While its highly unlikely that you will lose an arm or leg or your sight it also depends on the activities you engage in when youre traveling. A life insurance rider is an addendum to a policy that provides additional coverage.

Do You Need Add Insurance If You Have Term Or Whole Life Insurance National Income Life Insurance Co

Do You Need Add Insurance If You Have Term Or Whole Life Insurance National Income Life Insurance Co

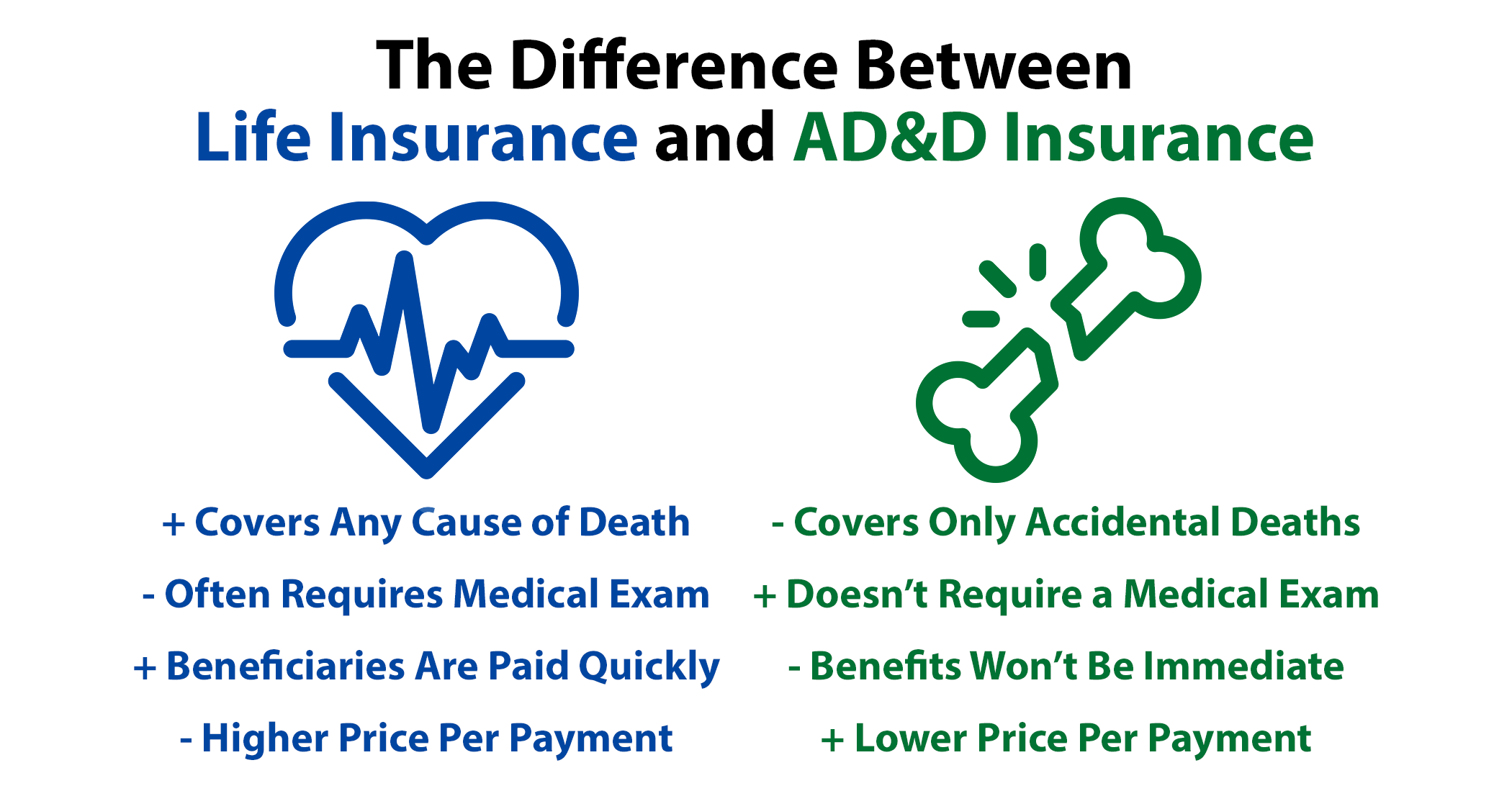

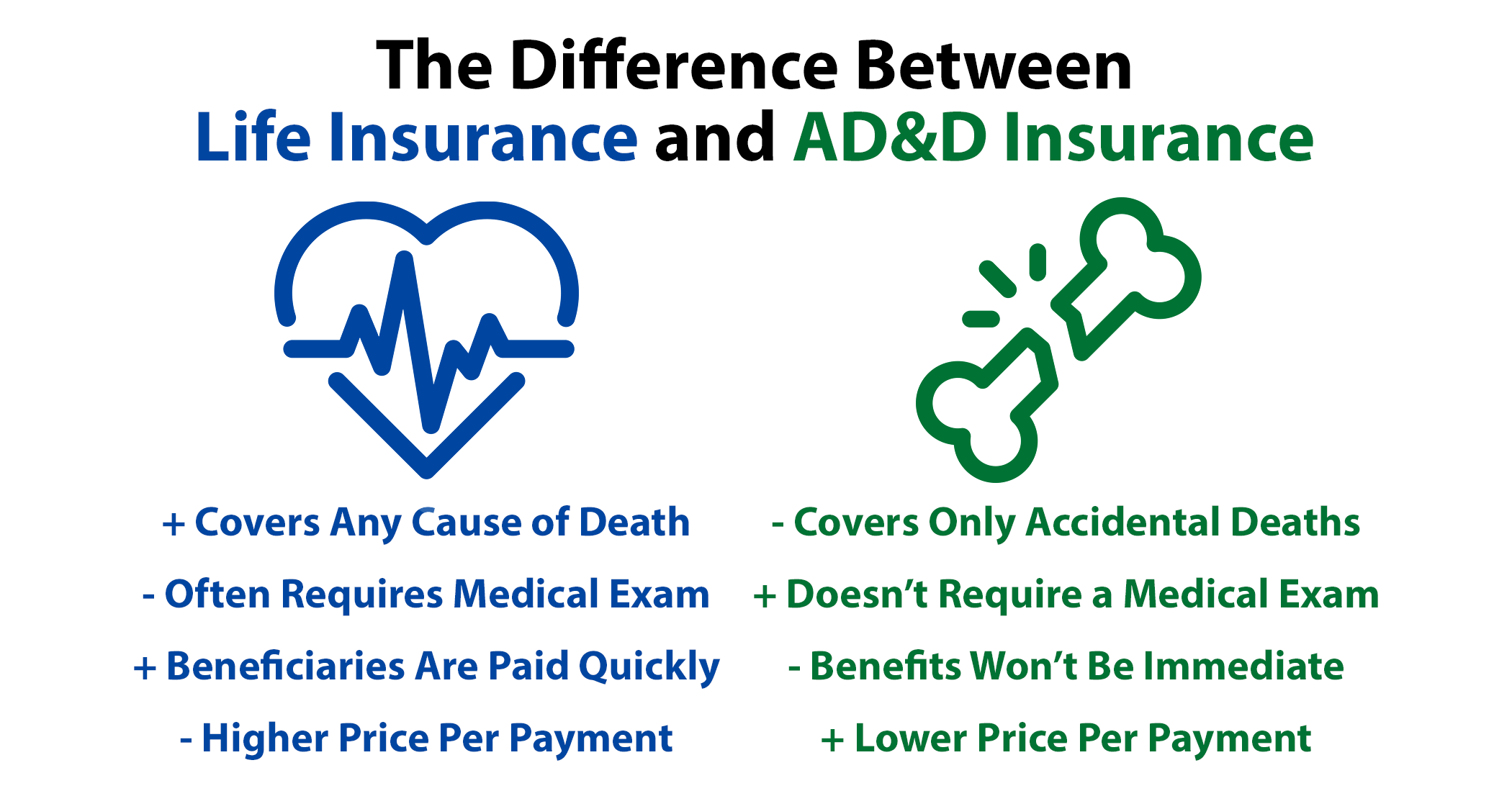

Often life insurance and accidental death and dismemberment insurance are sold together.

