High-deductible Medigap Plan F provides coverage for. With a High Deductible Plan F you have to pay the first 2180 2016 of charges out of your pocket.

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

The primary difference in the benefits of these two plans is that high-deductible Plan F covers the Medicare Part B deductible while high-deductible Plan G will not.

What is medicare plan f high deductible. Medicare supplemental Medigap Plans F and G can be sold with a high deductible option. Prefer a low monthly premium Live in a state that allows Medicare Part B excess charges the difference between the Medicare-approved amount and the. However its important to know that Medicare Supplement Plan F and.

The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1 2020. Beginning in 2020 Plan G and Plan F will be the only two Medigap plans to offer a high-deductible option. Your premium may cost 72 per month but you may have to pay a 2240 deductible before your plan pays anything.

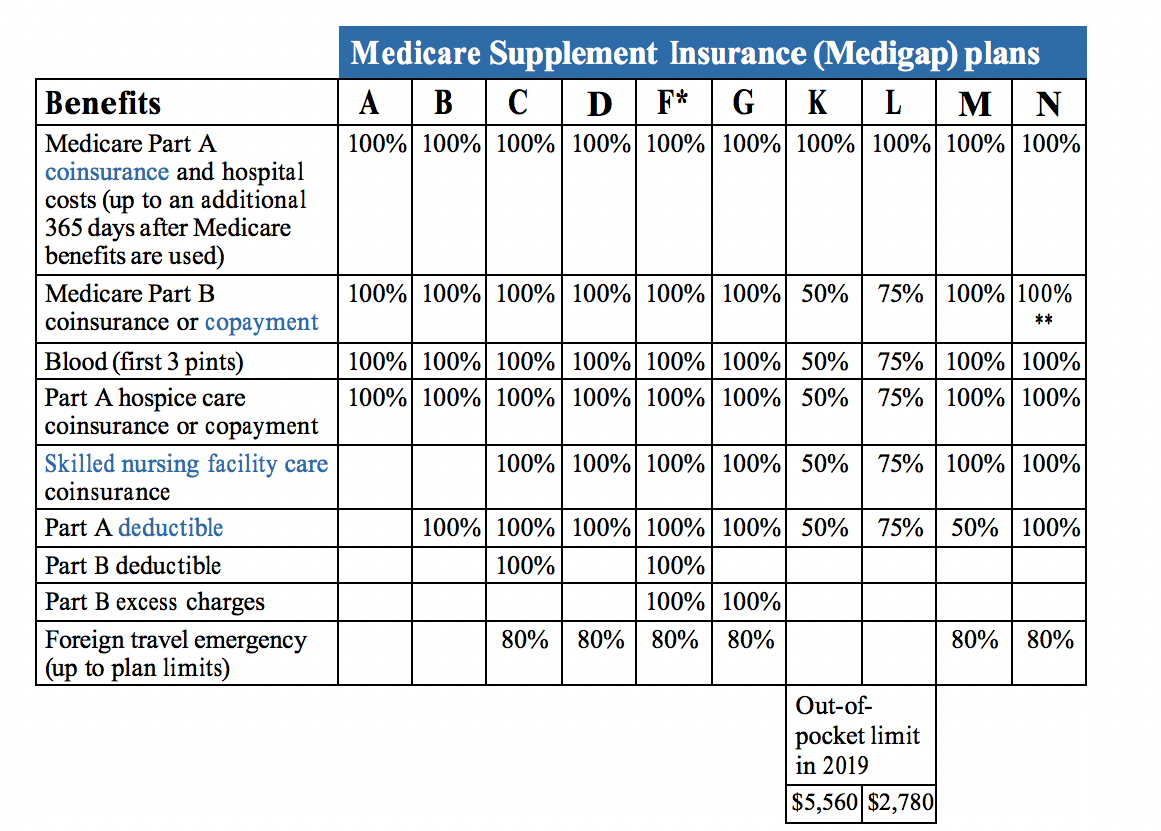

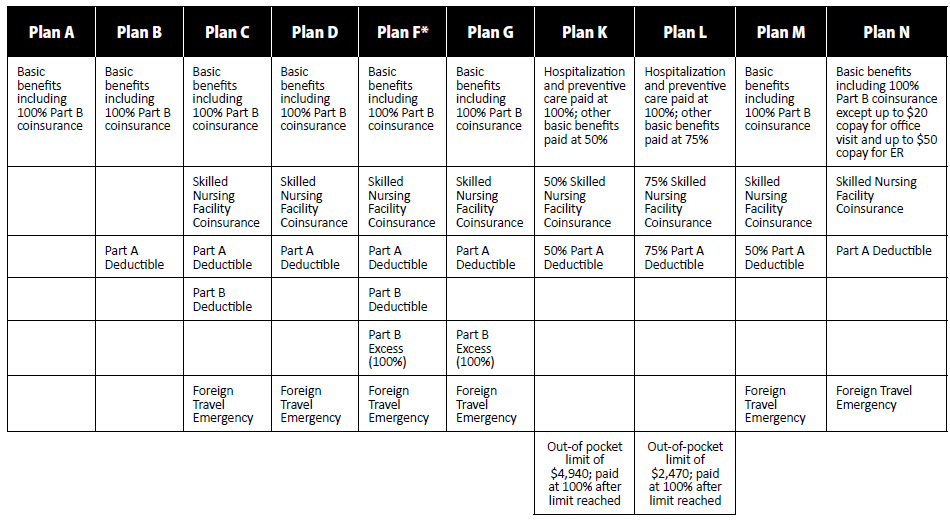

While monthly premiums for this option may be lower you must pay a deductible before Plan F begins paying for benefits. Medicare Part A coinsurance and hospital costs Medicare Part B coinsurance or copayment First three pints of blood Part A hospice care coinsurance or copayment Coinsurance for skilled nursing facility Medicare Part A deductible Medicare Part B. Medicare Supplement High Deductible Plan F.

