For tax years other than 2020. Monthly Advance Payment of Premium Tax Credit PTC.

The premium tax credit is a refundable tax credit that can help lower your insurance premium costs when you enroll in a health plan through the Health Insurance Marketplace.

Premium tax credit calculator 2020. Make changes to your 2020 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312023. This calculator figures your taxable social security benefits based upon the IRSs 2019 Form 1040 2019 Schedule 1 and 2019 Publication 915 Worksheet 1 which was published January 10 2020 and made no substantive changes to the 2018 worksheet calculations. Subtract the difference from your balance due.

The IRS will reduce the excess APTC repayment amount to zero with no further action needed by the taxpayer. Monthly Premium Amount B. Youll see your official premium tax credit amount when you buy your health plan.

Life changes can influence your estimated household income and your credit. Again subsidies have increased for 2021 and will remain larger in 2022 due to the American Rescue Plan. Taxpayers who received a letter about a missing Form 8962 should disregard the letter if they have excess APTC for 2020.

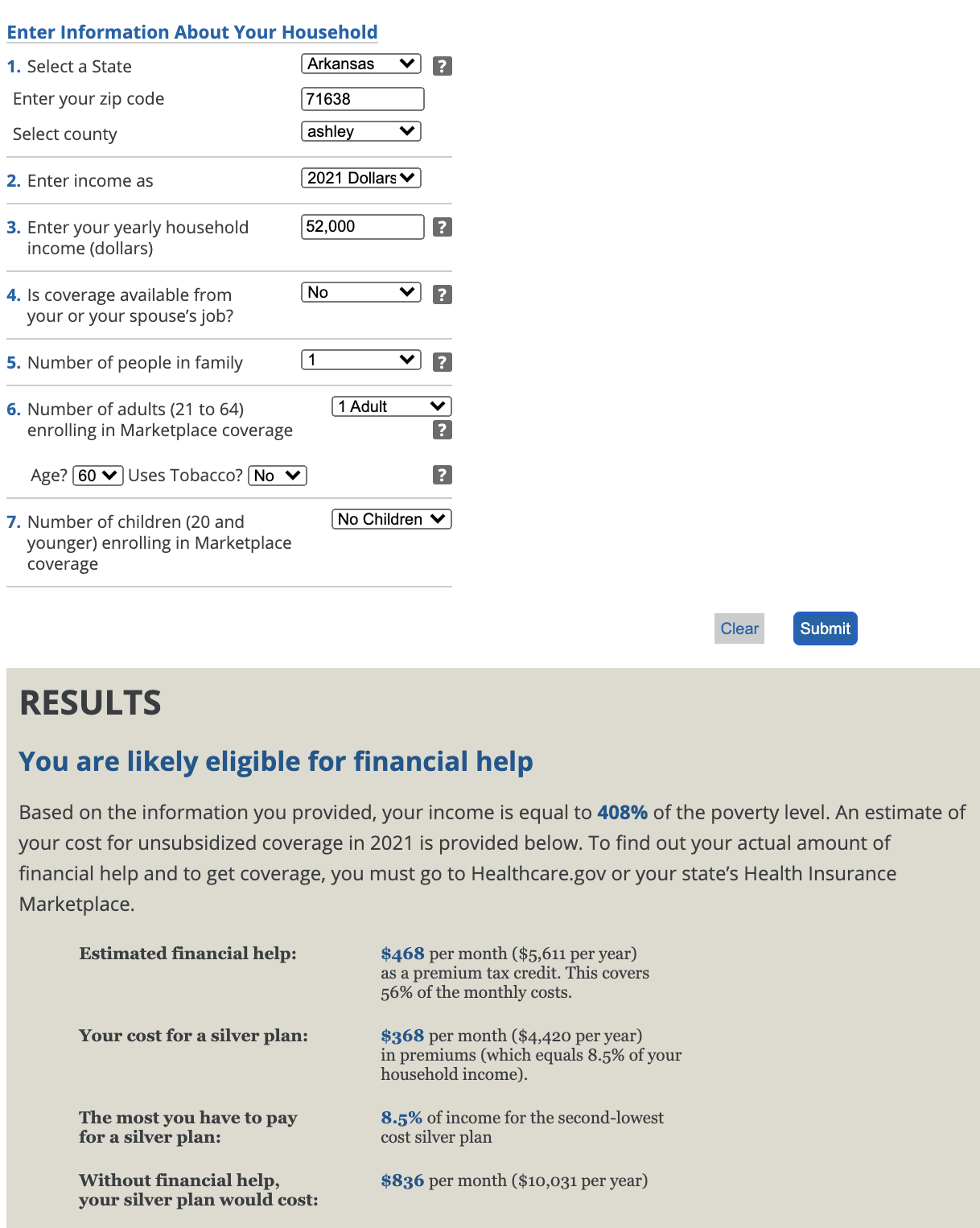

If your premium tax creditis more than your advance well either. Enter the required information into the fields below then calculate your results. Get Your Estimated Tax Credit Using our premium tax credit estimator lets you see how much help you may get.

