2A fixed amount. All co-payments or co-insurance eg.

Choosing A Medical Plan Adobe Benefits

Choosing A Medical Plan Adobe Benefits

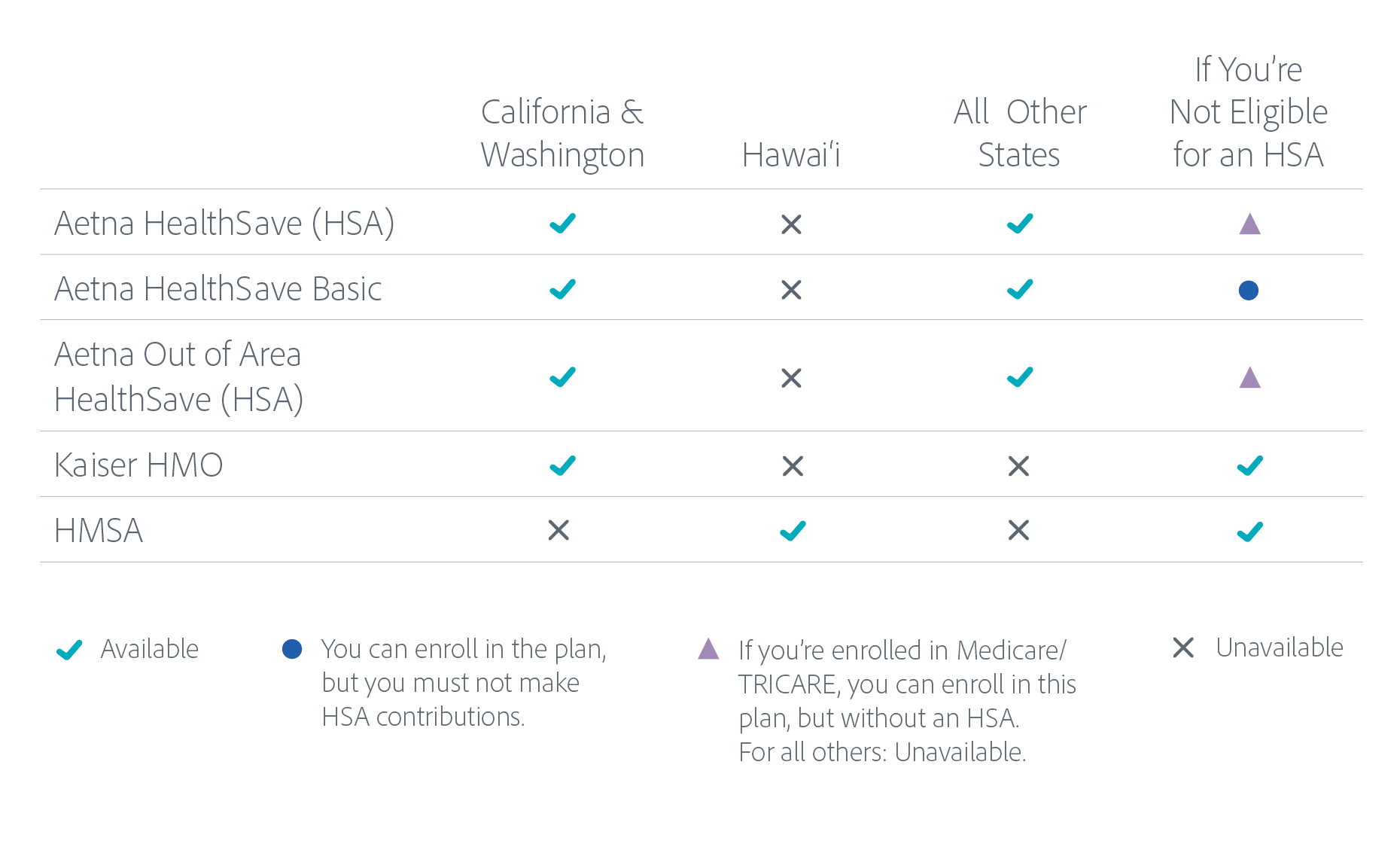

An HSA-compatible health plan is a health insurance plan that meets the guidelines set by the IRS regarding deductibles out-of-pocket expenses and acceptable coverage.

Hsa compatible insurance plans. Texas residents can pay for qualified medical expenses with pre-tax dollars and save for retirement on a tax-deferred basis. Since your health insurance generally related to your job changing jobs almost always changes your health insurance plan or provider. Not be covered by any other health plan that is not an HDHP with certain exceptions.

This plan provides you and your family with health insurance at lower monthly premiums. An HSA is the financial component the account that holds your funds. Not be enrolled in any part of Medicare.

