A critical illness plan offers a fixed benefitpayout for critical illnesses such as. TriTerm Medical Insurance 2 underwritten by Golden Rule Insurance Company is short term health insurance that offers coverage for preventive care doctor office visits and prescriptions.

Here S How You Compare Health Insurance Plans Sick Chirpse

Here S How You Compare Health Insurance Plans Sick Chirpse

Types of Health Insurance Plans Family Floater Health Plan.

Health insurance plans. The cost of your health insurance plan could be affected by age and tobacco use but you will not be declined for an individual health insurance plan due to pre-existing conditions. Learn about 0 Silver premiums. Its a good idea to compare the total costs and benefits of the plan and not just look at the premium.

Apply once for insurance coverage terms that equal one day less than 3 years. An HSA-eligible health insurance plan has a higher deductible than other plan types but is usually the least expensive option for major medical insurance. If youre looking for a UnitedHealthcare exchange plan you may find a range of affordable reliable coverage options in your area.

Health insurance coverage for multiple years. A family floater health plan covers all family members under a single policy. Critical Illness Health Plan.

Health Insurance is a type of insurance that offers coverage to the policy holder for medical expenses in case of a health emergency. Its quick easy and helps ensure that youre satisfied with the plan you choose. Learn about UnitedHealthcare Exchange plans available near you or call 1-800-806-0451.

Find out how the American Rescue Plan will drastically cut marketplace health insurance costs for millions of Americans. Personal Health Insurance Plans. Insurance bundles that let you personalize your coverage by purchasing two or more plans together such as vision and dental insurance short term coverage and dental insurance and more.

ACA plans are also called health insurance marketplace plans or exchange plans. Individual and family medical and dental insurance plans are insured by Cigna Health and Life Insurance Company CHLIC Cigna HealthCare of Arizona Inc Cigna HealthCare of Illinois Inc and Cigna HealthCare of North Carolina Inc. Health insurance plans can vary greatly in cost based on factors such as your health your geographic region the amount of your deductible and co-pay requirements.

What Is Health Insurance Plans. A health insurance plan chosen by the insured provides coverage for different expenses including surgical expenses day-care expenses and critical illness etc. While selecting the best health insurance policy you must look into the various factors including health insurance riders benefits coverage network hospitals etc.

Aetna offers health insurance as well as dental vision and other plans to meet the needs of individuals and families employers health care providers and insurance agentsbrokers. Insurance Plan Your Health Insurance Plan The Guideline Below Will Be Able To Lead You In The Right Direction For Your Health Insurance Plan Health insurance. Health insurance plans medical insurance reimburse the insured individuals for their medical expenses that include costs related to surgeries hospitalization treatments and the like arising due to injuries illnesses or even accidents.

The American Rescue Plans premium-cutting subsidies. Typical health insurance plans for individuals include costs such as a monthly premium annual deductible copayments and coinsurance. UnitedHealthCare has a large chosen supplier network of over 790000 participating doctors.

After answering a few short questions HealthMarkets searches thousands of health insurance plans from leading insurance companies to provide a customized list of the right options for you. The higher the FitScore the closer the plan is to your ideal match. What is Health Insurance Policy.

Low cost or no cost health insurance coverage that is managed by each state. Group health insurance and health benefit plans are insured or administered by CHLIC Connecticut General Life Insurance Company CGLIC or their affiliates see. Finding the best health insurance plan from so many different health insurance companies can get confusing for many people.

Enroll now during a nationwide special enrollment period. The Health Insurance Plans provide financial support for health related emergencies It helps meet various health insurance needs be it based on the life stage of a person or a specific disease. A catastrophic health plan provides bare minimum health coverage meant for those under the age of 30 or who qualify for a hardship exemption.

