However with Plan N after the deductible is met you may be responsible for Co-pays at. The 2021 Part B deductible is 203 per year 1692 per month.

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

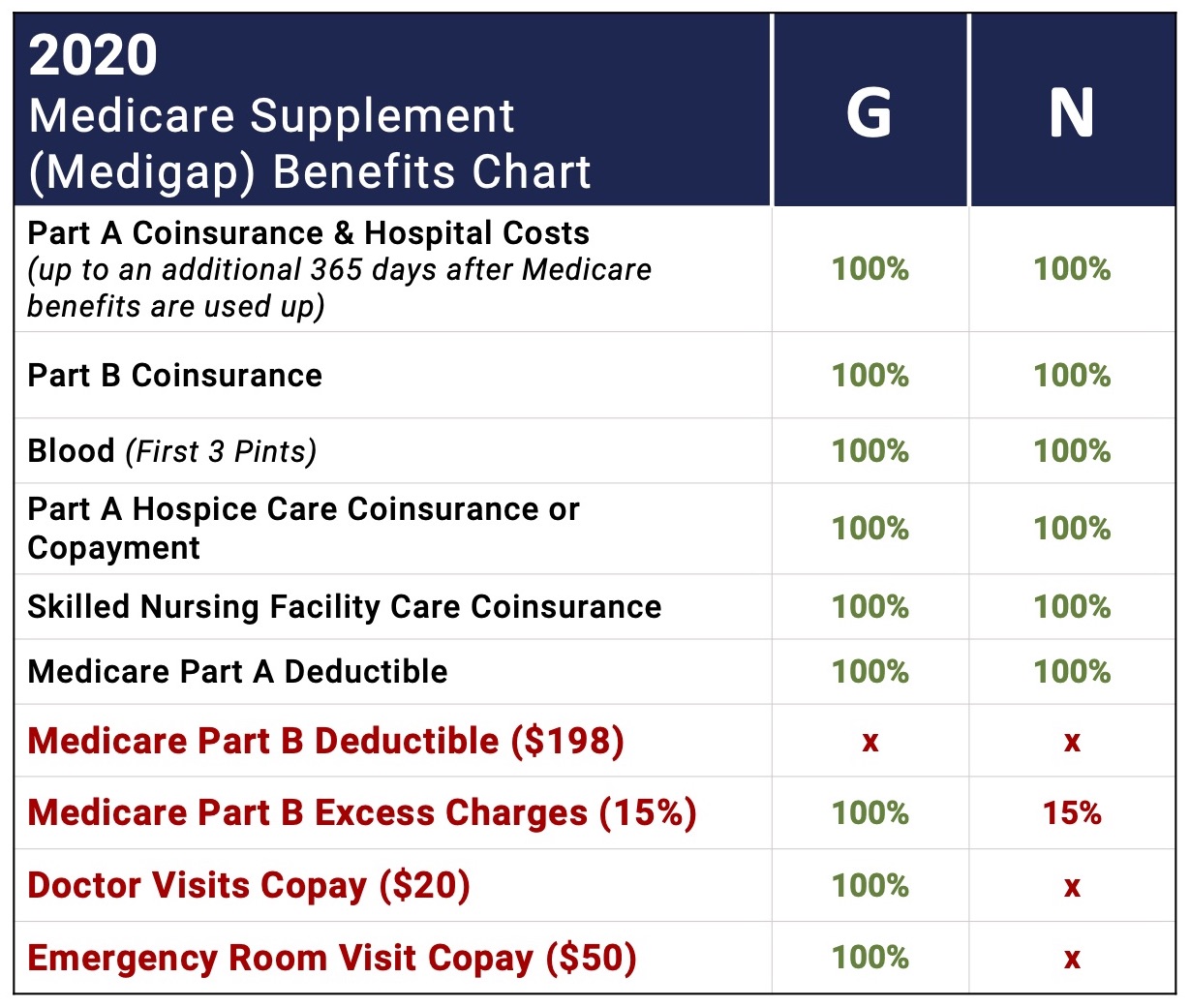

Plan N also involves cost-sharing via copayments and coinsurance which Plan G covers.

Plan g vs plan n. Plan-G v322 Pay what you like Click on the Donate button Donations provide funding for technical support and continued product development as well as. As mentioned above you can incur Part B excess charges when your health care provider does not accept Medicare assignment. There are two areas that Plan G covers that Plan N doesnt.

