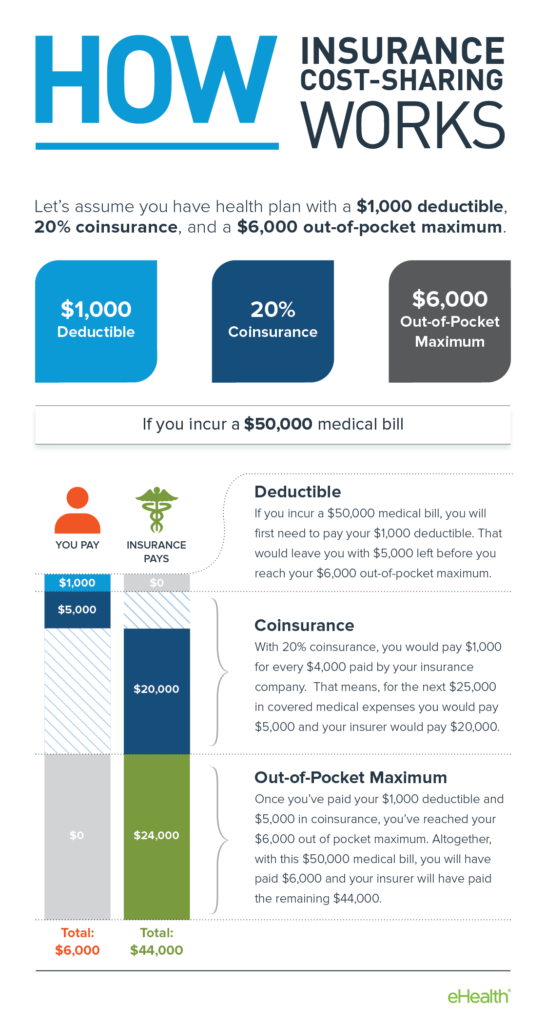

This is usually a fixed percentage and is similar to co-payment. The deductible is the amount that you need to pay as a share towards your medical bill upon which your policy comes into effect.

Out Of Pocket Maximums Copayments Coinsurance Bs Of Neny

Out Of Pocket Maximums Copayments Coinsurance Bs Of Neny

For example if your coinsurance is 20 percent you pay 20 percent of the cost of your covered medical bills.

Co insurance vs co payment. Youll continue to pay copays or coinsurance until youve reached the out-of-pocket maximum for your policy. If you have a health insurance policy that states the co-pay terms as 8020 where 80 is to be borne by insurer and 20 is to be borne by the insured. When your health plan is based on co-insurance once you meet the deductible you simply pay a fixed percentage of healthcare costs while PHP covers the rest.

The difference between a copayment and coinsurance is how the costs are split up. For example a prescription medicine. You can think of it as cost sharing between you and the health insurance plan.

Copays discourage unnecessary visits by making the patient responsible for a small portion of her healthcare costs. Lets say your health plan has 20 coinsurance. It is similar to the copayment provision under health insurance.

