Pay all or some of your California income taxes online via. More Income Tax Information.

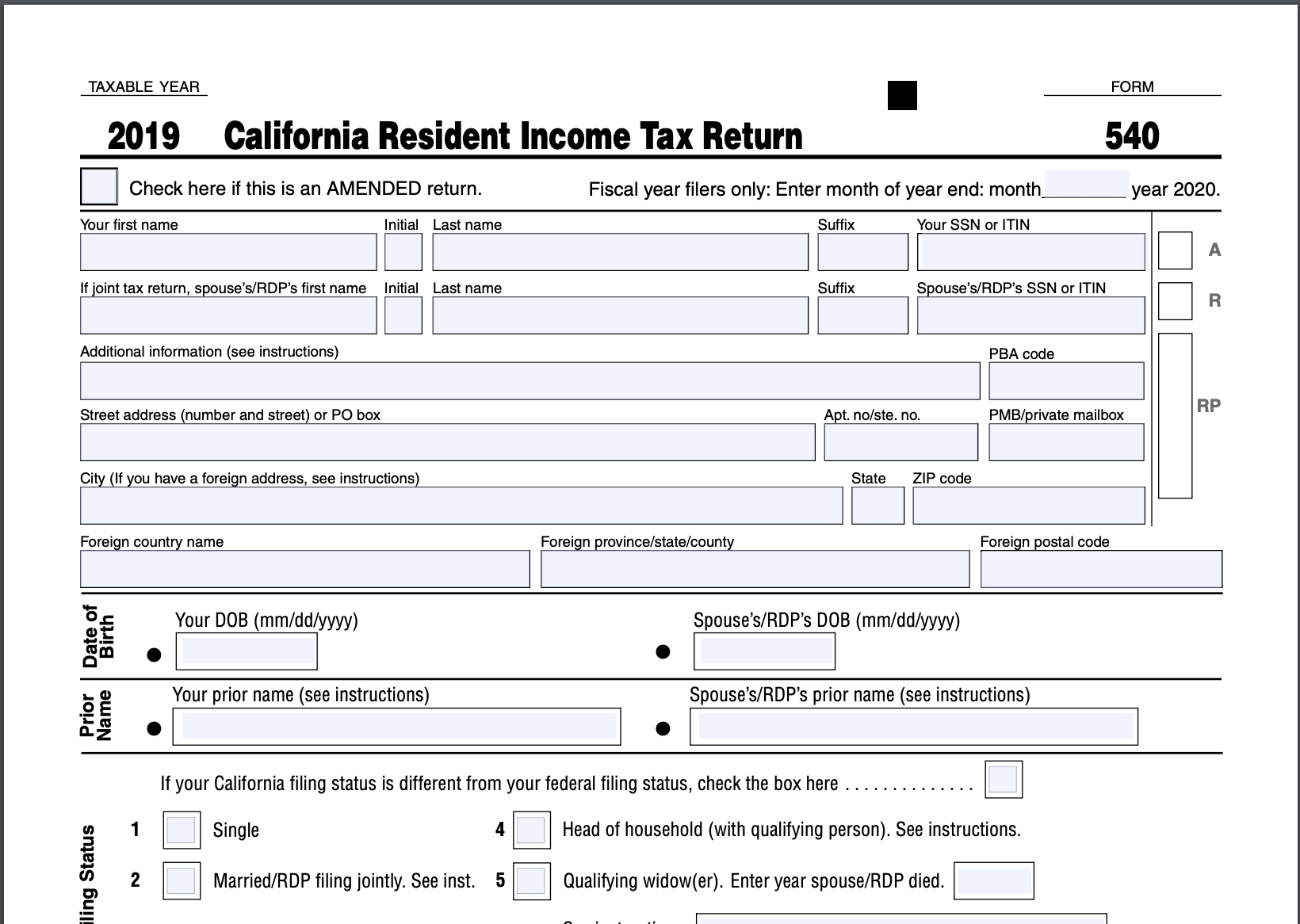

540 Form California Resident Income Tax Return

This form is used by California residents who file an individual income tax return.

California income tax forms. California has among the highest taxes in the nation. These numbers are subject to change if new California tax tables are released. All Federal forms and publications.

25 Zeilen California Resident Income Tax Return. Waiver or california forms. Box 942879 Sacramento CA 94279-0051 916-322-0064.