In most States a provider can charge you over and above Medicares Approved. Plan G covers Part B excess charges which are not a concern in most cases but especially not if they arent allowed in your state to begin with. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers except for the Medicare Part B deductible.

Medicare Supplement Plan N. Plan G is usually more expensive than Plan N. Medigap Plan G is the second most popular Medigap plan and it is quickly growing in popularity.

With Plan N you would pay up to 50 for an ER visit. Plan G will offer a high deductible option beginning January 1 2020. HOW PLAN N AND PLAN G ARE DIFFERENT The main differences between the two plans are some of the expenses youll pay for outpatient care.

The only other difference between Plan N and Plan G is that Plan G will pay doctors excess charges. In exchange for a lower monthly premium you agree to pay small copays when visiting the doctor or hospital. The reason G costs more is because it provides more coverage.

Since Plan G typically has a more expensive premium it actually may save you money in the long run. Depending upon the condition of your health it might be a better idea to sign up for Plan N even though there is a copay and. So if you prefer to pay out less as you use the benefits then Plan G may be better since you wont have.

In most states Plan G generally runs about 20-25 more per month than Plan N More about Plan G prices. With Plan N just like Plan G there is no coverage for the Part B deductible so with Plan N you also have the annual deductible of 185year. The next most comprehensive plan is Plan G which covers nearly as much with the Part B deductible being the only difference.

There are no copays with plan G only the Medicare Part B Deductible 140 this year. What are the Differences Between Medicare Supplement Plan N vs Plan G. Medicare Supplement Plan G.

When you compare Plan G vs Plan N youll see that Plan G comes with more coverage. They would rather spend the extra money and have either a Plan D a Plan N without the copays or a Plan G. Plan N offers the same coverage as Plan G in that it also does not cover the Medicare Part B deductible like Plan F does.

Plan N doesnt cover. Plan G enrollment spiked 39 percent in recent years. In addition some insurance companies are preparing for Medicare Supplement Plan D to be one of the top selling plans in Medicare.

In considering this option take a closer look at Part B excess charges as it might hit you hard unexpectedly. However it differs from Plan G by not covering Medicare Part B excess charges. Medigap Plan G offers all of the same benefits as Plan F except for the Part B deductible.

Contents Of This Video 000 Plan G vs Plan N204 What they cover306 Excess Charges Explained508 Coverage Differences546 Price Differ. However Plan N will come with a lower monthly premium. Finally Plan N is probably the third most popular plan because it operates similar to Plan G except that you pay copays for doctor and ER.

However Plan N still provides a good amount of coverage and manages to minimize high out-of-pocket expenses. Medicare supplement Plan N can be a better value than Medicare supplement Plan G. This an additional cost that some providers charge.

Medigap Plan N covers the same benefits as Plan F except the Part B deductible and Part B excess chargesAlso it covers the Medicare Part A deductible at. Medicare Supplement Plan G offers more protection than Plan N. Technically you would be responsible again for 20 of the approved charges of the ER visit up to 5000.

Plan G doesnt have a copay for these visits. After that assuming their doctor accepts assignment the balance of their doctor and hospital bills are paid in full for the rest of the year. Medigap Plan N premiums cost less than Medigap Plan G thats because it offer lesser benefits.

Plan N has a copay of 20 for office visits and 50 for emergency room visits which is not charged if you are admitted to the hospital. However premiums for Plan G. Visits and you also pay your own excess charges.

This is especially true in states that have specific laws reducing the value of Medicare supplement Plan G.

Medigap Plan G Vs Plan N Medicare Hero

Medigap Plan G Vs Plan N Medicare Hero

Medigap Planners Medigap Plan G Or Medigap Plan N Compare Rates And Benefits Medigap Planners

Medigap Planners Medigap Plan G Or Medigap Plan N Compare Rates And Benefits Medigap Planners

Plan G Vs Plan N Medicare Supplement Which Is Better Youtube

Plan G Vs Plan N Medicare Supplement Which Is Better Youtube

Medicare Plan N Vs Plan G Which Is Better Freemedsuppquotes

Medicare Plan N Vs Plan G Which Is Better Freemedsuppquotes

Medigap Plan N A Stable Choice

Medigap Plan N A Stable Choice

Medicare Supplement Plan G Vs Plan N What Is The Difference Gomedigap

Medicare Supplement Plan G Vs Plan N What Is The Difference Gomedigap

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Plan F Vs Plan G Vs Plan N How To Compare Medicarefaq Medicare Preventive Care How To Plan