Health Insurance Plans Policies In India

Health Insurance Plans Policies In India

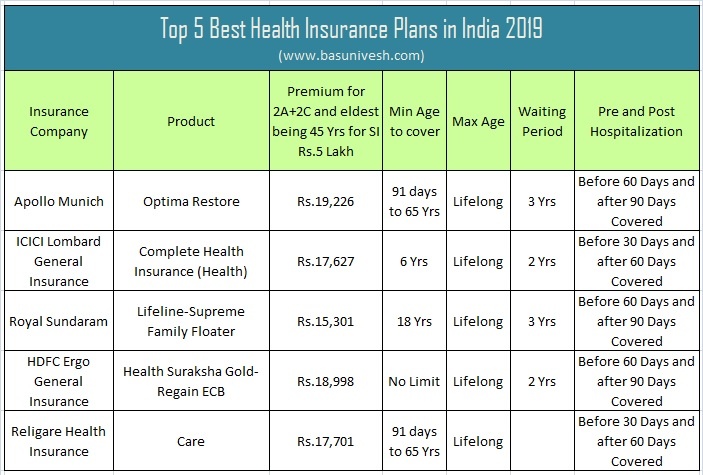

Top 5 Best Health Insurance Plans In India 2019 Basunivesh

Top 5 Best Health Insurance Plans In India 2019 Basunivesh

Comparison Of Health Insurance Plans By Hospital Accommodation Provided Download Table

Comparison Of Health Insurance Plans By Hospital Accommodation Provided Download Table

Individual Health Insurance Plans And Families

Individual Health Insurance Plans And Families

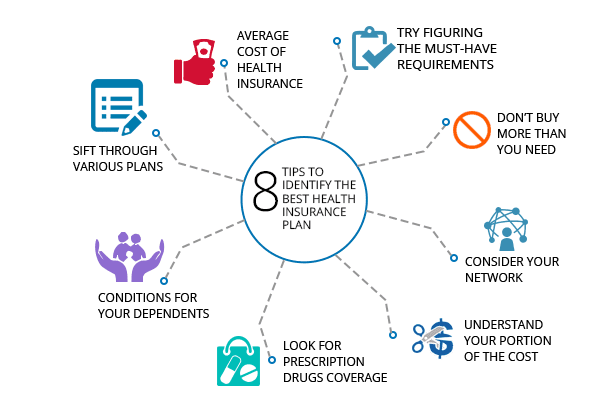

Tips To Find Best Health Insurance Plans Truecoverage

Tips To Find Best Health Insurance Plans Truecoverage

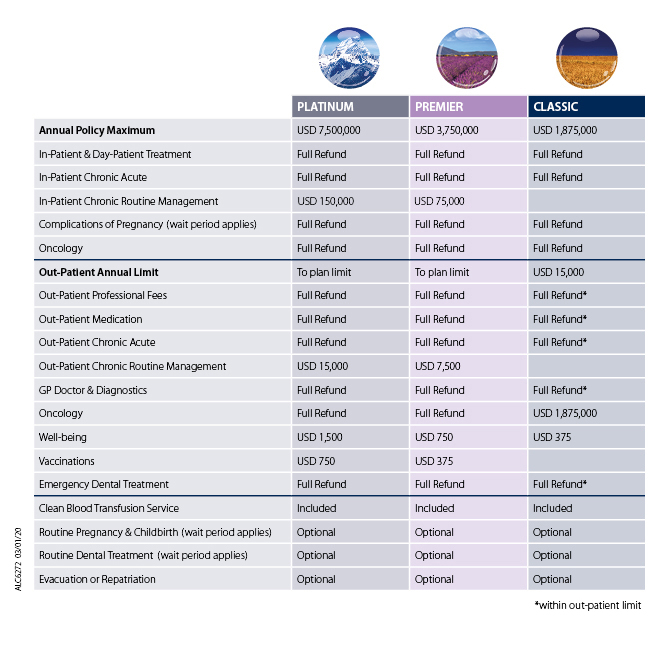

Alc Health International Medical Insurance Healthcare For Expatriates

Alc Health International Medical Insurance Healthcare For Expatriates

Individual Health Insurance Plans Quotes California Hfc

Individual Health Insurance Plans Quotes California Hfc

What Is Private Health Insurance

What Is Private Health Insurance

Illumination Wealth Managementunderstanding Your Health Insurance Plan Options Illumination Wealth Management

Illumination Wealth Managementunderstanding Your Health Insurance Plan Options Illumination Wealth Management

Best Health Insurance Plans In India For Family

Best Health Insurance Plans In India For Family

Health Insurance Compare Health Insurance Plan Compare Health Insurance Health Insurance Plans Best Health Insurance

Health Insurance Compare Health Insurance Plan Compare Health Insurance Health Insurance Plans Best Health Insurance

Bt Insight Why Individual Health Insurance Policy Matters

Bt Insight Why Individual Health Insurance Policy Matters

Should You Get Health Insurance Online

Should You Get Health Insurance Online

Health Insurance Plans Best Health Insurance Policy Online Icici Prulife

Health Insurance Plans Best Health Insurance Policy Online Icici Prulife

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.