There are a number of different types of networks with HMO PPO EPO and POS being some of. However like an HMO an EPO plan member does not have out of network benefits except for emergency services.

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

But an EPO plan is like an HMO plan in that youre responsible for paying all your out-of-pocket costs if you go out-of-network.

Epo v hmo. Learn more about HMOs. They may or may not require referrals from a primary care physician. This type of plan gives you a little more freedom than an HMO plan.

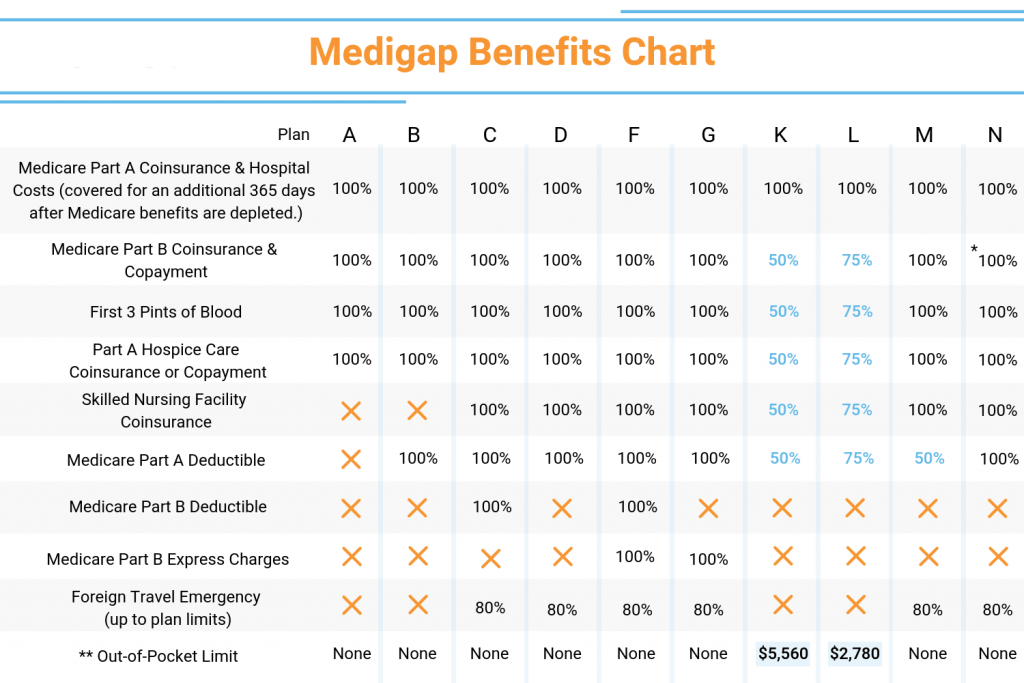

Members however may not. Only for out-of-network claims. The main difference between EPO and PPO plans and Health Maintenance Organizations HMOs is the need for a Primary Care Physician PCP in an HMO.

EPO Exclusive Provider Organization An EPO plan is less common than HMOs and PPOs but shares features of both. There is also a third option Exclusive Provider Organization EPO which is growing in popularity in California. EPO is short for Exclusive Provider Organization.

Yes but requires PCP referral. EPOs are similar to HMOs in that you must stay within your network emergency care is an exception however with an EPO you generally do not need to select a Primary Care Physician nor receive a referral to see a specialist. This specialist visit will be covered by your insurance.

Exclusive provider organization plans EPO PPOs are the most common type of health plan in the employer-sponsored health insurance market while HMOs lead the way in the individual insurance market. If you go to an orthopedist that is not in your HMO network youll pay the specialists fees on your own and your insurance provider will not reimburse you. EPO plans differ from Health Maintenance Organizations HMOs by offering participants a greater amount of flexibility when selecting a healthcare provider.

Exclusive Provider Organization EPO An EPO plan is like a hybrid of a PPO plan and an HMO plan. Like HMOs EPOs cover only in-network care but networks are generally larger than for HMOs. EPO vs PPO vs HMO vs POS Reviews by Zara Burton Published October 12 2017 Updated October 12 2017 When it comes to health plans.

EPO health insurance often has lower premiums than HMOs. HDHPs make up about one-third of employer-sponsored plans and are seen as a lower-cost health insurance option for employers over the past decade. A Health Maintenance Organization HMO is a fully integrated plan under a single network.

This means that in an HMO planyou do not contact the insurer to get pre-authorization for treatment but must be referred to a specialist by a PCP who is a member of the HMOs network. Premiums are higher than HMOs but lower than PPOs. If you are considering your options in terms of cost for EPO vs.

If required PCP likely does it. But like an HMO you are responsible for paying out-of-pocket if you seek care from a doctor outside your plans network. Learn the differences between health plans.

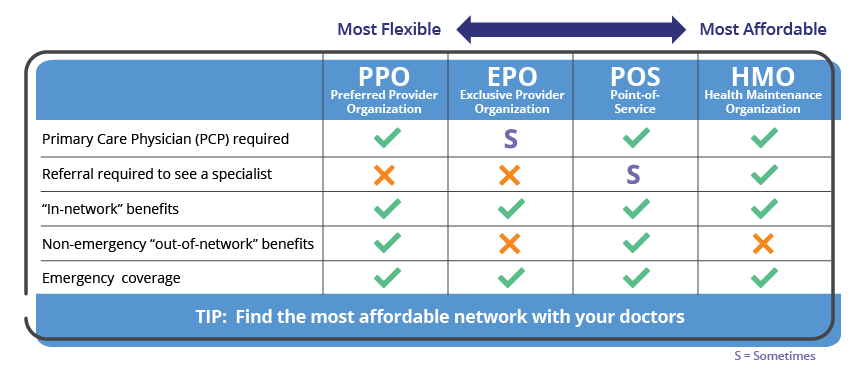

First of all its important to note that coverage across different companies does not differ. A Bronze plan in one company implies the same coverage as a bronze plan in another and so on and so forth. Typically lower in-network higher for out-of-network.

If required PCP does it for the patient. HMO health insurance you will want to consider all aspects of pricing such as premiums and copays. In California health insurance plan options primarily include Health Maintenance Organization HMO and Preferred Provider Organization PPO.

Exclusive provider organizations EPOs are a lot like HMOs. Like a PPO you do not need a referral to get care from a specialist. However HMOs have a bigger network of healthcare providers which more than makes up for it.

Like a PPO an EPO plan member does not require authorization from a PCP to see a specialist. EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO. An Exclusive Provider Organization EPO is a lesser-known plan type.

Out-of-network care may have different rules. A provider network can be made up of doctors hospitals and other health care providers and facilities that have agreed to offer negotiated rates for services to insureds of certain medical insurance plans. HMO PPO and EPO.

They generally dont cover care outside the plans provider network. Here well explain some of the basics starting with PPO HMO and EPO plans.