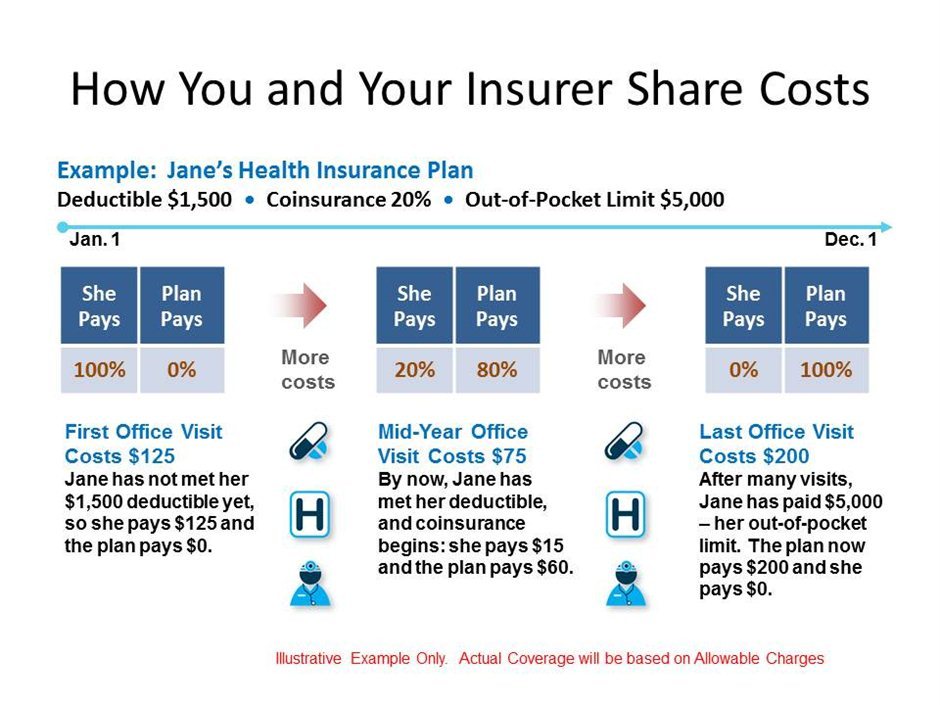

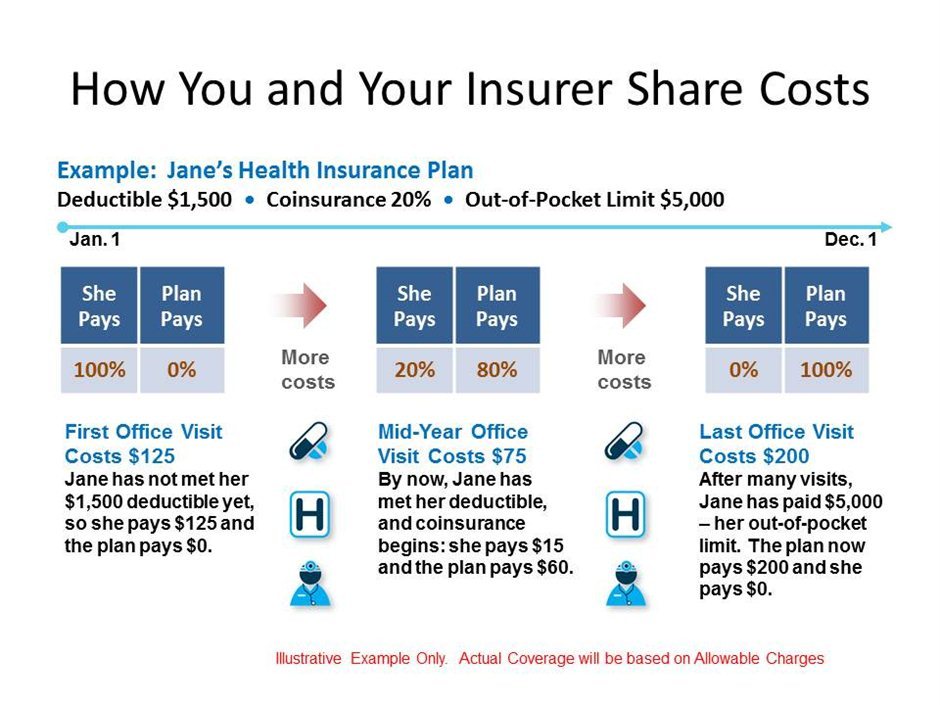

When you need services you and your health insurance provider each pay for a part of the cost of your care. Copayment and coinsurance are both forms of cost sharing. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent.

Coinsurance is health care costs sharing between you and your insurance company. Coinsurance is the percentage that you and the plan pay for the covered medical expenses until you reach your out-of-pocket maximum. For example if your coinsurance is 20 then you will be liable to bear 20 of the treatment cost while the rest 80 will be borne by your insurance provider.

What is the difference between co-insurance and co-pay. Whereas coinsurance is the percentage you pay for medical costs after your deductible your copay is a set amount you have to pay for other covered expenses. The remaining percentage that you pay is called coinsurance.

For example if your coinsurance is 20 it means you pay 20 for covered health care services and your insurer pays the remaining 80. Typically a health insurance plan with higher co-pay rates for various health care services has a much lower monthly premium while plans with lower co-pay rates will feature higher monthly. Co-pay is what you pay when you go to visit the doctor.

The cost-sharing stops when medical expenses reach your out-of-pocket maximum. A copay or copayment is the amount of money you are required to pay directly to the healthcare provider doctor hospital etc per visit or to a pharmacy for every prescription filled. The coinsurance typically ranges between 20 to 60.

Coinsurance is a portion of the medical cost you pay after your deductible has been met. Once you reach your deductible the health plan pays a portion of health care services. Coinsurance refers to the percentage of treatment cost youll have to pay once youve paid the deductibles.

Coinsurance can be explained easily with the co-pay provision of health insurance policies. Similarly under coinsurance multiple companies share the risk of loss in the pre-determined percentage.

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

Copay Vs Coinsurance The Differences And Why They Matter Professional Insurance Programs

Copay Vs Coinsurance The Differences And Why They Matter Professional Insurance Programs

Coinsurance And Medical Claims

Coinsurance And Medical Claims

Coinsurance And Medical Claims

Coinsurance And Medical Claims

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

/shutterstock_256703737_health_insurance-5bfc3c1846e0fb002605bf1f.jpg) What S The Difference Between Copays And Coinsurance

What S The Difference Between Copays And Coinsurance

Health Insurance Why Do People Get Health Insurance Ppt Download

Health Insurance Why Do People Get Health Insurance Ppt Download

/whats-the-difference-between-copay-and-coinsurance-1738506_final-4c635a490ace4b8d9ab16ac6fa61d192.jpg) Differences Between Copay And Health Coinsurance

Differences Between Copay And Health Coinsurance

Difference Between Coinsurance And Copay Difference Between

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Copays Vs Coinsurance For Health Insurance

Health Insurance Terms And How They Work Together Health Insurance Quotes

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Coinsurance Vs Copay Difference And Comparison Diffen

Coinsurance Vs Copay Difference And Comparison Diffen

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.