Premiums cannot exceed the full cost of the coverage plus a 2 percent administration charge. General COBRA FAQs for Workers.

Https Www Dol Gov Sites Dolgov Files Ebsa About Ebsa Our Activities Resource Center Faqs Cobra Premium Assistance Under Arp Pdf

One such provision provides for a 100 federal subsidy of COBRA premiums including the up-to-2 administrative fees during the period of April 1 2021 through September 30 2021.

Cobra information for employers. COBRA generally applies to all private-sector group health plans maintained by employers that had at least 20 employees on more than 50 of their typical business days in the previous calendar year. The companys plan must be covered by COBRA. The American Rescue Plan Act ARPA significantly impacts employers who have terminated or reduced the hours of an employee.

Both full-time and part-time employees are counted to determine whether a plan is subject to COBRA. Since COBRA premium assistance under the American Rescue Plan Act of 2021 became available to Assistance Eligible Individuals as of April 1 2021 employers and benefits advisers have had a number of questions about the mechanics of the subsidy and tax credit scheme among other issues. Employers everywhere need to prepare for the COBRA subsidy ASAP.

In Notice 2021-31 the IRS addresses a number of the key issues. If federal COBRA applies the employer pays or waives the AEIs COBRA premium each month. COBRA generally applies to all private-sector group health plans maintained by employers that had at.

The AEI does not have to pay the COBRA premium and wait to be reimbursed. Employers can be reimbursed up to 102 of AEIs COBRA costs through a dollar-for-dollar credit against the employers Medicare tax obligations. Each part-time employee counts as a fraction of a full-time employee with the fraction equal to the number of hours that the part-time employee worked divided by the hours an employee.

Beyond facilitating a 102 COBRA premium subsidy for eligible former employees they will also need to provide all applicable notices. Are governed by the Employee Retirement Income Security Act ERISA. Opinion What employers need to know about the new COBRA subsidies The American Rescue Plan Act of 2021 provides 100 premium assistance for eligible individuals under COBRA for a six-month period.

Notice will appear in IRB 2021-23 on June 7. It works like this. Also as noted above persons who lost coverage due to reduced hours or involuntary termination before April 1 2021 now have a second chance to elect COBRA and request the subsidy.

Because the information needed to ascertain point 1 above was not previously required when reporting COBRA events employers will need to identify individuals associated with their plans who are AEIs. Instead the employer or carrier must pay or waive the AEIs COBRA premium. COBRA-covered group health plans that are sponsored by private-sector employers generally.

The employer claims the subsidy amount as a credit against its quarterly Medicare payroll taxes. COBRA generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage called continuation coverage in certain instances where coverage under the plan would otherwise end. COBRA Premium Assistance under the American Rescue Plan Act of 2021 FAQs.

That means that employers need to provide COBRA notices including information about the subsidy option within 44 days of the COBRA event. The Internal Revenue Service Tuesday issued information on how employers can calculate the credit they will receive for providing former employees with coverage under COBRA. Model Notice in Connection with Extended Election Period.

Model General Notice and COBRA Continuation Coverage Election Notice. The American Rescue Plan provides a 100 subsidy for premiums. We plan to provide employers.

If the total COBRA premium assistance amount is greater than their Medicare obligations the government will pay the employer back. Group Health Plans Subject to COBRA. Also available in Spanish MS Word PDF.

The COBRA premium assistance credit is not available for individuals who were involuntarily terminated after May 31 2010. A qualifying event must have occurred such as the death of an employee or termination. COBRA generally applies to all private-sector group health plans maintained by employers that have at least 20 employees on more than 50 percent of its typical business days in the previous calendar year.

ERISA doesnt require employers to have plans or to provide any particular type or level of benefits but it does require plans to follow ERISAs rules. The employers or carriers expense will be reimbursed by the federal government. Notice 2021-31 gives information on eligibility for COBRA subsidies.

As soon as our software updates are completed we will provide you with instructions on how the identification process will work. Employers may require individuals to pay for COBRA continuation coverage. Both full- and part-time employees are counted to determine whether a plan is subject to COBRA.

