He or she must. Using pre-tax dollars you can save money for paying medical expenses.

To qualify for an HSA you need to be enrolled in a High Deductible Health Plan HDHP.

What plans qualify for hsa. The minimum required deductibles for an HDHP cannot be less than. How to find an HSA-eligible HDHP. Because HSAs have all these tax advantages Congress put some significant limitations in place on how they work and who is eligible for an HSA.

Be covered under a high deductible health plan HDHP that is HSA-compatible. Like the name sounds this means you have a higher deductible to pay for medical expenses. These limits for 2021 are.

3600 for self-only HDHP coverage. There are yearly limits for deposits into an HSA. Amounts are adjusted yearly for inflation.

Not be covered by any other health plan that is not an HDHP with certain exceptions. Who can establish an HSA. This list includes products like allergy medication pain relievers prenatal vitamins and tampons.

For plan year 2020 the minimum deductible for an HDHP is 1400 for an individual and 2800 for a family. To contribute to an HSA you need to have a high-deductible health plan HDHP. High Deductible Health Plans Can Lower Your Monthly Insurance Cost and Qualify You for a Health Savings Account HSA If youve spent any amount of time shopping for a more affordable health insurance plan then youve no doubt come across the term high deductible.

The minimum deductible must be no less than 1350 for individual plans and 2700 for families. Being enrolled in Medicare Medicaid or Tricare. Individuals must be covered by a qualified High Deductible Health Plan HDHP in Zenefits.

For a health plan to be HSA-qualified it must meet the following criteria for 2018. To qualify you must be under age 65 and have a high-deductible health insurance plan. You can still be HSA-eligible if your spouse is enrolled in one of.

Being covered by a Flexible Spending Account FSA. Your employer may offer an HSA option or you can start an account on your own through a bank or other financial institution. To open a health savings account HSA you must meet the following requirements according to the Internal Revenue Service IRS.

2600 for 2017 a limited Out-of-Pocket Maximum 7150 for an individual and 14300 for a family for 2017 AND it must not cover any additional benefits besides Preventative Care before the deductible is met. You must be covered under a high-deductible health plan HDHP that meets IRS requirements for the annual deductible and out. When you view plans in the Marketplace you can see if theyre HSA-eligible For 2019 if you have an HDHP you can contribute up to 3500 for self-only coverage and up to 7000 for family coverage into an HSA.

To qualify for a HSA. Updated December 09 2020 -- For Administrators and Employees Individuals must meet all of the following IRS-defined criteria in order to be eligible for opening and contributing to an HSA. Basically an HSA is meant for those whose health insurance doesnt kick in.

You cant have an HSA of your own if youre a dependent on someone elses tax return. Generally speaking a HDHP is a healthcare plan that trades relatively low premiums for relatively high deductibles as its name implies. You are covered under a high deductible health plan HDHP described later on the first day of the month.

If you have a spouse who uses your insurance as secondary coverage he or she also must be enrolled in a high-deductible plan. You have no other health coverage except. ELIGIBILITY Anyone is eligible to establish an HSA but in order to actually put money into the account you have to be insured by a Qualified High Deductible Health Plan QHDHP.

Your enrollment in any of the listed plans does not affect your qualifications for an HSA. Qualifying for an HSA To be an eligible individual and qualify for an HSA you must meet the following requirements. For a health insurance plan to be considered HSA eligible it must have a high deductible Self-only.

Not be enrolled in any part of Medicare. As part of the 2020 CARES Act over-the-counter medications and menstrual care products are now eligible for purchase with health savings accounts HSAs flexible spending accounts FSAs and health reimbursement arrangements HRAs. Anyone may establish and contribute to an HSA if he or she meets all of the following requirements.

7200 for family HDHP coverage. Are you covered by a supplemental or cancer plan discount card or discount price program employee assistance program EAP wellness or disease management program or insurance for a specified disease or illness. Thats where the HSA becomes helpful.

Another health plan that isnt HSA-qualified including a spouses health plan or a supplemental health plan. If you are age 55 or older at the end of your tax year your contribution limit is increased by 1000.