Medicare Plan F Vs Plan G Vs Plan N How To Compare Medicarefaq Medicare Preventive Care How To Plan

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

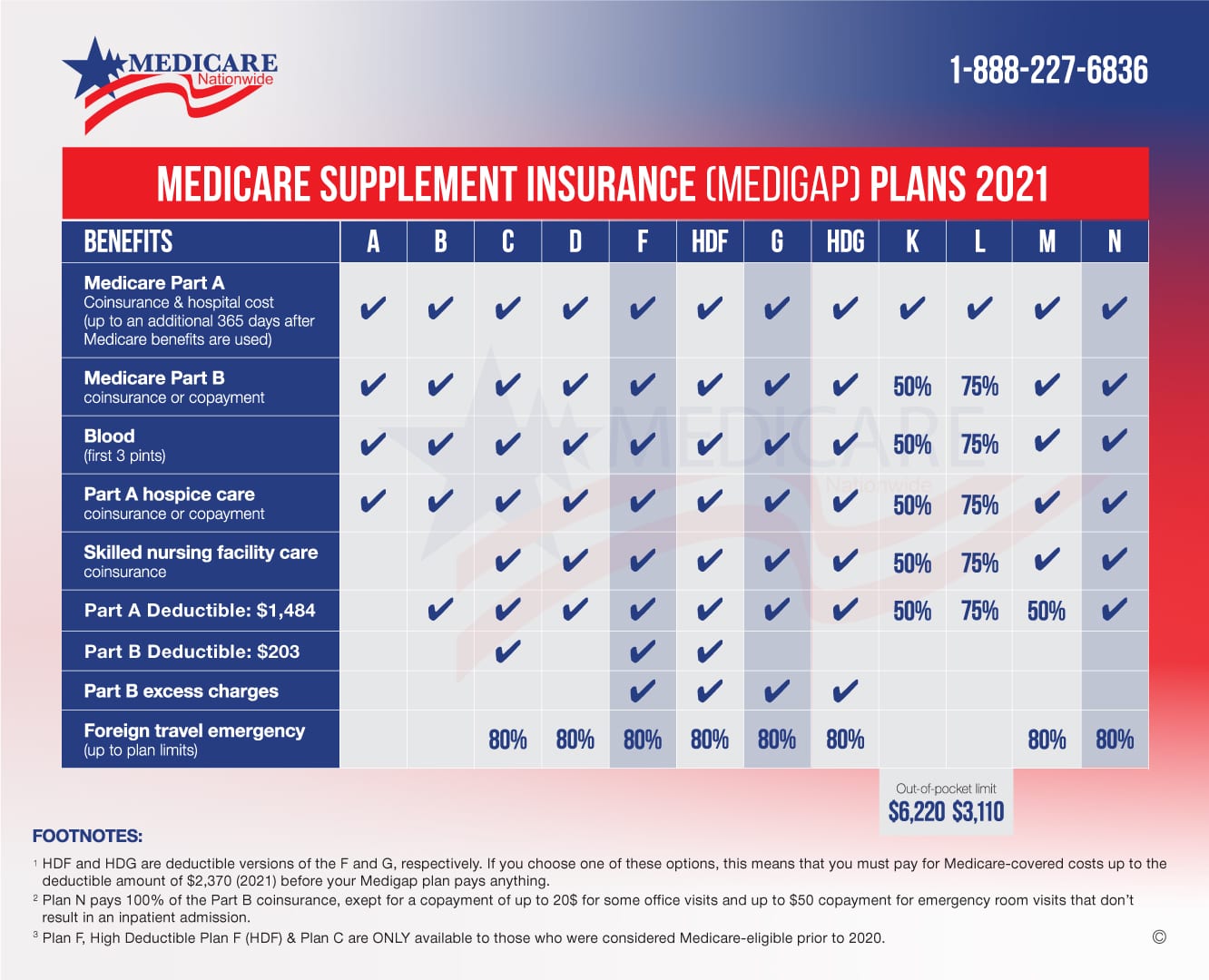

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Plan N Vs Plan G Senior Healthcare Direct

Medicare Plan N Vs Plan G Senior Healthcare Direct

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.