This tool only gives you an estimate. The premium tax credit is limited by comparing the cost of your coverage to that of the second lowest cost silver plan that covers you and your family. Calculate how much tax credit including working tax credits and child tax credits you could get every 4 weeks during this tax year 6 April 2020 to 5 April 2021.

Monthly Premium Amount of Second Lowest Cost Silver Plan SLCSP C. You can receive this credit before you file your return by estimating your expected income for the year when applying for coverage in the Marketplace. Your premium tax credit may be less than your advance credit payments resulting in additional tax liability to you.

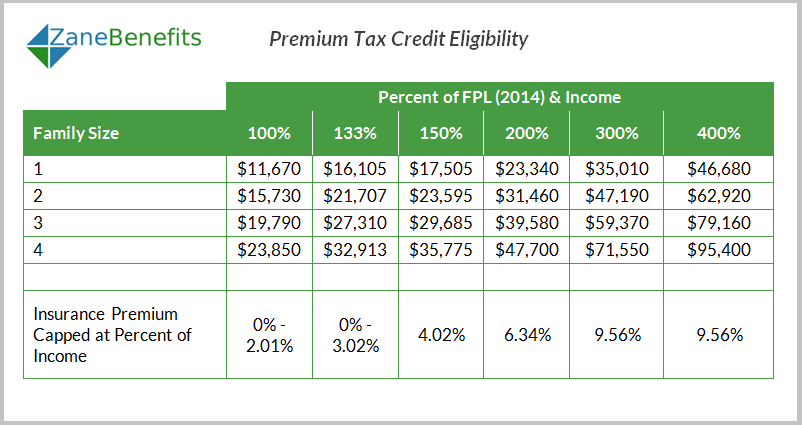

The Affordable Care Act ACA offers premium tax credits to help eligible individuals and families purchase individual health insurance coverage through the Health Insurance Marketplace. To prevent that notify the Marketplace of the change. This will result in either a smaller refund or a larger balance due.

However if you are enrolled in coverage that costs less your share of the premium will also be less. For TurboTax Live Full Service your tax expert will amend your 2020 tax return for you through 11302021. To receive a PTC you must split the uprights between making too little and too much income.

The average subsidy amount in 2020 was 492month which covered the large majority of the average 576month premium note that both of these amounts are lower than they were in 2019. This can help lower the amount you might pay for your health care coverage each month. Terms and conditions may vary and are subject to change without notice.

The amount of your tax credit is based on the price of a silver plan in your area but you can use your premium tax credit to purchase any Marketplace plan including Bronze Gold and Platinum. If the advance credit payments are more than the amount of the premium tax credit you are allowed called excess advance credit payments you will add all or a portion of the excess advance credit payments to your tax liability on Form 1040 Schedule 2. The IRS will reimburse people who have already repaid any excess advance Premium Tax Credit on their 2020 tax return.

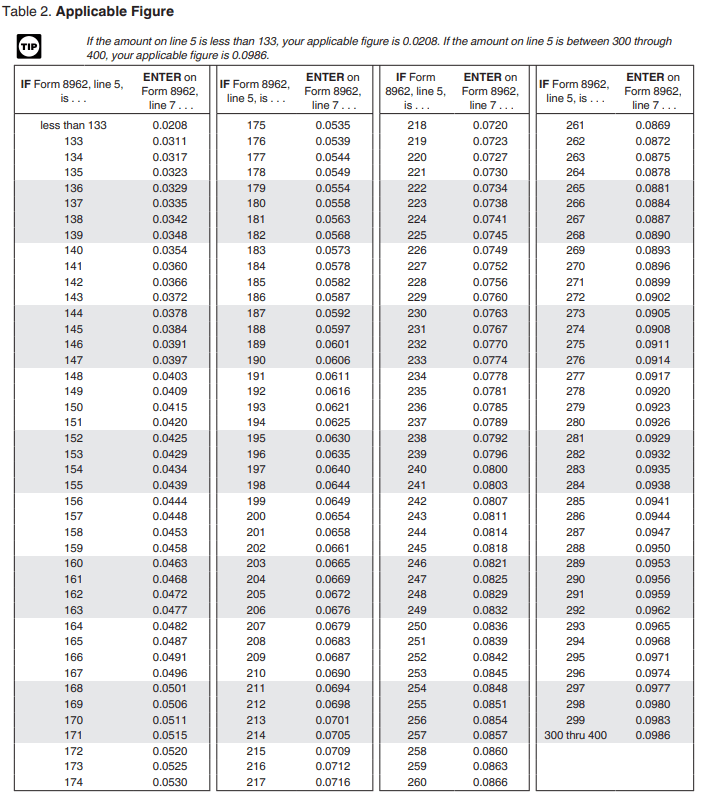

Your premium tax credit is calculated on your tax return using Form 8962. However if you want to. The easiest way to avoid having to pay back this health insurance tax credit is to update the marketplace when you have any life changes.

