Its the only place where you can get financial help when you buy. And 2 determining who is in.

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

By Phil Daigle on November 1 2013 805 PM 43 Comments.

Covered california magi. Steve Shorr is not a medical doctor a tax. Consumers at 400. If you make 601.

This document summarizes relevant federal regulations. This web site is owned and maintained by California Health Benefit Advisers LLC which is solely responsible for its content. For Non-MAGI if the payment is retained it is considered property in the following month.

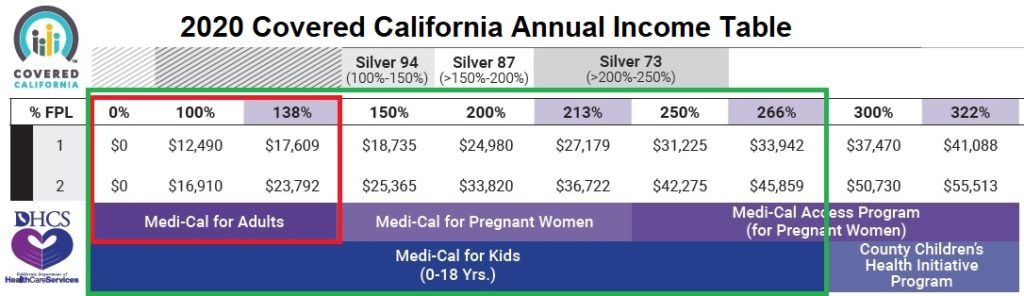

Medi-Cal and Covered California have various programs with overlapping income limits. Covered California determines if you or your dependents are eligible for Modified Adjusted Gross Income MAGI Medi-Cal based on your monthly income not you. Non-taxable Social Security benefits which can be determined by subtracting line 5b from line 5a on the 1040.

In order to be eligible for assistance through Covered California you must meet an income requirement. Must be a resident of California and agree to pay 15 of the household MAGI as a subscriber contribution. MAGI MC is for the Medi-Cal rules and APTCCSR is for Covered California subsidies.

Recipients of the RRUI can spend down or transfer in the month received to avoid excess property. Covered California California Health Benefit Exchange and the Covered California Logo are registered trademarks or service marks of Covered California in the United States. Covered California Outreach and Sales Division OutreachandSalescoveredcagov July 11 2017 Medi-Cal Access Program MCAP Household monthly income between 213 and up to 322 FPL.

For most individuals who apply for health coverage under the Affordable Care Act MAGI is equal to Adjusted Gross Income. The methodology has two components. The individual will continue with Covered California coverage until the county completes a full Medi-Cal determination.

Important Reminders 6 Duplicate applications are created when individuals have previously established a case within Covered California Once a Covered California case is linked to a county case. For Covered California programs the taxable portion is counted in the eligibility. Now CalHEERS will automatically place individuals into CFS when redetermination of eligibility results in potential MAGI Medi-Cal eligibility.

For MAGI and Non-MAGI Medi-Cal this one-time payment is counted in the month received. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. It is not personalized tax or legal advice.

The e-mail addresses and telephone numbers that appear throughout this site belong to Steve Shorr Insurance and cannot be used to contact Covered California directly unless specifically stated. If ineligible for Medi-Cal consumers may qualify for a Covered California health plan with financial help including. Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act.

If it says that your income type is not counted you dont need to put it on yourapplication. Yes the following types of income should be added to the Adjusted Gross Income line 7 on Form 1040 listed on your Tax Return in order to determine your Modified Adjusted Gross Income MAGI for Covered California. This site is not maintained by or affiliated with Covered California and Covered California bears no responsibility for its content.

You will see that for almost all income types the answer is the same in both columns. Federal tax credit Silver 94 87 73 plans and AIAN plans. In the first scenario the couple entered Covered California with an estimated MAGI of 55000.

MAGI - What It Is and What It Isnt. If it says counted in either one of the columns you should put it on your application. However when they did their federal income tax return for 2020 their final MAGI was 65000.

Their annual federal Premium Tax Credit was 21115 1760month and the California Premium Assistance Subsidy was 376 31month. Covered California News Commentary Topics of interest to both consumers and agents related to Covered California and the ACA biased in favor of the successful implementation of the Exchange and deliberately apolitical. MAGI Medi-Cal Covered California Information updated on the Covered California website is transmitted to the assigned county in the form of an electronic referral 5 CalHEERS.

Most consumers up to 138 FPL will be eligible for Medi-Cal. MAGI Modified Adjusted Gross Income is a meth-odology created under the Affordable Care Act ACA to determine financial eligibility for Medi-Cal as well as for premium tax credits and cost-sharing assistance through Covered California the states health insurance marketplace.

Covered California Q A Covered California Archives

Covered California Q A Covered California Archives

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

What To Do If You Have A Covered California Plan Become Eligible For Medicare Part 4 California Health Advocates

What To Do If You Have A Covered California Plan Become Eligible For Medicare Part 4 California Health Advocates

The Basics Of Magi Medi Cal Through Covered California

The Basics Of Magi Medi Cal Through Covered California

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

Health Care Reform Subsidies Explained In Layman S Terms

Health Care Reform Subsidies Explained In Layman S Terms

Covered California Small Business Quotes Obamacare Subsidy Chart 2016 Covered California Health Medis Dogtrainingobedienceschool Com

Covered California Small Business Quotes Obamacare Subsidy Chart 2016 Covered California Health Medis Dogtrainingobedienceschool Com

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Https Hbex Coveredca Com Toolkit Webinars Briefings Downloads Fpl Webinar Slides Final Pdf

Covered California Income Limits Explained

Covered California Income Limits Explained

Updated Countable Sources Of Income Covered California 2020

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.