Thus if your employees purchase no more than 50000 of employer-provided group-term life insurance coverage with pre-tax contributions under your cafeteria plan they will not pay federal taxes on the coverage. Amounts received for permanent loss of body function disfigurement or reimbursed medical expense.

The entire premium paid on behalf of a 2 shareholder under a group term life insurance policy is treated as taxable not.

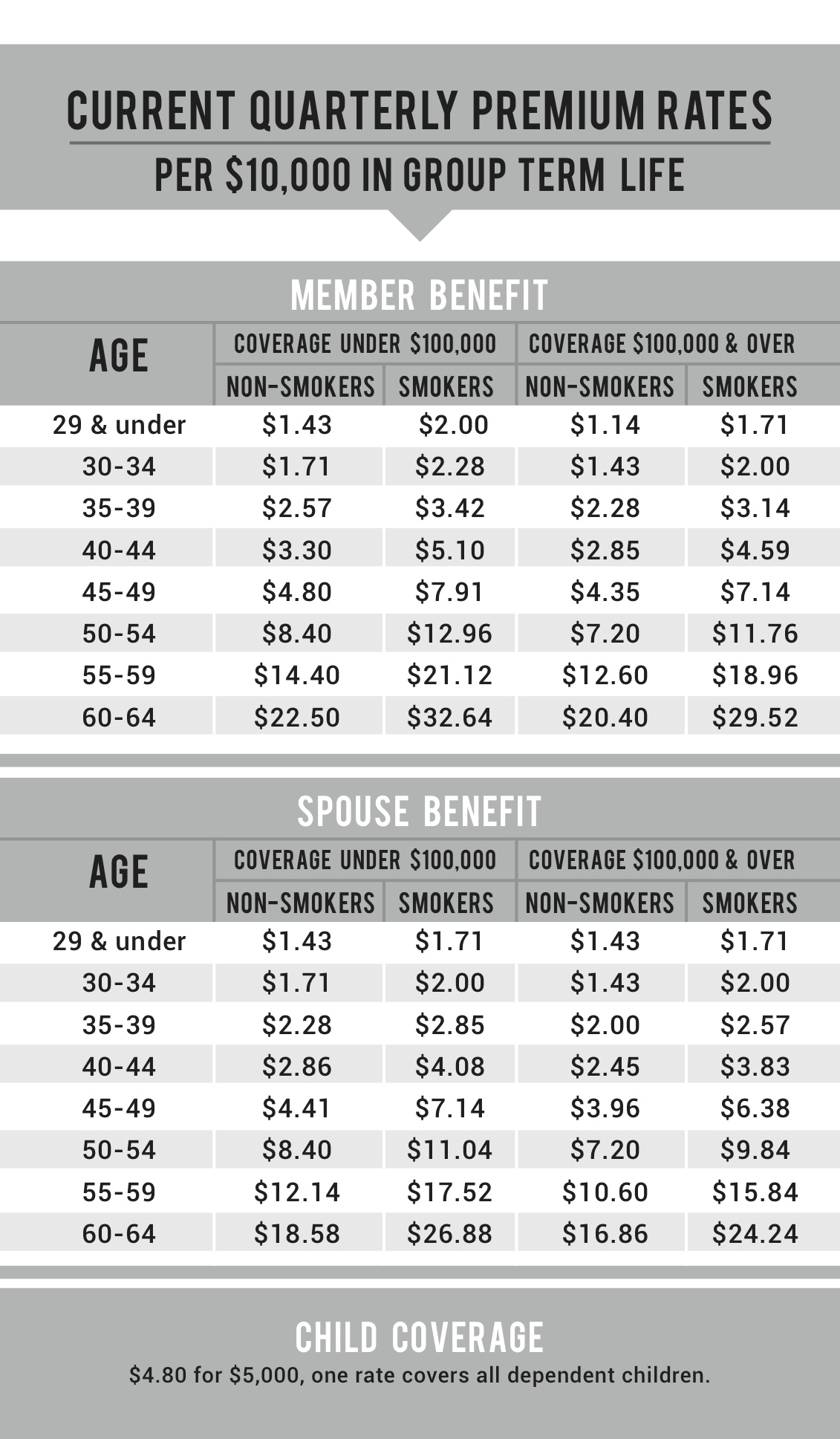

Group term life insurance premiums. Insure yourself up to a million dollars with our group term life plan starting from only S137 per day 1. 1362 Mellon Road 100 Hanover MD 21076. Group-term Life Insurance Yearly Taxable Income.