Do i need both life insurance and ad&d. 1 Typically applied as a rider to an existing health insurance or life insurance policy 1 ADD is commonly offered by an employer in addition to whatever policy they may offer. ADD insurance provides coverage only if you die or are dismembered in an accident. What does this mean.

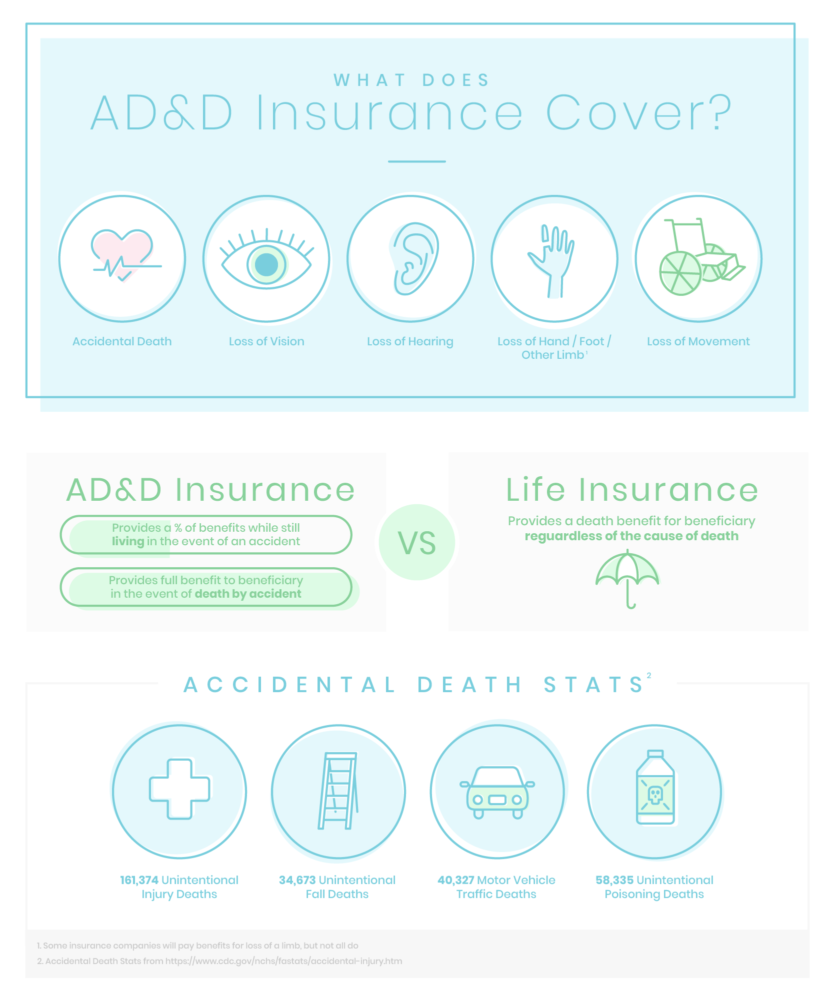

Unlike with life insurance you dont have to die to get benefits paid under ADD insurance. ADD is also not a replacement for disability insurance. This way in case of a normal death that is not a result of an accident your insurer will just payout 100 of the policy amount.

An accidental death and dismemberment insurance policy ADD is not the same as a standard life insurance. Unlike term life insurance ADD policies pay out only if you are killed or injured in an. If the policy pays itll be a pleasant bonus for your beneficiaries but you shouldnt count on it.