100 of Medicare Part B coinsurance or. Before June 1 2010 Medigap Plan J could also be sold with a high deductible. A High Deductible Plan F Works the Same as a Standard Medigap Plan F It works the same with only one difference.

Medicare Supplement Plan F and High Deductible Medicare Supplement Plan F are almost identical Medigap plans. You also get lower premiums. The only difference in plan details is that High Deductible Plan F requires you to meet a deductible before it begins covering you 2370 in 2021 whereas Plan F provides coverage immediately.

For more information on high deductible Plan F call us at 844 633-5239. Travel abroad frequently Are likely to get medical care. Medicare Supplement Plan F is the most comprehensive private insurance policy available to go with Medicare Part A and Part B.

According to AHIP in 2016 55 of those with Medigap policies had Plan F or its high-deductible version. The high deductible version of Plan F is only available to those who are not new to Medicare before 112020. Once the annual deductible is met the plan pays 100 of covered services for the rest of the year.

Medicare Supplement Plan F. High Deductible Plan F is an alternative version of the standard Plan F. Afterward the plan functions just like regular Medigap Plan F and covers 100 of your cost-sharing for the rest of the year.

While both the High-Deductible plans offer lower premiums for higher deductibles each plan comes with different benefits. The difference is the beneficiary agrees to pay the deductible before full coverage kicks in. It pays the out-of-pocket costs associated with Parts A and B including deductibles and the 20 coinsurance after the Part B deductible and more.

You may have a 0 deductible but your monthly premium may cost 321 per month. First three pints of blood 100 of Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits have been. Whether you choose Medicare Supplement Plan F or High-Deductible Plan F.

The benefit of this high deductible option is a lower monthly premium. It covers eight of the nine benefits. Here are the extensive benefits that Medicare Supplement Plan F and the high-deductible Plan F provide.

19 Zeilen Medigap Plan High F is one of the Medicare Supplement Insurance. Plan F also has a high deductible option. In addition to covering your out-of-pocket costs Plan F travels well.

After that amount the plan pays. The high deductible version of Medigap Plan F offers the same benefits as Plan F. Plan G is one notch down from that.

1 Plans F and G offer high-deductible plans that each have an annual deductible of 2370 in 2021. Well explain more about the High Deductible after the chart. Here is an example of how pricing may look when comparing Medicare Supplement Plan F and High-Deductible Plan F.

Once you reach the deductible the plan covers the left-over costs going forward keeping the monthly premium low. In 2019 the Medicare Part B deductible is 185 for the year. For 2021 this deductible is set.

As well as you will see on the chart how once the High F deductible is paid for you have IDENTICAL coverage. High Deductible Plan F is a Medigap plan where you meet a deductible up front. One of the main differences between the two is that High-Deductible Plan F offers coverage for the Medicare Part B deductible on top of its other benefits.

Below you will see how the Medigap High Fs annual deductible of 2370 must be paid before coverage kicks in. Medigap Plan High F Vs F Benefit Details. A high-deductible Medicare Supplement Plan F or Plan G may be a good fit for you if you.

How Does High Deductible Medigap Plan F Work Medicaresupplement Com

How Does High Deductible Medigap Plan F Work Medicaresupplement Com

High Deductible Plan F High Deductible Medicare Supplement How To Plan Medicare Supplement Medicare Supplement Plans

High Deductible Plan F High Deductible Medicare Supplement How To Plan Medicare Supplement Medicare Supplement Plans

High Deductible Plan F High Deductible Medigap Plan Medicarefaq

High Deductible Plan F High Deductible Medigap Plan Medicarefaq

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

High Deductible Medigap Plan Makes Sense For Some

High Deductible Medigap Plan Makes Sense For Some

Medigap High Deductible Plan F Made Simple 2019 Bridge Insurance

Medigap High Deductible Plan F Made Simple 2019 Bridge Insurance

Medicare Supplement Plan F High Deductible Risky But Cheap

High Deductible Plan F High Deductible Medicare Supplement How To Plan Medicare Supplement Social Security Benefits Retirement

High Deductible Plan F High Deductible Medicare Supplement How To Plan Medicare Supplement Social Security Benefits Retirement

Medigap Plan F Hd For Florida Seniors Medigap Seminars

Medigap Plan F Hd For Florida Seniors Medigap Seminars

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Comparing Medigap Plans Senior65

Comparing Medigap Plans Senior65

High Deductible Medicare Supplement Crowe Associates

High Deductible Medicare Supplement Crowe Associates

High Deductible Plan F High Deductible Medicare Supplement

High Deductible Plan F High Deductible Medicare Supplement

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.