Some Medicare Advantage plans may cover transportation to doctor appointments. Nonemergency transportation benefits vary by insurance company and plan but may include travel to doctors appointments lab tests pharmacies massage therapy fitness centers and other health care-related destinations.

Wellmed Medical Management Wellmedhealth Profile Pinterest

Wellmed Medical Management Wellmedhealth Profile Pinterest

You may also be able to get non-Medicare transportation to doctor appointments through various organizations such as your local Area Agency on Aging AAA.

Does medicare cover transportation to doctor's appointments. However Medicare Part A and B do not cover non-emergency transportation to and from your doctors office. However you do have options. You may be able to get coverage for a non-emergency ambulance ride to a doctor appointment if your doctor orders it as medically necessary.

1-571-386-3769 24 hours a day 7 days a week to schedule a ride or find out. Transportation to doctor appointments is not generally covered by Original Medicare Part A and Part B. Insurance companies generally provide free transportation to help you get to appointments.

Ambulance companies must accept the Medicare-approved amount as payment in full. However in general if you need a ride to a doctor appointment for routine care Medicare wont cover this type of transportation. However some Medicare Advantage plans may cover transportation to doctor appointments.

The only exception to this is if a Medicare recipient requires transport by ambulance in. NEW Kaiser Permanente Medicare Advantage HMO benefits for 2020 Transportation to appointments Kaiser Permanente Medicare Advantage includes 24 rides for nonurgent medical appointments at Kaiser Permanente medical centers and contracted facilities. The ambulance transport is en route to a Medicarecovered destination.

Check with your provider. In fact its estimated. Does Medicare cover transportation costs for older adults.

A written statement by a doctor is necessary for Medicare Part B coverage of nonemergency ambulance coverage but it doesnt guarantee Medicare coverage. Private insurance including some Medicare Advantage plans also may cover non-emergency medical transit. Medicare Advantage plans may cover nonemergency transportation to a doctors office or clinic.

While Medicare coverage provides benefits for a wide range of care services and supplies it does not cover the cost of transportation to or from medical appointments. Some Medicare Advantage plans may cover non-emergency transportation such as trips to your doctors. Original Medicare Parts A B will cover transportation only in certain situations but generally it doesnt cover expenses when its a routine trip from home to your doctor.

Non-emergency medical transportation NEMT is an important benefit for people who need assistance getting to and from medical appointments. Medically reviewed by Debra Sullivan PhD MSN RN CNE COI Written by Sherri Ledbetter on July 16 2020 Coverage. These plans will require that you have a specific need for transportation and you would only be able to use your coverage for healthcare-related transportation.

Medicare is a vitally important part of our society today for the impact it has on the elderly and disabled populations. But Medicaid can also cover nonemergency transportation to a doctors office or clinic. Does Medicare cover Transportation to Doctors Offices.

Thanks to the many coverage options that are available through Medicare these members of our society have a better chance of living a happy and comfortable life. Some Medicare allow transportation benefits through Uber Lyft and other ridesharing services. Medicare Part B generally pays all but 20 of the Medicare-approved amount for most doctor services plus any Part B deductible.

Ambulance service to a physicians office is covered only under the following circumstances. However it is. Medicare covers medically necessary medical transportation to the closest hospital in the event of an emergency.

This can include rides to doctors appointments pharmacies and other healthcare providers. Like Medicare Medicaid covers the cost of emergency transportation in an ambulance. For example if you have Priority Health Choice coverage just call 8889758102 or 6169758102 to make ride arrangements.

NEMT as its known is a Medicaid benefit that covers travel to medical appointments. Certain Medicare Advantage plans may cover a taxi or rideshare service while others contract with a transportation broker. During the transport the ambulance stops at a physicians office because of the beneficiarys dire need for professional.

Part A may cover emergency transportation services and Part B may cover transportation if its deemed medically necessary. To be certain of coverage for nonemergency ambulance transportation ask the treating physicians office to get prior approval from Medicare Part B. Our resources for providers explain important guidelines such as the difference between emergency and non-emergency medical transportation accepted types of transportation the types of transportation.

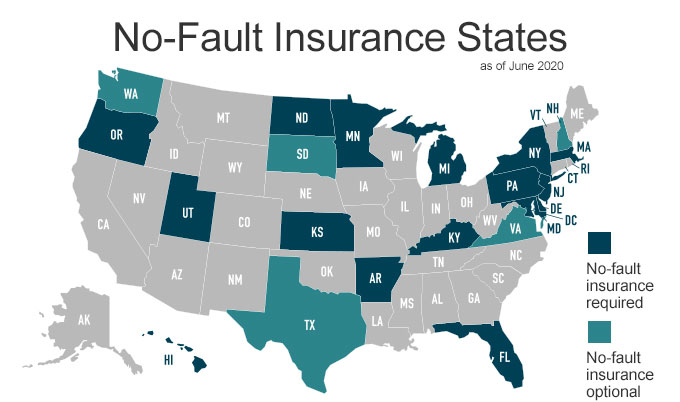

When it comes to nonemergency transportation as in the examples listed above these services are not generally covered. Yes Medicare Part B may cover medically necessary transportation ordered by a doctor and Medicare Part A may cover emergency transportation. Eligibility rules types of destinations and allowable modes of transport vary from state to state.