You dont have to file Form 1095-A because individuals dont prepare that form. To get a copy of your form 1095-A you will need to contact your Marketplace insurance carrier.

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

It comes from the Marketplace not the IRS.

How can i get a 1095 a form. Contact them directly ONLY your insurer will have access to it and can provide you with a copy. The Medicare premiums you pay will show on your Social Security statement Form SA-1099. And you may need to include it with your tax return.

Information to populate Form 1095-C Parts II and III can be entered on or imported to the Setup Employees Personal tab. If a 1095-A the kind the marketplace sends was never sent out to the policy holder then it could cause issues. A copy is sent to you and the IRS.

How to find your 1095-A online Log in to your HealthCaregov account. When the pop-up appears select Open With and then OK. Form 1095-C employer-provided health insurance offer and coverage shows the coverage that is offered to you by your employer.

Under Your Forms 1095-A for Tax Filing click Down-load PDF and follow these steps based on your browser. Click here if you purchased your plan via healthcaregov. If you bought your plan there you should get a Form 1095-A also called the Health Insurance Marketplace Statement The IRS also gets a copy of the form.

Download all 1095-As shown on the screen. Internet Explorer users. This form provides information of the coverage your employer offered and whether or not you chose to participate.

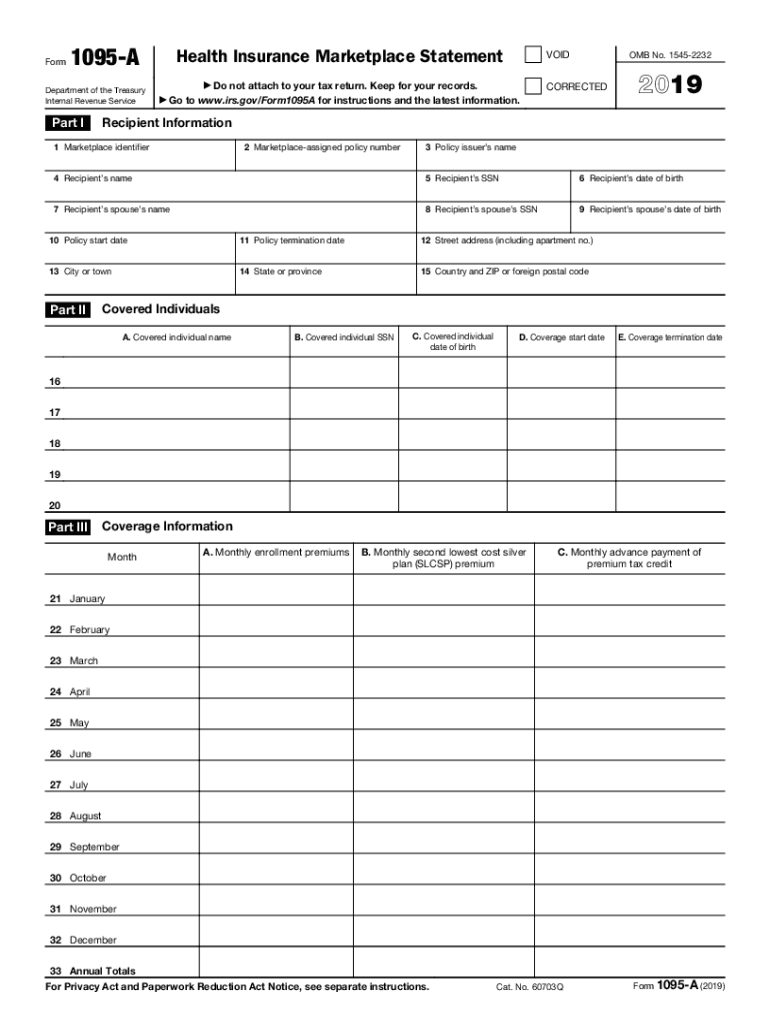

The 1095 is used to help you fill out forms like form 8962 for tax credits and is used to prove you had coverage. Click Save at the bottom and then Open. Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Health Insurance Marketplace.

If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement. If you get healthcare from your employer contact your companys benefits department. If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A.

Look for Form 1095-A If anyone in your household had Marketplace coverage in 2017 you can expect to get a Form 1095-A Health Insurance Marketplace Statement in the mail by mid-February. The form provides information about your insurance policy your premiums the cost you pay for insurance any advance payment of premium tax credit and the people in your household covered by the policy. Select Tax Forms from the menu on the left.

Form 1095-A is also furnished to individuals to allow them to take the premium tax credit to reconcile the credit on their returns with advance payments of the premium tax credit advance credit payments and to file an. When you follow these steps be sure to choose your 2018 application not your 2019 application. It is used by larger companies with 50 or more full-time or full-time equivalent employees.

Under Your Existing Applications select your 2020 application not your 2021 application. Say Thanks by clicking the thumb icon in a post Mark the post that answers your question by clicking on Mark as Best Answer. The marketplace will only issue it.

The downloaded PDF will appear at the bottom of the screen. You can do that by calling them or through your Marketplace account as Leonard Smith describes above. However if you purchased health insurance through a marketplace during any month of the year you should receive Form 1095-A from the marketplace.

If you cant find your 1095-A check online. The 1095 forms are filed at the end of January and into February but Ive heard of people getting forms as late as March. If you are on Medicare you will not receive a Form 1095-A.

If your form didnt come by mail or you cant find it check your online Marketplace account. If your form is accurate youll use it to reconcile your premium tax credit. Theres only one place where you can get a copy of your 1095 tax form.

Before you file make sure your 1095-A. Data Entry Accounting CS. If the taxpayer expects to receive Form 1095-A from the Marketplace you should wait to file the taxpayers Individual Income Tax Return until after Form 1095-A has been received.

For those in doubt the best thing one can do is contact their state Marketplace or HealthCareGov.

Understanding Your Form 1095 A Youtube

Understanding Your Form 1095 A Youtube

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Breakdown Form 1095 A Liberty Tax Service

Breakdown Form 1095 A Liberty Tax Service

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

Irs 1095 A 2019 2021 Fill And Sign Printable Template Online Us Legal Forms

Irs 1095 A 2019 2021 Fill And Sign Printable Template Online Us Legal Forms

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.