As of April 1st 100 percent of premiums for COBRA or state continuation. MS Word PDF. If the plan sponsors COBRA premium costs exceed its Medicare payroll tax.

ERISA also gives participants and beneficiaries. The COBRA premium assistance credit was available to an employer for premiums paid on behalf of employees who were involuntarily terminated from employment between Sept1 2008 and May 31 2010. HR and payroll experts warn that employers should not ignore this COBRA premium subsidy or its notice requirements.

The American Rescue Plan Act of 2021 ARPA includes a number of provisions requiring immediate action by employers. The Employee Benefits Security Administration EBSA enforces COBRA laws and sets three basic requirements for determining whether an employee is entitled to coverage. MS Word PDF.

Https Www Nbsbenefits Com Wp Content Uploads 2015 12 Cobra Employer Manual Pdf

Https Www Dol Gov Sites Dolgov Files Legacy Files Ebsa About Ebsa Our Activities Resource Center Publications An Employers Guide To Group Health Continuation Coverage Under Cobra Pdf

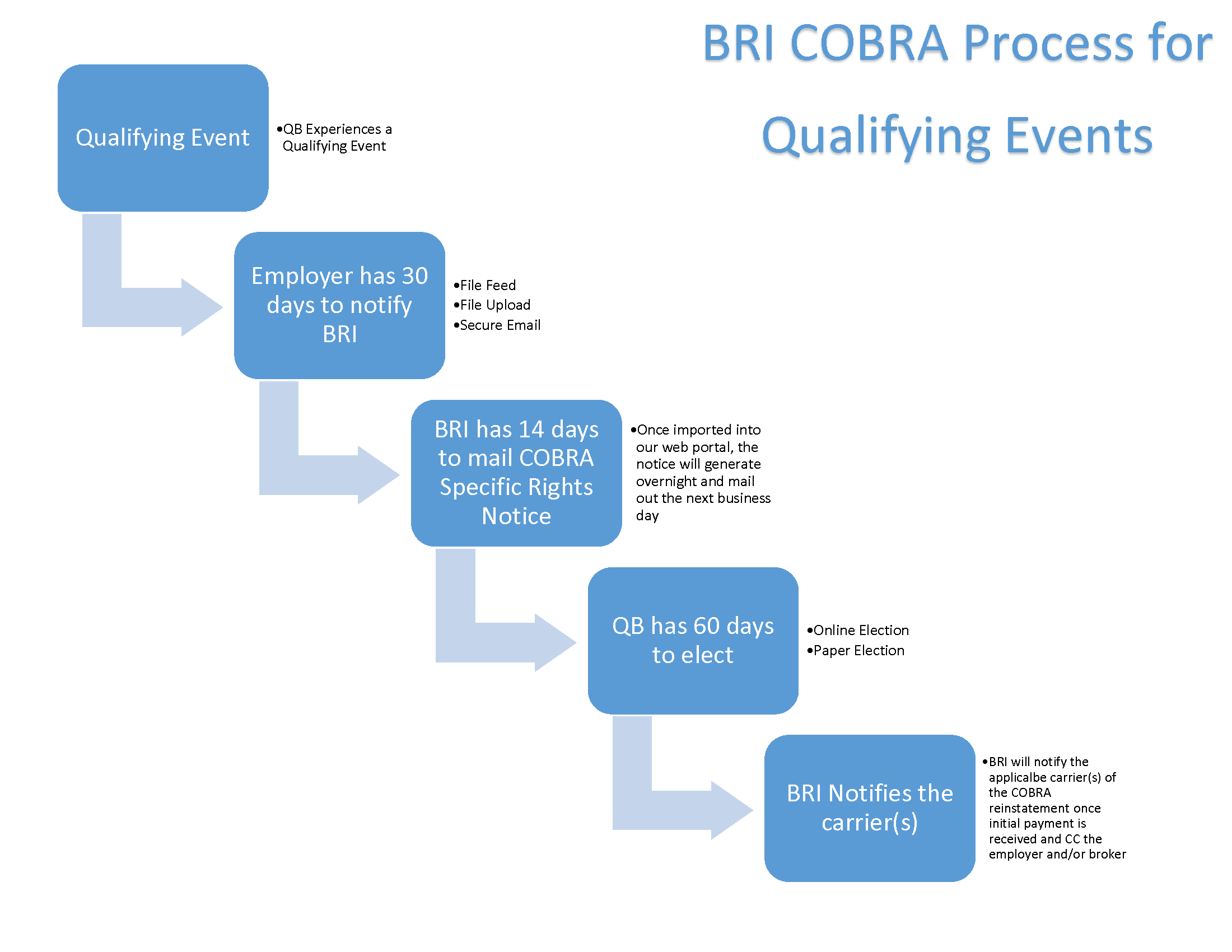

The Next Step What Happens When A Qualifying Cobra Event Occurs Bri Benefit Resource

