The American Rescue Plan the. Its similar to a debit card as its a fast and convenient way to pay for medical expenses.

Small Businesses Can T Offer An Fsa Consider A Qsehra Miller Kaplan

Small Businesses Can T Offer An Fsa Consider A Qsehra Miller Kaplan

FSAs are a welcome addition to a companys benefits package helping employees feel that the company is invested in their good health.

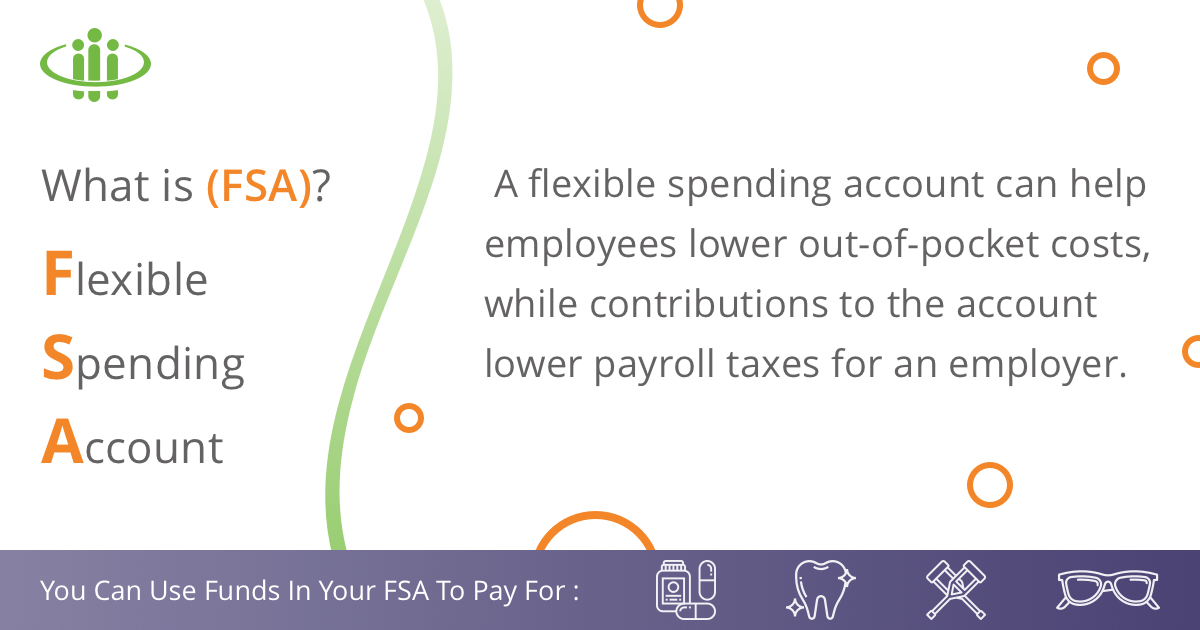

Small business flexible spending account. A flexible spending account FSA is a tax-deferred savings account established by an employer to help employees meet certain medical and dependent-care expenses that are not. Offset medical costs and increase take-home pay with a TASC FlexSystem Flexible Spending Account FSA Home Offerings FSA Simple FSA. It helps them pay for medical andor dependent care and childcare expenses using pre-tax dollars.

Employers decide the maximum contribution they wish to allow for their FSA up to a Health Care Reform set maximum of. Flexible Spending Accounts offer substantial savings on qualified health care expenses. A flexible spending account FSA allows employees to contribute pretax earnings into an account that can pay for health care costs like copayments deductibles etc.

The rules governing flexible spending accounts are temporarily more generous to workers thanks to two pieces of legislation. In 2018 employees can contribute up to 2650 to their health FSAs. FSAs lower your employees taxable income at year-end so they also lower your businesss payroll taxes.

For business the administration of these accounts typically results in a net gain the more employees enrolled in FSA plans the less payroll and FICA tax the employer has to pay. Did you know a small business can set up a Flexible Spending Account for individual employees medical expenses. Business Benefits Groups BBG Benefits Consultants can help businesses to establish flexible spending accounts FSAs for employees.