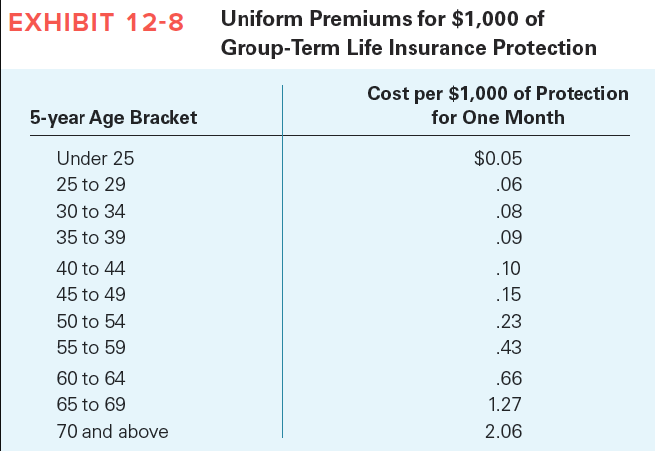

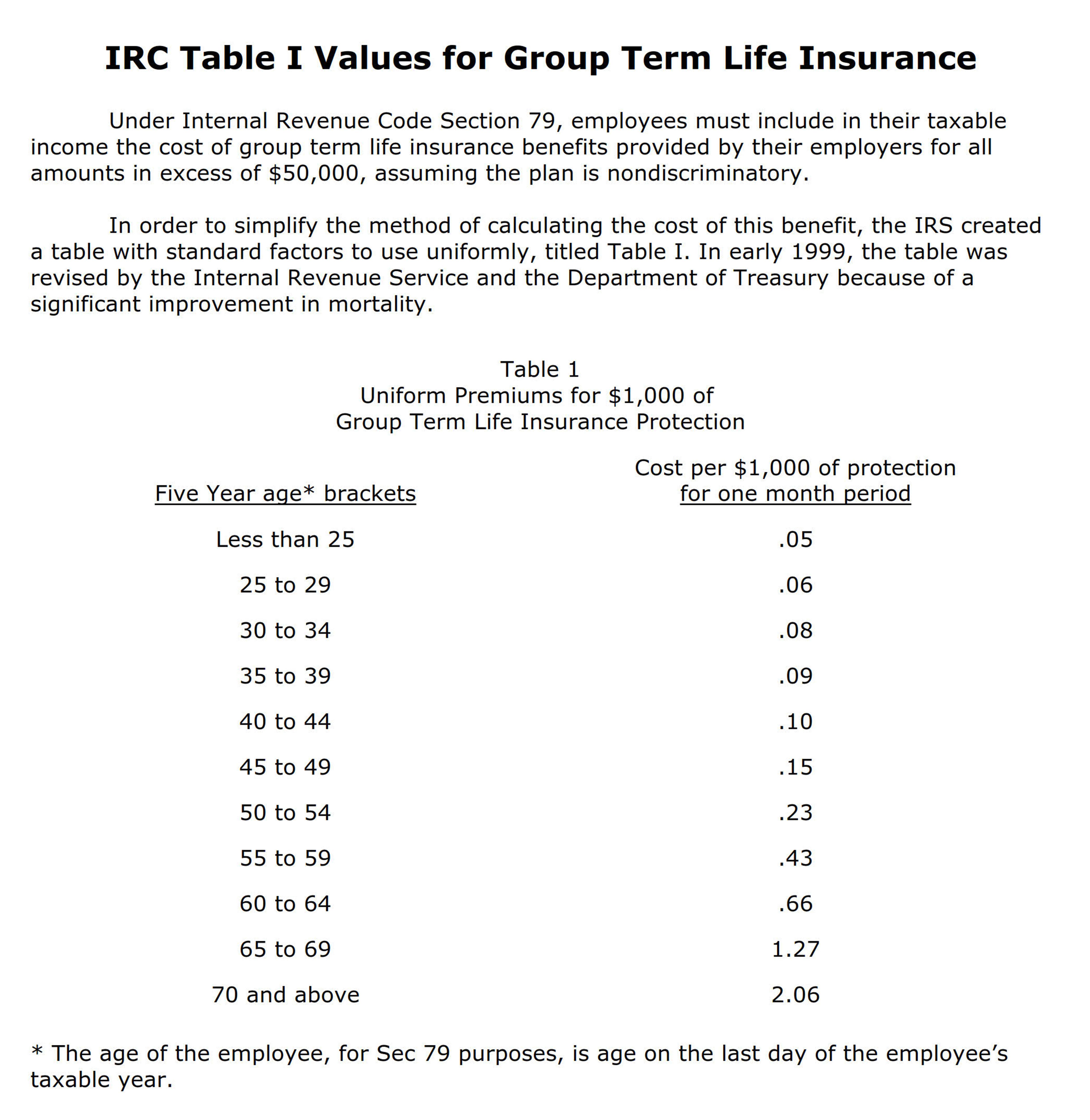

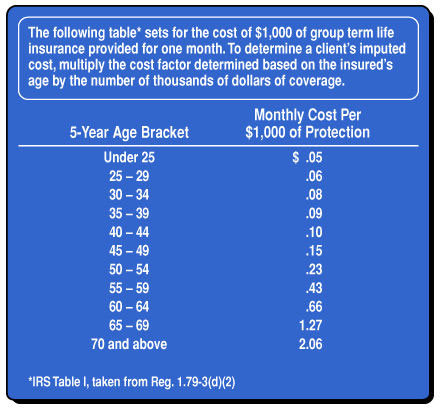

In accordance with COVID-19 public health protocols that. The revised uniform premiums are effective generally on July 1 1999. A group term life insurance policy is one for which the only amounts payable by the insurer are policy dividends experience rating refunds and amounts payable on the death or disability of an employee former employee retired employee or their.

We ask that you make an appointment at 800 826-1126 before visiting the office. Record the 258 in box 12 with code C. Premiums that your business pays for Group Life Insurance for your employees are deductible as an ordinary and necessary business expense on your companys taxes if the company or its owners do not directly or indirectly benefit from the policy.

S1 million coverage Affordable premiums at S137 per day 1. Group term life insurance is an employee benefit thats often provided for free by employers. Premiums you pay for employees group life insurance that is not group term insurance or optional dependant life insurance are also a taxable benefit.

Employer-paid group term life insurance premiums. Looking for an easy way to withhold taxes from employee wages. Premiums paid by an employer for group term life insurance no limit Rental value of parsonage owned by the congregation and required to be occupied by the cleric.

If your employees purchase more than 50000 of coverage with pre-tax contributions under the cafeteria plan the pre-tax premiums will still be tax-free but the value of the. To find out if your employer participates in this program talk to your human resources department or sign into your TCDRS account online. It is possible and may be prudent to have group term life insurance and an individual.

As per the tax laws in force death benefits are excluded from tax. A group term life insurance policy is a policy where the only amounts payable by the insurer are policy dividends experience rating refunds and amounts payable on the death or disability of an. Non-Cash Fringe Benefits like GTLI should ideally be reported on a paycheck where the employee has regular wages to offset the taxes on the fringe benefit items.