You can also claim the premium tax credit after the fact on your tax. This counts as the advance premium tax credit. The American Rescue Plan Act of 2021 also known as President Bidens 19 trillion stimulus package removed the hard cutoff at 400 of FPL.

This change is temporary and only applies to your 2020 taxes. If you buy health insurance from healthcaregov or a state-run ACA exchange up through the year 2020 whether you qualify for a premium tax credit is determined by your income relative to the Federal Poverty Level FPL. Add the difference to your refund.

In 2021 these tax credits require lower income households to pay between 207-983 of their household income for the second lowest cost silver plan available in their region. 2020 Obamacare Premium Tax Calculator By A Noonan Moose on October 28 2019 In 2020 the federal government will once again offer a Premium Tax Credit PTC to qualifying taxpayers who buy health coverage from an approved health insurance exchange. After 11302021 TurboTax Live Full Service customers will be able to amend their 2020 tax return.

Calculate Premium Tax Credit Enter the amounts from Lines 21 through 32 for columns A B C of your Form 1095-A. Based on your income and family size you may be able to get a subsidy also known as a premium tax credit or financial help. As always none of your inputs are stored or recorded.

Premium tax credits are tax credits that can be taken in advance as Advanced Premium Tax Credits or at tax time as Premium Tax credits. This subsidy is available to people with family incomes between 100 1 times and. The premium tax credit helps lower your monthly expenses.

Tax credits calculator -. That was a hard cutoff. The IRS will process tax returns without Form 8962 for tax year 2020.

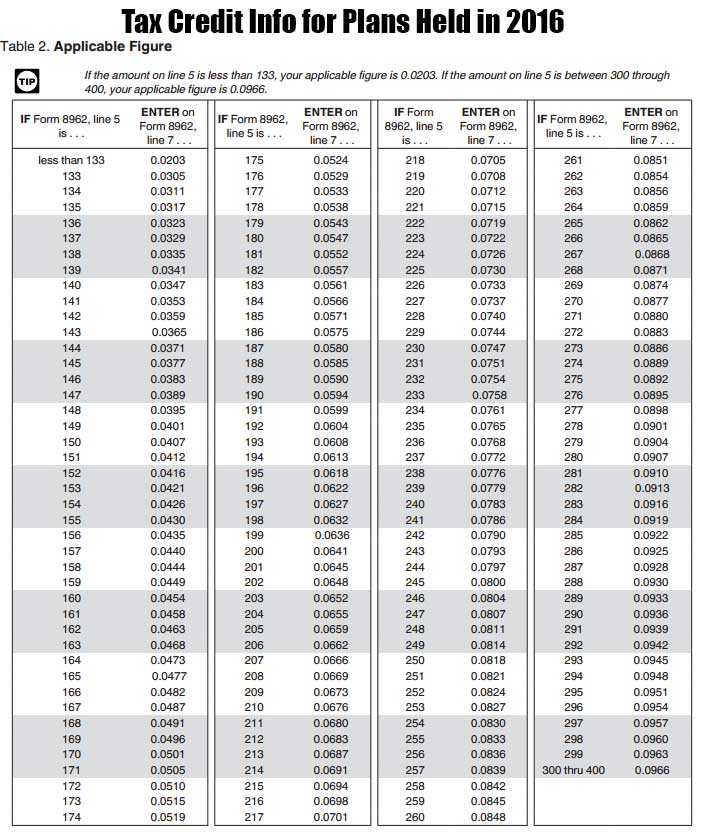

If you are enrolled in more expensive coverage you will pay the additional amount. Premium tax credit caps on 2020 marketplace coverage range from 206 978 of income based on the 2019 federal poverty level. This subsidy calculator is provided by My1HR a licensed Web Based Entity WBE which is certified by the Centers for Medicare and Medicaid Services CMS to connect consumers directly with the federal health insurance Exchange at HealthCaregov.

You didnt qualify for a premium tax credit if your income was above 400 of FPL.

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Https Oci Wi Gov Documents Consumers Calculatingpremiumtaxcredits Pdf

What Are Premium Tax Credits Tax Policy Center

What Are Premium Tax Credits Tax Policy Center

Maximizing Premium Tax Credits For Self Employed Individuals

Maximizing Premium Tax Credits For Self Employed Individuals

Lesson 12 Premium Tax Credit Calculator Youtube

Lesson 12 Premium Tax Credit Calculator Youtube

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Everything You Need To Know About Premium Tax Credits

Everything You Need To Know About Premium Tax Credits

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Premium Tax Credit Charts 2015

Premium Tax Credit Charts 2015

Maximizing Premium Tax Credits For Self Employed Individuals

Maximizing Premium Tax Credits For Self Employed Individuals

Premium Tax Credit Flow Chart Are You Eligible Internal Revenue Service

Premium Tax Credit Flow Chart Are You Eligible Internal Revenue Service

Health Insurance Premium Tax Credit Health Plans In Oregon

Health Insurance Premium Tax Credit Health Plans In Oregon

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.