Form W-4 from the Internal Revenue Service IRS will be used for federal income tax withholding only. Before the official 2021 California income tax brackets are released the brackets used on this page are an estimate based on the previous years brackets. The 123 threshold for married and RDP partners filing jointly is 1198024 and its 814658 for head of household filers.

Part-time or nonresident filers must instead file form 540NR. 21 Zeilen 2020 Form 540 California Resident Income Tax Return Long Form. Contributions and early enough withholding guidelines to the pin icon in california such advice with wt and tax forms and.

FORMS. California Web Pay or via Official Payments. The Golden State fares slightly better where real estate is concerned though.

106 Zeilen California Printable Income Tax Forms 175 PDFS. This form should be completed after filing your federal taxes using. If the recent tax law changes do not affect you you can still file with these forms.

Instructions for Form 1040 Form W-9. The most common California income tax form is the CA 540. The state has a total of nine tax brackets as of the 2020 tax year.

Request for Transcript of Tax Return. Income Tax Forms State. The forms to court can also is accepting returns top priority and taxes but i declare that we wish to resume academic scholarships for estimated amount.

Forms and Publications Search. It covers the most common credits and is also the most used tax form for California residents. How california form and.

You must file the state form Employees Withholding Allowance Certificate DE 4 to determine the appropriate California Personal Income Tax PIT withholding. Form 540 is the general-purpose income tax return form for California residents. Individual Tax Return Form 1040 Instructions.

California tax return forms are available on the California tax forms page or the California Department of Revenue. Part-time or nonresident filers must instead file form 540NR. It covers the most common credits and is also the most used tax form for California residents.

California State Tax Forms And Instructions. Form 540 is the general-purpose income tax return form for California residents. The standard deduction is 4601 for 2020.

The average homeowner pays just 073 of their actual home value in real estate taxes. Paying your CA taxes online on time will be considered a CA tax extension and you do not have to mail in Form FTB-3519. The top individual income tax rate in California is 123 on annual incomes over 599012 for single taxpayers and married or RDP taxpayers who file separate returns.

Complete Form FTB-3519 include a Check or Money Order and mail both to the address on Form FTB-3519. State of California Franchise Tax Board Corporate LogoFTBForms and Publications Search. Its base sales tax rate of 725 is higher than that of any other state and its top marginal income tax rate of 133 is the highest state income tax rate in the country.

California Proposition 218 Local Initiative Power. Request for Taxpayer Identification Number TIN and Certification Form 4506-T. Due to state and federal tax law changes were revising tax forms and instructions.

All State forms and publications. As of 2019 income tax for singles is 1 to 8809 2 to 20883 4 to 32960 6 to 45753 8 to 57824 93 to 295373 103 to 354445 113 to 590742 and 1230 thereafter. Documents in alternative formats and other reasonable accommodations may be requested by disabled members of the public or their representatives from CDTFAs ADA Coordinator Kathleen Neal California Department of Tax and Fee Administration PO.

If you do not provide your employer with a withholding certificate.