The employees can elect to contribute part of their wages to the FSA. With a Flexible Spending Account small business owners set up a pretax payroll deduction for each employee to use throughout the year and that cannot be changed unless the employee has a qualifying life event such as a marriage. These accounts simplify the process of reimbursement and deposits made into these accounts are made with pre-tax dollars resulting in lower taxable income and lower taxes.

Flexible spending accounts FSAs are another type of employee benefit in this case solely designed to save employees money through pre-tax savings on. Open An FSA For Your Small Business. Flexible spending accounts help employees plan for expenses in the coming year in addition to saving a bit on their tax burden.

Posted by Complete Payroll Jan 7 2019 70000 AM. Bill Photo via Shutterstock. About 74 of large employers and 23 of small businesses offer Flexible Spending Accounts for their employees health care.

Flexible spending accounts are an attractive fringe benefit for employees. With HSA accounts the employee can usually change his or her distribution rate with each check. A flexible spending account FSA is a type of savings account that provides the account holder with specific tax advantages.

A flexible spending account FSA is a benefit you can offer your employees instead of or in addition to health insurance. There is a max contribution of 2650 per year. Talk with your tax advisor and if necessary a benefits expert.

In this white paper well look at what a flexible spending account is what can be included in one and why small businesses are using flexible spending. An FSA sometimes called a flexible spending arrangement can be set. Flexible spending accounts allow small businesses to offer benefits for as little as 100 to 200 per month per employee 1200 to 2400 per year.

Setting up an FSA is relatively low cost and pain free for an employer and adds significantly to the employers overall benefits offering. With a health care payment card users can easily access funds from health savings accounts HSAs flexible spending accounts FSAs or health reimbursement arrangements HRAs without having to pay out-of-pocket and seek reimbursement later. Small business owners should consider implementing them now for 2016 and beyond so that employees can commit to their contributions for the upcoming year if they want to participate.

The passage of the Patient Protection and Affordable Care Act PPACA allows small businesses to sponsor a SIMPLE cafeteria plan and avoid discrimination testing if during either of the preceding two years the. Flexible Spending Accounts FSAs are an employer-established health benefit that allows employees to use pre-tax dollars for out-of-pocket medical expenses. Employers have to sponsor an FSA plan and eligibility rules are set by the plan.

Is An Fsa Worth It For Your Small Business Primepay

Is An Fsa Worth It For Your Small Business Primepay

Lively Launches Flexible Spending Accounts Expanding Modern Healthcare Solutions Business Wire

Lively Launches Flexible Spending Accounts Expanding Modern Healthcare Solutions Business Wire

The Small Business Guide To Fsas For 2020 Workest

The Small Business Guide To Fsas For 2020 Workest

Benefits Resources For Small Businesses During And After Covid 19

Benefits Resources For Small Businesses During And After Covid 19

Should Your Small Business Offer Hras And Fsas Physicians Health Plan

Should Your Small Business Offer Hras And Fsas Physicians Health Plan

What Is An Fsa Definition Eligible Expenses More

What Is An Fsa Definition Eligible Expenses More

What Is A Flexible Spending Account Fsa How Does It Work

What Is A Flexible Spending Account Fsa How Does It Work

/flexible-spending-account-fsa-written-on-a-wooden-cubes--1070418618-74ab17cbd81e44fdbd5cf019a02c2593.jpg) Flexible Spending Account Fsa Definition

Flexible Spending Account Fsa Definition

Flexible Spending Account Fsa Advantage Benefits Tax Benefits Of Fsas

Flexible Spending Account Fsa Advantage Benefits Tax Benefits Of Fsas

Flexible Spending Account Rules Are More Generous What To Know

Flexible Spending Account Rules Are More Generous What To Know

Flexible Spending Account Employee Benefits Bb T Small Business

Flexible Spending Account Employee Benefits Bb T Small Business

A Guide To Flexible Spending Accounts Peoplekeep

A Guide To Flexible Spending Accounts Peoplekeep

What Are Flexible Spending Accounts The Complete Employer S Guide Employers Resource

What Are Flexible Spending Accounts The Complete Employer S Guide Employers Resource

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.