If youre self-employed a small business owner an individual or a family who needs affordable health insurance give us a call today. As a member of the PEO you will have access to a suite of benefits including health insurance workers comp and disability insurance Bear in mind that PPO health insurance may be more expensive than the plans that are available on the individual market EmblemHealth.

Self Employed Ppo Health Insurance Freelancers

Self Employed Ppo Health Insurance Freelancers

You get to make all the big decisions like choosing a healthcare plan.

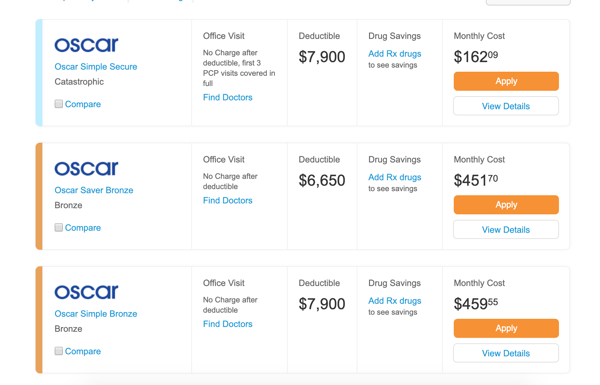

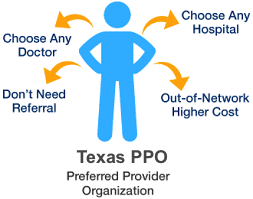

Ppo insurance for self employed. Find out about the plans and policies Cigna offers. Here are the options for getting the best care. We can help you choose a Cigna health insurance plan thats right for your needs and your budget.

The PPO plan includes global emergency and urgent care coverage 24 hours a day seven days a week. There are multiple options for cost assistance when you purchase self-employed health insurance. The 6 Best Ways to Get Health Insurance When Youre Self-Employed For entrepreneurs finding good health coverage can be difficult.

You will also need to meet a separate out-of-network deductible. 6 This is a deduction for self-employed individuals and their dependents not for small businesses. Cigna health plans make sense for self-employed people like you.

Some self-employed people choose a short-term income protection STIP plan. We promise youll be in good hands for all your health insurance needs. These are generally cheaper as they last for a shorter amount of time usually between six months and up to two years.

Can I get a health insurance deduction if Im self-employed. Annual memberships cost 25 for students and a max of 120 for general members. And you can do that with the health insurance tax deduction for the self-employed.

Save money on your self-employed benefits. Video Player is loading. The National Associate for the Self-Employed or NASE is an organization that provides day-to-day support for the self-employed.

Prior to the March 3 2021 change if you were self-employed and did not have employees your business must have showed a net profit on either your 2019 or 2020 Schedule C to qualify for PPP. Now your business must show gross income or a net profit to qualify. The cost includes health insurance premiums which varies based on state and.

Self-employed health insurance is available to those whose income is through a business with no other employees whose income that you report at the end of the year via a W2 form. Were looking forward to hearing from you. However eligible emergency care is always covered even out-of-network.

The cost of public liability insurance for self-employed and sole traders depends on many factors including the type of industry you work in. Class 2 if your profits are 6515 or more a year. The Affordable Care Act now allows a self-employed health insurance deduction on premiums of 100 meaning that you can reduce your adjusted gross income by the total amount of health insurance premiums you pay in a calendar year.

Some member benefits give you access to Health Savings Accounts and life insurance policies. Self-employed National Insurance rates You usually pay 2 types of National Insurance if youre self-employed. Buying Health Insurance for Self-Employed Workers Through the Public Exchange The public exchange for employers known as the Small Business Health Options SHOP Marketplace categorizes business owners with no employees hiring independent contractors doesnt count as having employees as self-employed and those with employees as small employers.

Premiums you pay for health insurance are a tax deductible expense. This means you are still required to have health insurance or be subject to penalties come tax season. You can enroll through the Marketplace if youre a freelancer consultant independent contractor or other self-employed worker who doesnt have any employees.

Self-employed workers can find health insurance options through the Affordable Care Act. Can self-employed people and freelancers deduct the cost of dental insurance. The IRS does allow freelancers to deduct 100 of their health insurance premiums including dental for themselves spouses and their dependents but there are specific conditions you have to meet to do this.

Critical illness cover is a separate type of insurance. Manual workers such as plumbers and builders generally pay more than clerical workers like graphic designers as their work is more likely to physically affect members of the public. As a self-employed person with no employees you are considered an individual in the eyes of the government.

Health insurance for the self-employed is any insurance plan purchased as an independent contractor or self-employed individual where. Does self-employed income protection include critical illness cover. KYLE LAROSE HEALTH INSURANCE ADVISOR.

If your business has even one employee other than yourself a spouse family member or owner you may be able to use the SHOP Marketplace for small businesses to offer coverage to yourself and your employees. If you qualify for this deduction it means youre allowed to deduct 100 of your health insurance premiums from your adjusted gross income every year.