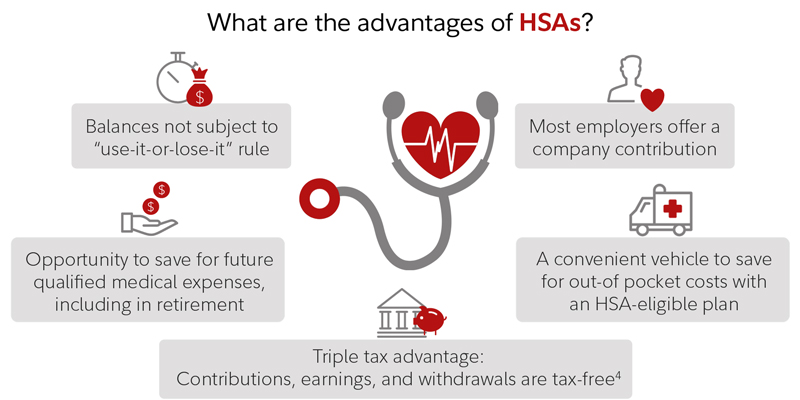

Health Savings Account Habits Fidelity

Health Savings Account Habits Fidelity

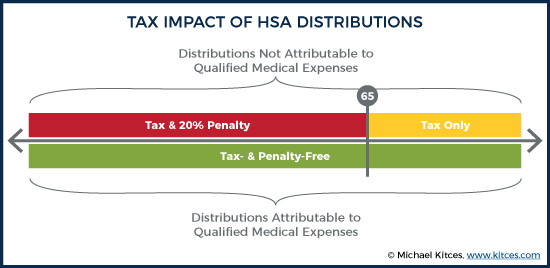

Hsa Planning When Both Spouses Have High Deductible Health Plans

Hsa Planning When Both Spouses Have High Deductible Health Plans

Health Savings Account Thrive Credit Union

Health Savings Account Thrive Credit Union

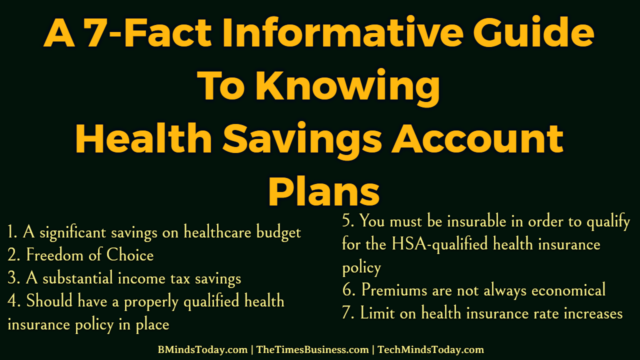

A 7 Fact Informative Guide To Knowing Health Savings Account Plans

A 7 Fact Informative Guide To Knowing Health Savings Account Plans

The Magic Of Health Savings Accounts Recovering Women Wealth

The Magic Of Health Savings Accounts Recovering Women Wealth

Hsa And Medicare Can You Have Both Boomer Benefits

Hsa And Medicare Can You Have Both Boomer Benefits

5 Things To Know About Health Savings Accounts Thinkhealth

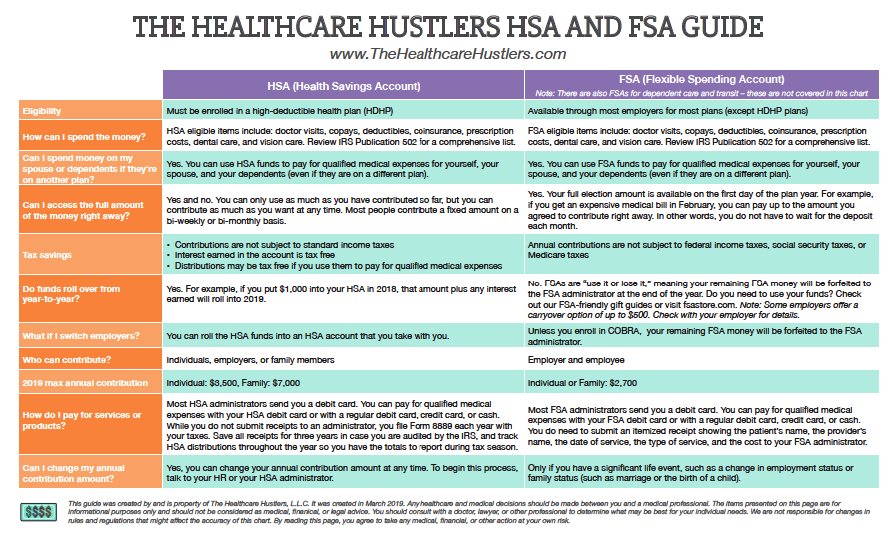

Hsa Vs Fsa What Is The Difference The Healthcare Hustlers

Hsa Vs Fsa What Is The Difference The Healthcare Hustlers

Flexible Spending Accounts Fsa Vs Health Savings Accounts Hsa

Flexible Spending Accounts Fsa Vs Health Savings Accounts Hsa

Hsas Fsas Eligibility And Contribution Limits Hays Companies

Hsas Fsas Eligibility And Contribution Limits Hays Companies

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.