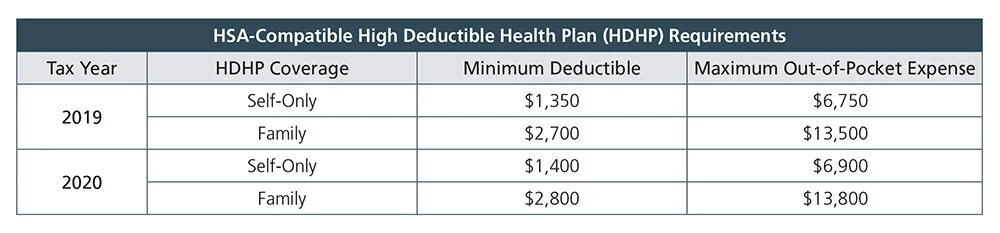

Hospital indemnity insurance you offer your employees is compatible with their HSA plan according to IRS requirements1 In order for the plan to be HSA compatible each of its benefits must pass the following tests. HSA-qualified plans HDHPs have deductibles that must be at least 1400 for singles and 2800 for families in 2020. Are your clients looking for new ways to help their employees ease the financial pressure that higher out-of-pocket expenses present as a result of high-deductible health plans.

For a health insurance plan to be considered HSA eligible it must have a high deductible Self-only. Thirdly once youve found the plan that is right for you its quick and easy to apply online. Keep in mind that insurance companies offer.

If a plan that is intended to be an HDHP is one in. Life happens however and sometimes you have to change your healthcare insurance coverage. Prescription drug costs must.

Our advice is to select a plan that fits the needs of your employees rather than trying to find the best health savings account compatible insurance plan. To open an HSA you must be enrolled in a high deductible healthcare plan. The health plan cannot provide benefits before the deductible is met except for preventive care services.

One of the big perks is that an HSA is portable. Be covered under a high deductible health plan HDHP that is HSA-compatible. Offering additional benefits like health savings accounts HSAs and voluntary benefit options like hospital.

Anyone may establish and contribute to an HSA if he or she meets all of the following requirements. These amounts will be unchanged for 2021 note that insurers can still increase deductibles from 2020 to 2021 despite the fact that the minimum allowable deductibles will not increase. As health insurance premiums continue to climb many companies are turning to High Deductible Health Plans combined with HSAs to curb costs incentivize good health and help employees save on their tax bill.

However you can also contact your Personal Benefits Manager or set up a consultation. It has said In addition to permitted insurance an individual does not fail to be eligible for an HSA merely because in addition to an HDHP the individual has coverage whether provided through insurance or otherwise for accidents disability dental care vision care or long-term care. Is Your Clients Hospital Indemnity Insurance HSA Compatible.

Finally if you have any questions about your state health insurance call us at 800-913-0172. For a health plan to be HSA-qualified it must meet the following criteria for 2018. He or she must.

Your HSA is yours to keep as long as you keep it open so youll still be able to use the funds in your HSA. Each benefit must pay. As such this situation has similar implications to the above section and the key is to determine if your new health insurance is HSA eligible or not.

An HSA-compatible high-deductible health plan HDHP is your health coverage with Western Health Advantage. On a per-period basis3 On the basis of a hospitalization. Here we describe some of the HSA compatible health insurance plans currently available in California.

That means youll keep your HSA regardless of your employment status or healthcare. 2600 for 2017 a limited Out-of-Pocket Maximum 7150 for an individual and 14300 for a family for 2017 AND it must not cover any additional benefits besides Preventative Care before the deductible is met. HSAs and Changing Health Insurance Coverage.

If you switch to a non-HSA compatible plan youll no longer be eligible to contribute to your HSA. If youve enrolled in an HSA compatible plan through your employer there will come a time when your relationship with that employer ends. The minimum deductible must be no less than 1350 for.

Health Savings Account Any previously allocated funds. We also offer health sharing options. Who can establish an HSA.

And 4 these variables are constantly changing. Updated December 09 2020 -- For Administrators and Employees HSAs are available only with compatible high-deductible health plans. An HSA is tax-favored savings account that is used in conjunction with a high-deductible HSA-compatible health insurance plan to make healthcare more affordable and to save for retirement.

Is It Worth Having A Hdhp To Be Eligible For A Health Savings Account

Is It Worth Having A Hdhp To Be Eligible For A Health Savings Account

5 Important Hsa Questions Employers Ask Before Choosing An Hsa Compatible Hdhp Ascensus

5 Important Hsa Questions Employers Ask Before Choosing An Hsa Compatible Hdhp Ascensus

Hsa And Medicare Can You Have Both Boomer Benefits

Hsa And Medicare Can You Have Both Boomer Benefits

Hsa Planning When Both Spouses Have High Deductible Health Plans

Hsa Planning When Both Spouses Have High Deductible Health Plans

A Massage Health Savings Accounts May Cover More Than You Think

A Massage Health Savings Accounts May Cover More Than You Think

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Health Savings Account Habits Fidelity

Health Savings Account Habits Fidelity

Illumination Wealth Managementunderstanding Your Health Insurance Plan Options Illumination Wealth Management

Illumination Wealth Managementunderstanding Your Health Insurance Plan Options Illumination Wealth Management

Hsa Vs Fsa What S The Difference Quick Reference Chart

Hsa Vs Fsa What S The Difference Quick Reference Chart

Increasing High Deductible Contributing To Increasing Hsa Payments

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.