Health Insurance For Self Employed Individuals Health Plans In Oregon

Health Insurance For Self Employed Individuals Health Plans In Oregon

Health Insurance For The Self Employed Or Early Retiree Biglaw Investor

Health Insurance For The Self Employed Or Early Retiree Biglaw Investor

How To Buy Group Health Insurance For Self Employed Workers

How To Buy Group Health Insurance For Self Employed Workers

Non Obamacare For Individuals Families And Self Employed Svl Insurance

Non Obamacare For Individuals Families And Self Employed Svl Insurance

Health Insurance For Freelancers What You Need To Know In 2020

Health Insurance For Freelancers What You Need To Know In 2020

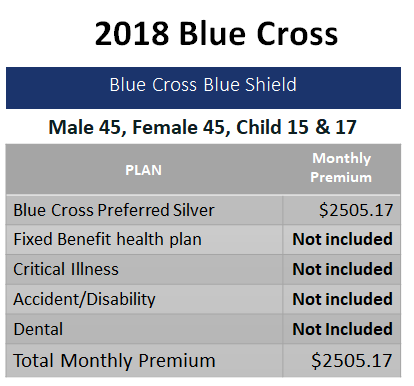

Self Employed Family Plans Health Insurance Ok

Self Employed Family Plans Health Insurance Ok

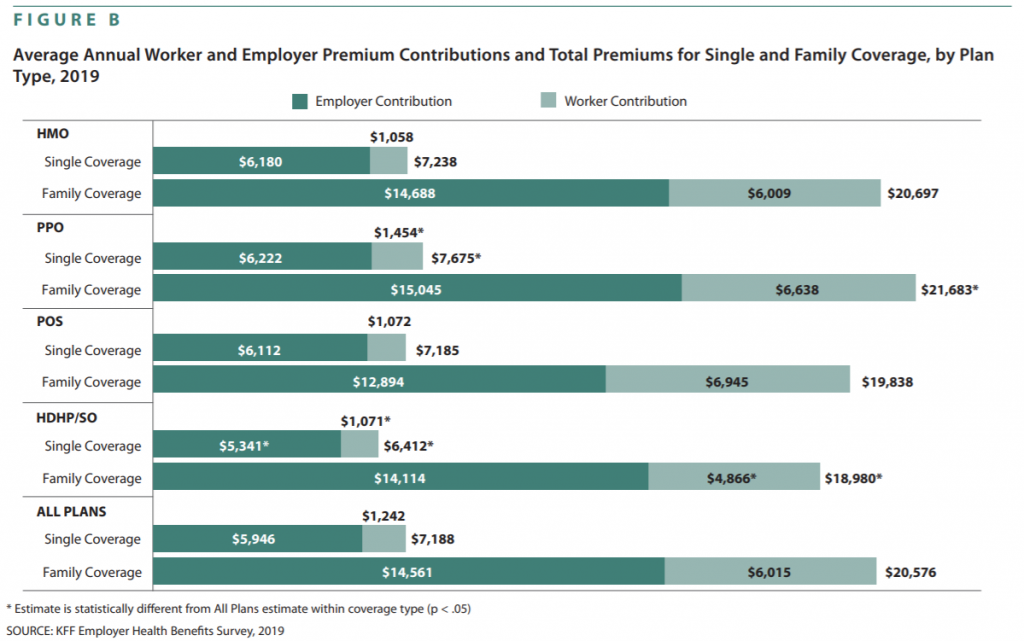

Average Cost Of Employer Sponsored Health Insurance

Average Cost Of Employer Sponsored Health Insurance

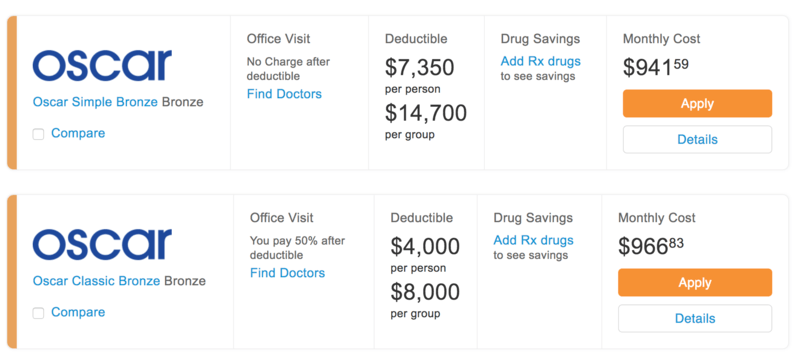

Individual Health Insurance Plans Quotes California Hfc

Individual Health Insurance Plans Quotes California Hfc

The Best Self Employed Health Insurance Options

The Best Self Employed Health Insurance Options

How Do You Get Health Insurance If You Re Self Employed Ramseysolutions Com

How Do You Get Health Insurance If You Re Self Employed Ramseysolutions Com

6 Best Health Insurance Options For The Self Employed

6 Best Health Insurance Options For The Self Employed

Shop Affordable Texas Ppo Plans In All 254 Counties Forhealthinsurance Com Health Insurance

Shop Affordable Texas Ppo Plans In All 254 Counties Forhealthinsurance Com Health Insurance

How Much Does Individual Health Insurance Cost Ehealth

How Much Does Individual Health Insurance Cost Ehealth

/getting-self-employed-or-freelancer-health-insurance-4147449-v2-c4cbfc66a47444d6bb82d2621a79cfed.png) How To Get Self Employed Or Freelancer Health Insurance

How To Get Self Employed Or Freelancer Health Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.