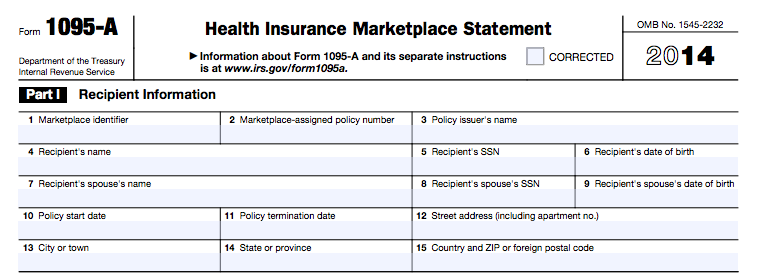

If you or members of your family enrolled in a private health plan through MNsure you will receive IRS Form 1095-A Health Insurance Marketplace. All the recipient has to do with this form is to hold on to the form for record-keeping purposes.

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

It comes from the Marketplace not the IRS.

What is the marketplace identifier on form 1095 a. My 1095-c doesnt say any of those it has my name ssn and my employers name. Before you file make sure its accurate. The Recipient Information will not flow to a form or schedule.

Below are the different codes that can be entered on line of the 1095-C. Health Insurance Marketplace Statement. This is all informational.

If you dont have your user name and password. Check the box Spouse is recipient if applicable. What Is Form 1095-A.

Your 1095-A contains information about Marketplace plans any household members had in 2020. Health Insurance Marketplaces must file Form 1095-A to report information on all enrollments in qualified health plans in the individual market through the Marketplace. Form 1095-A is a form that is sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace.

The main difference between Form 1095-B and 1095-A is that Form 1095-B shows one purchased coverage through an employernot the Marketplace. Do not file a Form 1095-A for a catastrophic health plan or a separate dental policy called a stand-alone dental plan in these instructions. If anyone in your household had a Marketplace plan in 2020 youll use Form 1095-A Health Insurance Marketplace Statement to fill out Form 8962 Premium Tax Credit PDF 110 KB.

If your client received a form 1095-A for Health Insurance Marketplace Statement this information is still required for tax year 2019. Enter the 1 Market-place identifier. How to use Form-1095-A.

You should receive your IRS Form 1095-A by mid-FebruaryIf you have questions about your form see these frequently asked questions or call our Contact Center. Due to recent tax law changes 1 if you bought your health plan directly from Blue Cross and Blue Shield of Illinois BCBSIL 2 or got your BCBSIL health plan through your job 3 the IRS says you no longer need Form 1095-B to file your federal income taxesThis change is as of January 2021. It means that the employee was not employed.

What is IRS Form 1095-A. Your 1095-A includes information about Marketplace plans anyone in your household had in 2020. Both 1095-A and CA 3895 allow 15 characters for the marketplace assigned policy umber.

The 1095 is a tax form that shows the health care coverage you had in the previous year. Keep your 1095-As with your important tax information like W-2 forms and other records. First you must be able to log into your Mass Health Connector online account.

Whats a Market Identifier. Call the Health Connector at 1-877-623-6765. See this TurboTax support FAQ for a Form 1095-C - httpsttlcintuit.

Complete the Recipient Information Part I section from Form 1095-A. If the program is not letting you input all of the numbers then use a browser and clear browsing data for all time before signing into TurboTax. Both 1095-A and CA 3895 allow unlimited characters for Box 1 - Marketplace Identifier.

If you bought health insurance through one of the Health Care Exchanges also known as Marketplaces you should receive a Form 1095-A which provides information about your insurance policy your premiums the cost you pay for insurance any advance payment of premium tax credit and the people in your household covered by the policy. Dont file your taxes until you have an accurate 1095-A. Due to these changes form 1095-B and 1095-C are no longer required to be entered into the tax return and should be kept by the taxpayer for their records.

And the marketplace assigned policy number. You do not report your Form 1095-C on a tax return nor do you report the Form 1095-C as a Form 1095-A. You can find a copy of your 1095-A form in your MNsure account.

This code is simple. Also if one is receiving Form 1095-B then he does not have to fill out Form 8962 to affirm tax credits. Form FTB 3895 California Health Insurance Marketplace Statement Publication 3849A Premium Assistance Subsidy PAS Publication 3895B California Instructions for Filing Federal Forms 1094-B and 1095-B Publication 3895C California Instructions for Filing Federal Forms 1094-C and 1095-C.

Heres how to find IRS Form 1095-A on the Massachusetts Health Connector website. Click on the screen Form 1095-A - Health Insurance Marketplace Statement from the left navigation panel.

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Http Info Nystateofhealth Ny Gov Sites Default Files Irs 20form 201095 A Pdf

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Breakdown Form 1095 A Liberty Tax Service

Breakdown Form 1095 A Liberty Tax Service

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.