Some employers provide employees with the option to purchase supplemental life insurance that increases coverage and does not have stipulations such as ADD or burial insurance. In comparison ADD protection is only of marginal value. Do I need both life insurance and ADD.

It can be an affordable way to supplement your life insurance or medical coverage if youre seriously injured or die as a result of an accident. Natural causes illness suicide and overdoses are not covered under ADD insurance. If you have adequate life insurance to protect your family in case of your death then spending more to have the additional ADD benefits is probably unnecessary.

Along with offering standalone policies many insurers allow you to add an ADD rider to your life insurance coverage for a fee. Do I need both life insurance and ADD. An accidental death and dismemberment ADD insurance policy can help protect your familys finances in the event of the loss of your life or limbs.

An ADD insurance policy is not a replacement for a standard life insurance policy it but does offer a payout under certain conditions and can provide you with valuable coverage. With this rider your beneficiaries will receive an additional payout if you die in an accident as specified in the policy. Understanding what it is and.

You shouldnt consider ADD insurance as a replacement for life insurance. Accidental death and dismemberment insurance often shortened to ADD overlaps with life insurance and disability insurance but it doesnt fully replace either one. The difference is ADD is considered a dual policy which covers you in the event of death but also pays out some money in case you didnt die but survived with serious injury like dismemberment.

ADD coverage is limited to accidents. It doesnt provide the kind of coverage you find in life insurance. Most experts agree that under most situations you would not need ADD insurance if you already have life insurance.

What Does ADD insurance cover. Yet you can still choose to buy normal life insurance but with an accidental death rider. For someone who wants both life insurance and ADD insurance a rider is a viable option.

Life insurance covers many more causes of death such as natural causes and illnesses while ADD only covers accidental deaths. This option may be. Life insurance such as term life insurance could provide your family with funds to pay expenses if you pass away.

It really depends on what kind of life insurance policy you have and what your financial goals and planning requires. ADD insurance covers accidental death and dismemberment. When youre deciding on your coverage life insurance is fundamental for most young couples.

If you have adequate life insurance you generally wouldnt need ADD insurance. Accidental death and dismemberment ADD insurance provides coverage should the insured suffer unintentional death accidental death or dismemberment. Life insurance pays out only when you die to your beneficiary.

An ADD rider pays out an extra amount if death is due to an accident but if the death is from natural causes the policy simply pays out the base amount. ADD policy will pay you for suffering dismemberment. 2 However because of.

ADD insurance may be purchased at work as a stand-alone product or as a rider on a life insurance policy. If your life or group policy includes ADD dont include the benefit amount in your planning.

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Life Insurance Vs Ad D Insurance Freeway Insurance

Life Insurance Vs Ad D Insurance Freeway Insurance

What Is Supplemental Life Insurance And Do You Need It Thestreet

What Is Supplemental Life Insurance And Do You Need It Thestreet

Accidental Death Dismemberment Ad D Vs Term Life Insurance

Accidental Death Dismemberment Ad D Vs Term Life Insurance

What Is Accidental Death And Dismemberment Coverage Quotacy

What Is Accidental Death And Dismemberment Coverage Quotacy

What Is Ad D Insurance Youtube

What Is Ad D Insurance Youtube

Accidental Death And Dismemberment Insurance Ad D Overview

Accidental Death And Dismemberment Insurance Ad D Overview

The 5 Best Ad D Insurance Providers Termlife2go

The 5 Best Ad D Insurance Providers Termlife2go

What Is Supplemental Life Insurance And Is It Worth The Cost

What Is Supplemental Life Insurance And Is It Worth The Cost

What To Know About Ad D Insurance Forbes Advisor

What To Know About Ad D Insurance Forbes Advisor

Life Insurance Vs Accidental Death And Dismemberment Insurance

Life Insurance Vs Accidental Death And Dismemberment Insurance

Get To Know Your Group Term Life And Ad D Insurance Hub

Get To Know Your Group Term Life And Ad D Insurance Hub

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.