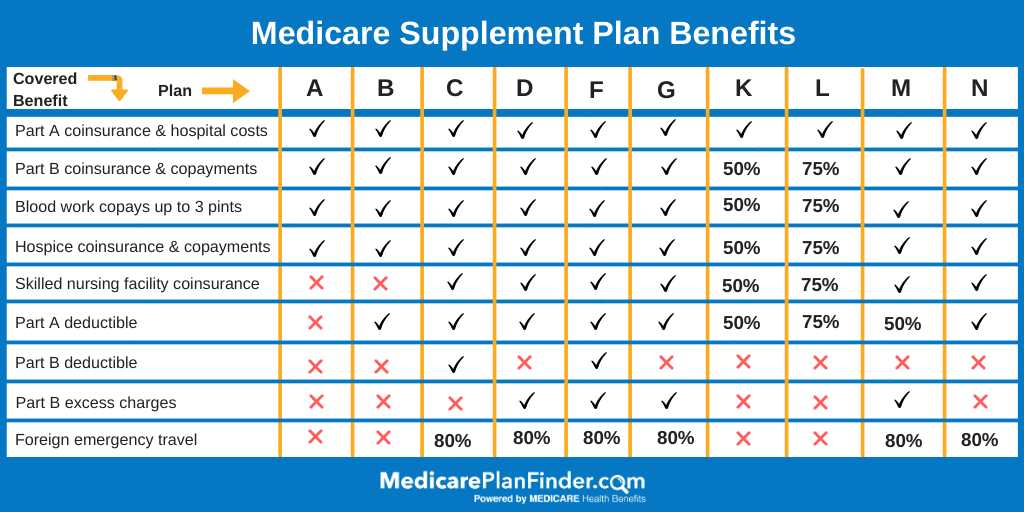

Medigap plans will work to supplement your Medicare benefits which is where they get the name. In most states there are up to 10 types of Medicare Supplement insurance plans available from private insurance companies. Plans can also choose to cover even more benefits.

How do Medicare Advantage plans work with Medicare Supplement. There are several things a person should take into account when deciding which Medicare supplement. For example some plans may offer coverage for services like transportation to doctor visits over-the-counter drugs and services that promote your health and wellness.

Medicare Supplement insurance plans generally help reduce your out-of-pocket Original Medicare costs. Most Medicare Advantage Plans offer coverage for things Original Medicare doesnt cover like some vision hearing dental and fitness programs like gym memberships or discounts. Plans can also tailor their benefit packages to.

Plan K covers it 50 percent and Plan L covers it at 75. Medicare Supplement insurance plans are designed to work with Original Medicare. Medicare Advantage plans cover a range of preventive care and wellness programs which keep participants.

When you purchase a Medicare Supplement insurance plan your Medigap policy will serve as a secondary source of insurance. For example they may pay your Medicare Part B coinsurance for Medicare-approved doctor visits and lab tests. You can buy a Medicare Supplement plan to go alongside Original Medicare Part A and Part B but you cannot use a Medicare Supplement plan to cover out-of-pocket costs with Medicare.

Medicare Supplement plans cover the costs that Original Medicare doesnt. Costs are lower because Medicare agrees upon rates with a network of healthcare providers. How do Medicare supplement plans work.

Unless your employer or a union pays the. Medicare Supplement Medigap plans are designed to help pay your share of health-care costs under Medicare Part A and Part B. Medigap insurance plans are a form of private health insurance that help supplement your Original Medicare coverage.

As mentioned Medicare Supplement Insurance plans are provided by private insurance companies. Medicare Supplement plans sometimes referred to as Medigap plans are designed to pay for many different types of out-of-pocket medical expenses such as copays and deductibles. Original Medicare pays for much but not all of the cost for covered health care services and supplies.

These supplemental plans are not meant to provide stand-alone coverage. They are often referred to as Medigap plans as they help fill the coverage gaps left by Medicare. How do Medicare Supplement insurance plans work with Medicare Advantage plans and other plans.

Medicare supplement plans are partially standardized plans offered by private companies under Medicare rules that pay for some of the costs Medicare normally doesnt cover things like copays coinsurance and deductibles. In order to be eligible for this type of coverage you need to be enrolled in Medicare. Medicare Supplement Medigap plans help cover some Medicare out-of-pocket costs including copayments coinsurance and deductibles.

After Medicare has been applied then your Medigap policy will be charged. Medicare Supplement plans work in addition to your existing Medicare coverage so the benefits of the Medigap plan kick in once coverage from Part A or Part B ends. These plans are designed to help pay some of the health care costs that Original Medicare may leave you with.

What is a Medicare Supplement Plan. These plans work with Medicare Part A and Part B and are not stand-alone plans. You pay a premium to a private insurance company for enrollment in a Medigap plan and the Medigap insurance helps pay for certain Medicare out-of-pocket costs including certain deductibles copayments and coinsurance.

It can help pay some of the out-of-pocket costs that Original Medicare Part A and Part B doesnt pay such as coinsurance copayments and deductibles. You are not able to receive the coverage without being enrolled in Medicare. Many Medicare Supplement plans also offer.

Other examples of how Medicare supplement plans work with Medicare include. Medigap is Medicare Supplement Insurance that helps fill gaps in Original Medicare and is sold by private companies. A person is eligible to buy a Medicare supplement plan when they first enroll in Medicare parts A and B.