The Next Step What Happens When A Qualifying Cobra Event Occurs Bri Benefit Resource

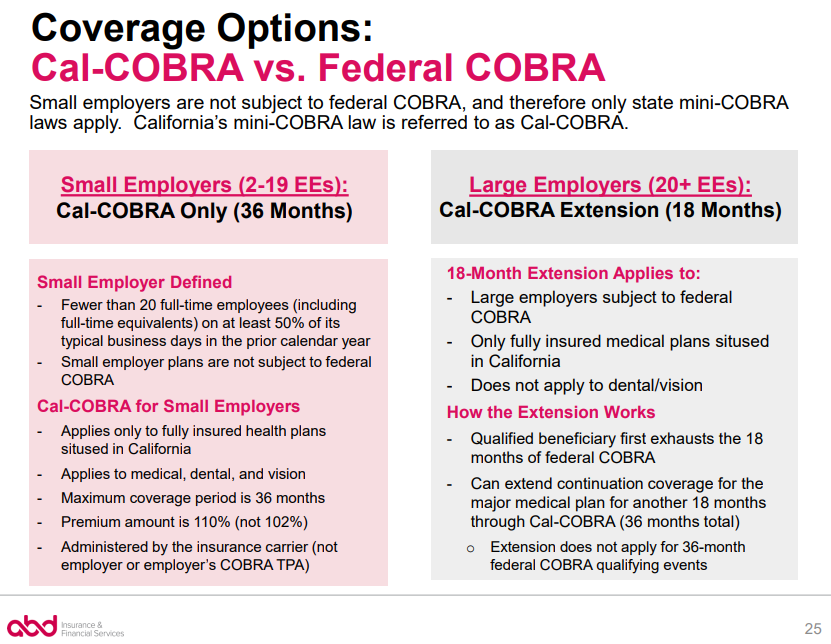

Cobra Small Employer Exception Abd Insurance Financial Services

Cobra Small Employer Exception Abd Insurance Financial Services

![]() An Employer S Guide To Cobra Basic

An Employer S Guide To Cobra Basic

Cobra Rules For Employers Simplicityhr

Cobra Rules For Employers Simplicityhr

Employers Now Required To Pay 100 Of Cobra Premiums

Employers Now Required To Pay 100 Of Cobra Premiums

Https Www Dol Gov Sites Dolgov Files Ebsa About Ebsa Our Activities Resource Center Faqs Cobra Continuation Health Coverage For Employers Pdf

Cobra Subsidy Information For Workers New York State

Cobra Subsidy Information For Workers New York State

/GettyImages-482307267-8691de0ef14741db996ce7c941671a48.jpg) Cobra Insurance Information For Employers

Cobra Insurance Information For Employers

Https Www Ajg Com Us Media Files Us Legacy An Employers Guide To Cobra Pdf

What Is Cobra Health Insurance Requirements Compliance More

What Is Cobra Health Insurance Requirements Compliance More

Https Www Nh Gov Insurance Consumers Documents Federal Cobra Nh State Continuation Coverage Pdf

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.