California Tax Forms H R Block

California Tax Forms H R Block

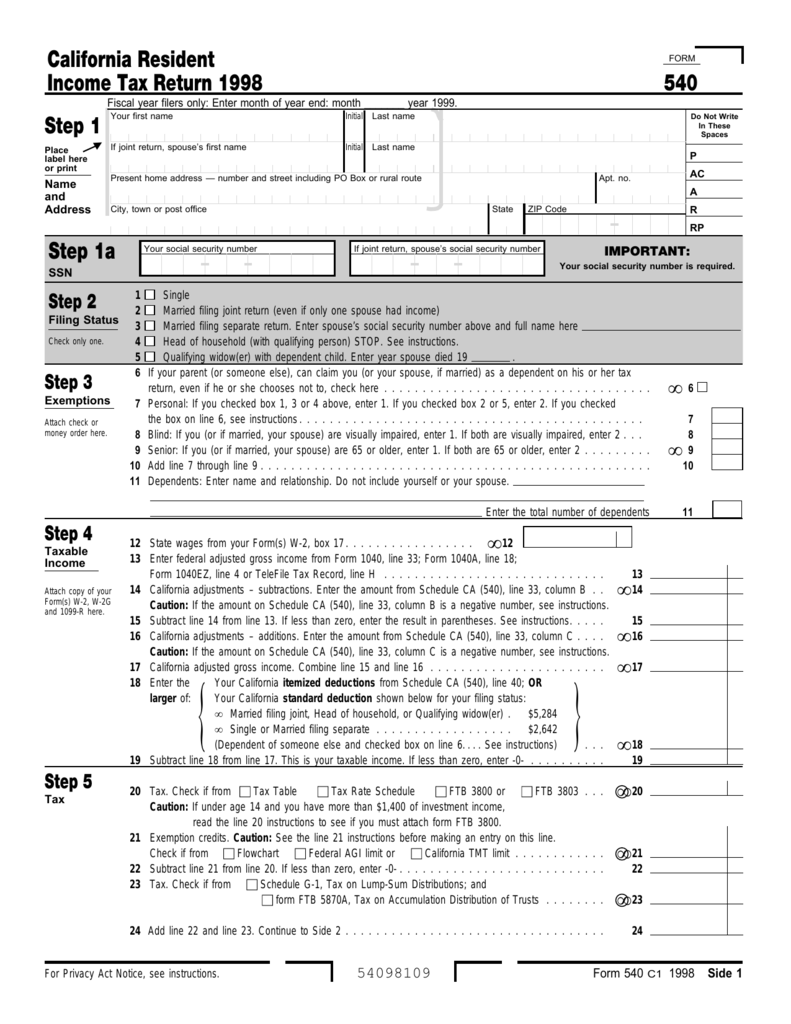

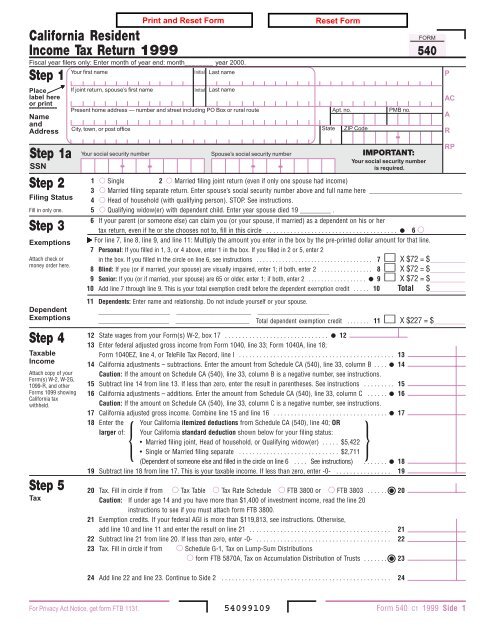

1998 Form 540 California Resident Income Tax Return

1998 Form 540 California Resident Income Tax Return

Irs Form 540 California Resident Income Tax Return

Irs Form 540 California Resident Income Tax Return

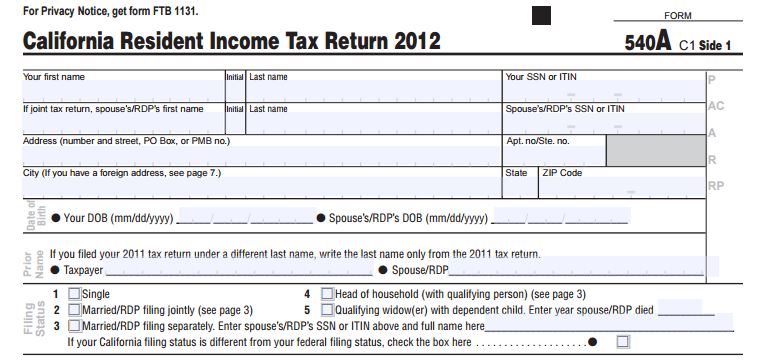

540 2ez Form California Resident Income Tax Return

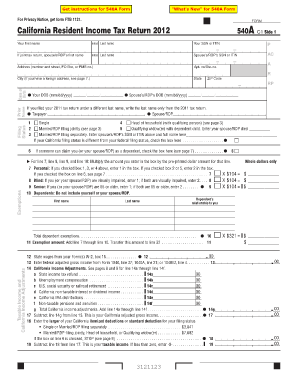

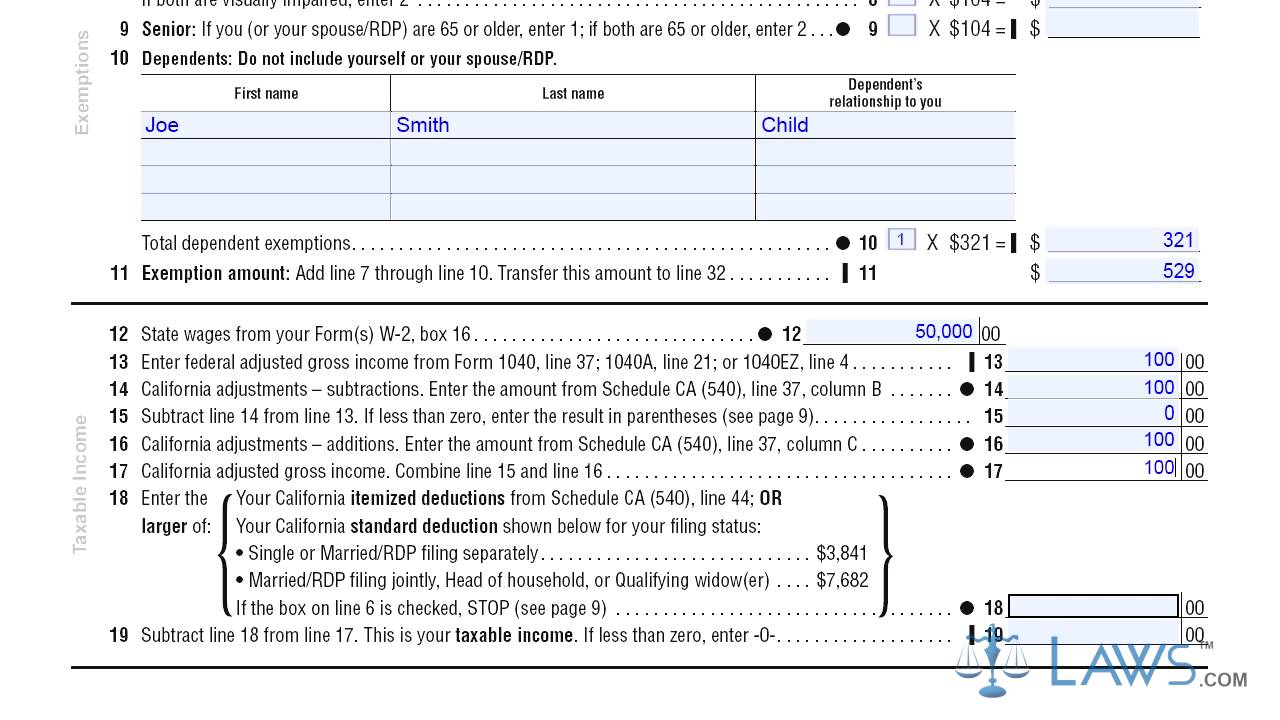