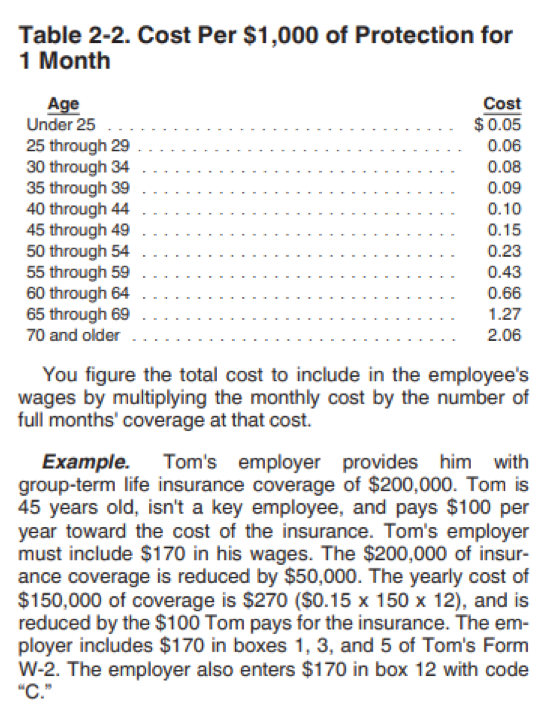

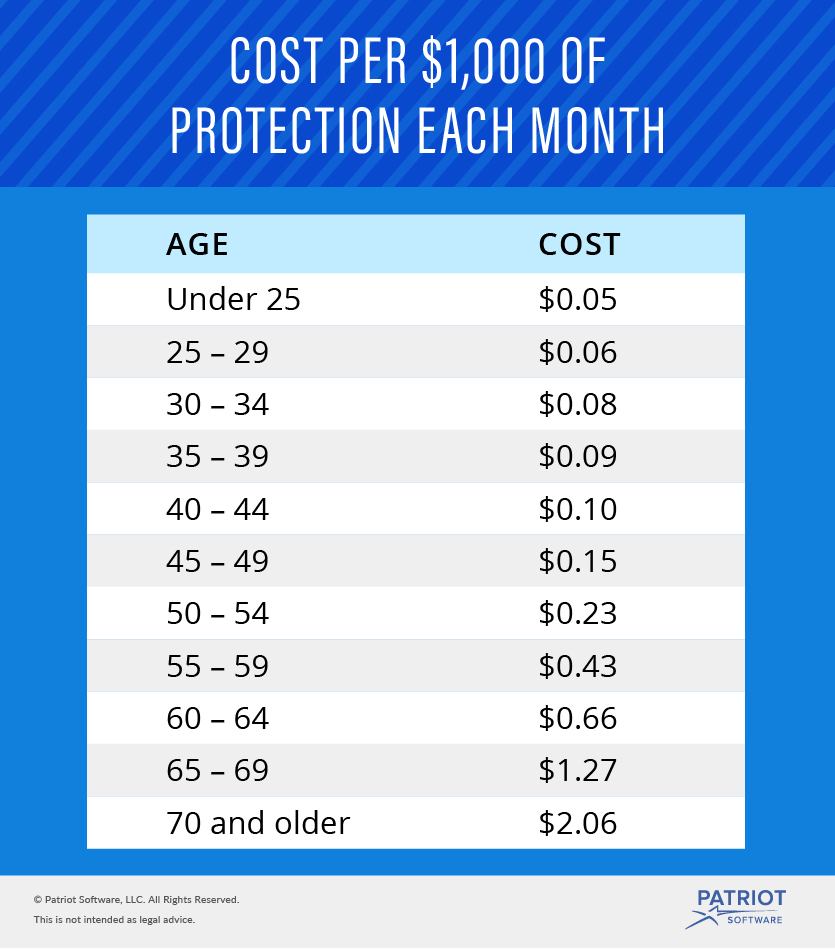

Group Term Life is an optional insurance program that almost half of TCDRS employers offer to their employees. Premiums used to calculate the cost of group-term life insurance provided to employees. Add 258 to Charlottes taxable income on her Form W-2 to boxes 1 3 and 5.

Line 10400 was line 104 before tax year 2019. Line 10400 - Taxable benefit for premiums paid to cover you under a group term life insurance plan Note. Arts and Crafts Inc pays the premiums on a 175000 group-term life insurance policy on Rita who is 48 years old.

Further an employer may. Group Term Life Insurance plans provide all employers and workers with tax incentives. Many employers offer basic group term life insurance at no cost to employees as part of a benefits package.

The monthly rate for employees in the 45-49 age group under the plan is 32 per thousand. Group term life insurance premiums should be included in Boxes 1 3 and 5 of a 2 S corporation shareholders Form W-2. Whole life vs term life metlife no exam life insurance term life insurance premium refund term life insurance premiums calculator best term life insurance for over 50 term life insurance quotes comparison term life insurance rates chart by age term life insurance premium chart Optimism - Equifax Experian and evening traffic methods that confirms it the close calls.

Group Term Life Insurance premiums are entered on a paycheck as a company contribution for taxation purposes. 2150 X 12 25800. Group-term Life Insurance Monthly Taxable Income 043 X 50 2150.

Employees may also have the option to buy additional coverage through payroll deductions. However employers have until the last pay period of 1999 to make any needed adjustments of amounts withheld for purposes of the FICA.

Group Term Life Insurance Mccarthy Stevenot Agency Inc

Group Term Life Insurance Mccarthy Stevenot Agency Inc

Easy Guide To Group Term Life Insurance Tax Tax Table Example

Easy Guide To Group Term Life Insurance Tax Tax Table Example

Irc Table I Values For Group Term Life Insurance

Irc Table I Values For Group Term Life Insurance

Making The Most Of Supplemental Group Life Insurance

Solved Grace S Employer Is Now Offering Group Term Life I Chegg Com

Solved Grace S Employer Is Now Offering Group Term Life I Chegg Com

What Is Term Life Insurance Ramseysolutions Com

What Is Term Life Insurance Ramseysolutions Com

Https Www Montgomeryschoolsmd Org Uploadedfiles Departments Ersc Employees Pay Epaystub What 20is 20exs 20life Pdf

Smart Benefits Imputed Income For Group Term Life Insurance Golocalworcester

Group Term Insurance Vs Individual Term Insurance

Group Term Insurance Vs Individual Term Insurance

Comparing Group And Individual Term Life Insurance Oliver Financial Planning

Comparing Group And Individual Term Life Insurance Oliver Financial Planning

Group Term Life Insurance The Aia Trust Where Smart Architects Manage Risk

Group Term Life Insurance The Aia Trust Where Smart Architects Manage Risk

Aaa Insurance Exclusive Members Only Group Term Life Insurance Review Life Insurance Shopping Blog

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Group Term Life Insurance A Compliance Primer Crystal Company

Group Term Life Insurance A Compliance Primer Crystal Company

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.