In 2021 Obamacare subsidies begin if your health plan cost is greater than 85 of your household income towards the cost of the benchmark plan or a less expensive plan the benchmark plan is the second-lowest silver plan. Qualifying for the subsidy.

Obamacare Subsidies Frequently Asked Questions Ehealth

Obamacare Subsidies Frequently Asked Questions Ehealth

The original cutoff was May 15 but you now have until.

How do you qualify for obamacare subsidy. The subsidies are designed to ensure nobody puts more than. Prior to 2021 the rule was that households earning between 100 and 400 of the federal poverty level could qualify for the premium tax credit health insurance subsidy the lower threshold is 139 of the poverty level if youre in a state that has expanded Medicaid as Medicaid coverage is available below that level. Temporarily Congress has approved everyone to receive Obamacare subsidies but your subsidies will be based on the percentage of income your healthcare makes up.

23 In March 2021 the federal government enacted the American Rescue Plan Act which expanded the eligibility requirements for subsidies. The majority of the states have expanded. Do I Qualify For ObamaCares Cost Assistance Subsidies.

Thankfully it may have gotten a bit easier for a lot of households. Your employer doesnt offer affordable health insurance to you. Who Qualifies for the Premium Tax Credit.

These subsidies help make Obamacare health insurance coverage more affordable by paying a part of your monthly premium on your behalf. You may qualify for a subsidy if you meet the following criteria. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

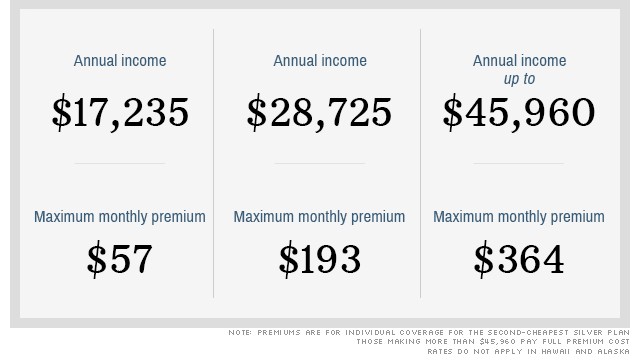

In a nutshell you look at your income as a percentage of the poverty level and then find where that puts you in the sliding scale of the percentage of income youre expected to pay for the benchmark Silver plan itll be somewhere between 0 and 85 depending on your income. Have you lined up your healthcare through the marketplace. ObamaCare Cost Assistance.

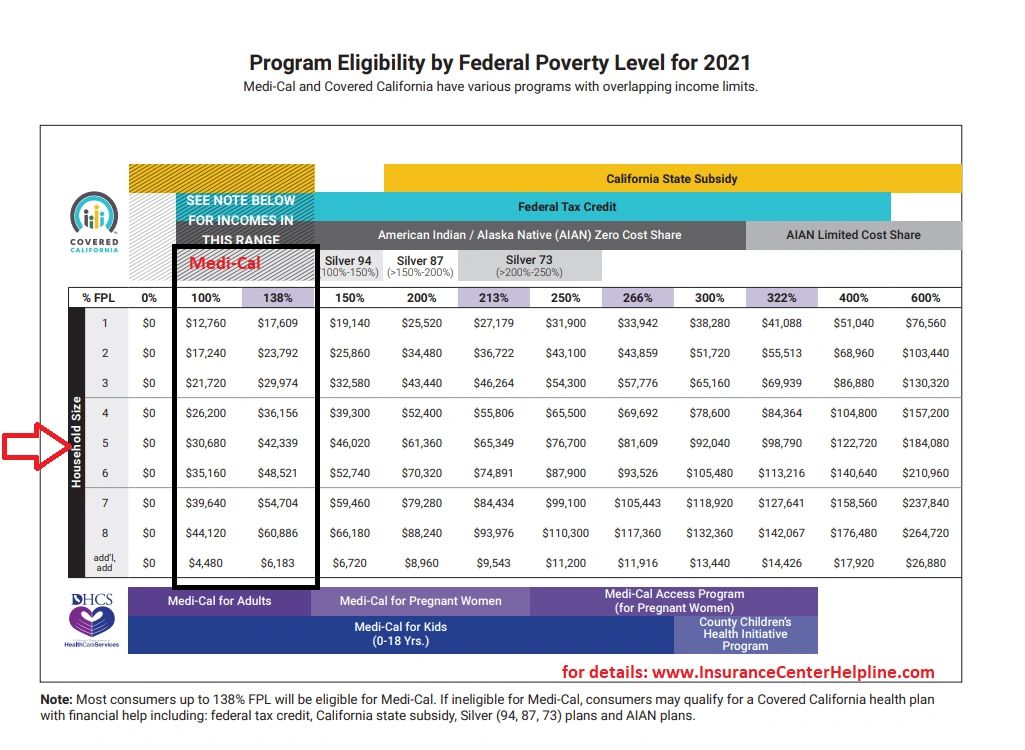

The Obamacare subsidy will come in. In this case affordable insurance means at least 60 percent of covered benefits or the premiums would cost you no more than 95 percent of your annual household income after tax credits are applied. For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four.

Subsidy eligibility determinations are fairly simple. The types of assistance offered under the Affordable Care Act are. To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. You may qualify for a subsidy if all of the following are true. There are two features of Obamacares premium tax credits that are important for early retirees to understand.

To qualify for Obamacare subsidies you must meet the following criteria. You are currently living in the United States You are a US citizen or legal resident You are not currently incarcerated Your income is no more than 400 of the federal poverty level. The federal government has extended the special enrollment period for Obamacare.

The discount on your monthly health insurance payment is also known as a premium tax credit. If not youre lucky because it can be a huge headache. In states that have expanded Medicaid coverage your household income must be below 138 of the federal poverty level FPL to qualify.

Then you see how much more than that the benchmark plan actually costs and the difference is the amount of your subsidy which can. You can qualify for a premium tax credit if your individual income falls between 12880 and 51520 or 100 and 400 of the FPL. Any legal resident under 65 making between 100-400 of the Federal Poverty Level qualifies for cost assistance as long as they dont have access to affordable employer coverage.

Further in those states that have not expanded Medicaid those with household income of at least 100 percent of the federal poverty line qualify for a subsidy. You are not eligible for coverage through your employer or through someone elses employer. Instead a household with income above 400 of the poverty level can qualify for a subsidy in 2021 and 2022 if the benchmark plan would otherwise cost more than 85 of the households income.

In all states your household income must be between 100 and 400 FPL to qualify for a premium tax credit that can lower your insurance costs. First the highest household income that can qualify for a.

Obamacare Health Insurance Income Requirements Il Health Insurance

Obamacare Health Insurance Income Requirements Il Health Insurance

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

How Do Obamacare Subsidies Work Youtube

How Do Obamacare Subsidies Work Youtube

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Obamacare Shopping Is Trickier Than Ever Here S A Cheat Sheet

Obamacare Shopping Is Trickier Than Ever Here S A Cheat Sheet

Obamacare Subsidies Made Easy Healthtn Com

Obamacare Subsidies Made Easy Healthtn Com

Aca Open Enrollment What If You Make Too Much For A Subsidy The New York Times

Aca Open Enrollment What If You Make Too Much For A Subsidy The New York Times

What Is The Maximum Income For Obamacare Subsidies In Year 2021

What Is The Maximum Income For Obamacare Subsidies In Year 2021

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

What You Ll Actually Pay For Obamacare

What You Ll Actually Pay For Obamacare

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.