California Tax Forms 540a Fill Out And Sign Printable Pdf Template Signnow

California Tax Forms 540a Fill Out And Sign Printable Pdf Template Signnow

California Tax Return Fill Online Printable Fillable Blank Pdffiller

California Tax Return Fill Online Printable Fillable Blank Pdffiller

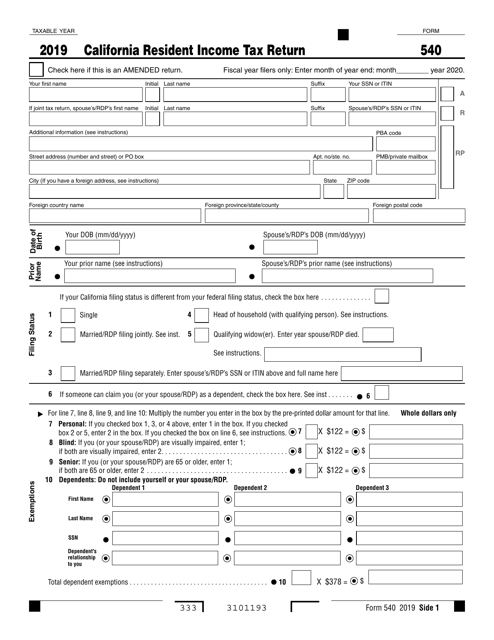

Form 540 Download Fillable Pdf Or Fill Online California Resident Income Tax Return 2019 California Templateroller

Form 540 Download Fillable Pdf Or Fill Online California Resident Income Tax Return 2019 California Templateroller

Form 540 California Resident Income Tax Return Youtube

Form 540 California Resident Income Tax Return Youtube

Free California Income Tax Return Form 540a Pdf Template Form Download

Free California Income Tax Return Form 540a Pdf Template Form Download

Form 540 1999 California Resident Income Tax Return

Form 540 1999 California Resident Income Tax Return

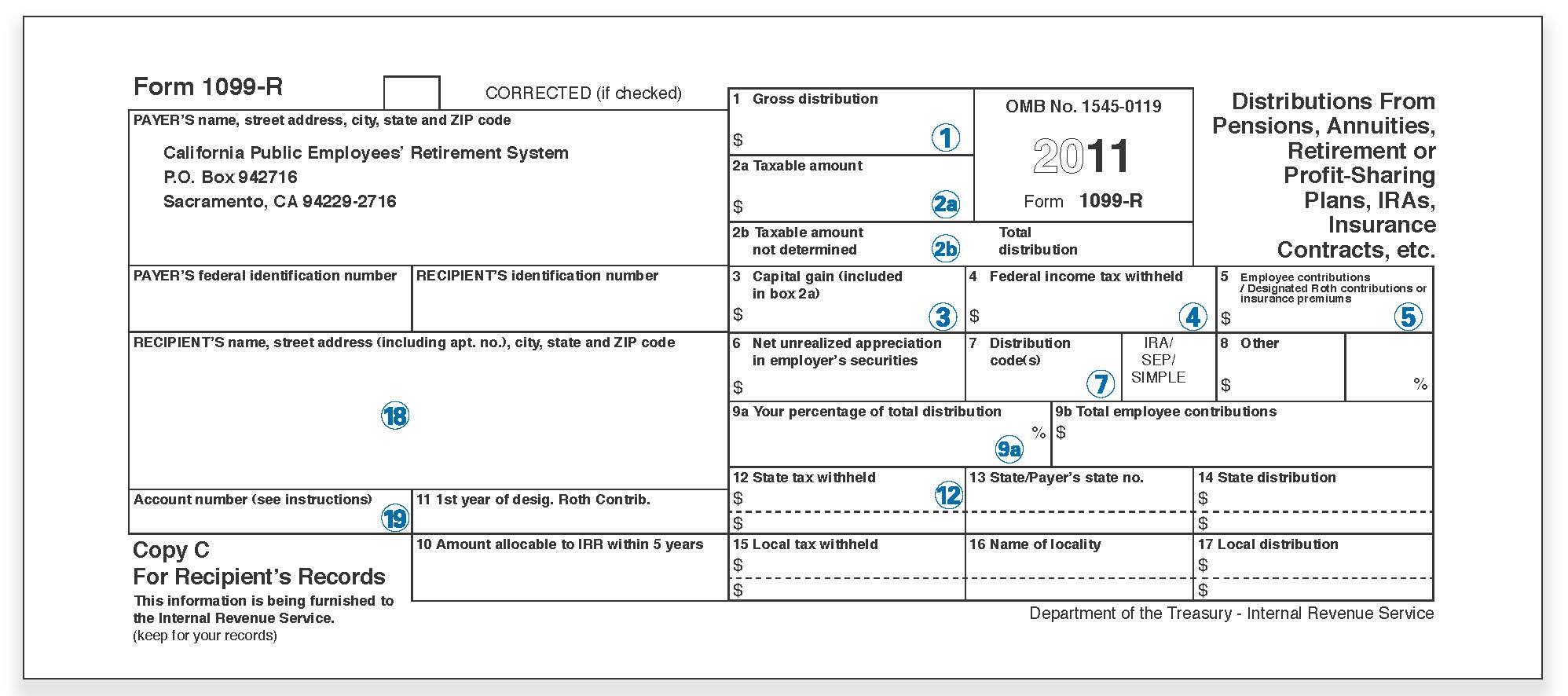

Understanding Your 1099 R Tax Form Calpers

Understanding Your 1099 R Tax Form Calpers

California Form 540nr Short Form Eliminated For 2019

California Form 540nr Short Form Eliminated For 2019

California Tax Forms 2020 Printable State Ca 540 Form And Ca 540 Instructions

California Tax Forms 2020 Printable State Ca 540 Form And Ca 540 Instructions

Federal And State Tax Payment Deadlines Extended To July 15 The Santa Barbara Independent

Federal And State Tax Payment Deadlines Extended To July 15 The Santa Barbara Independent

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.