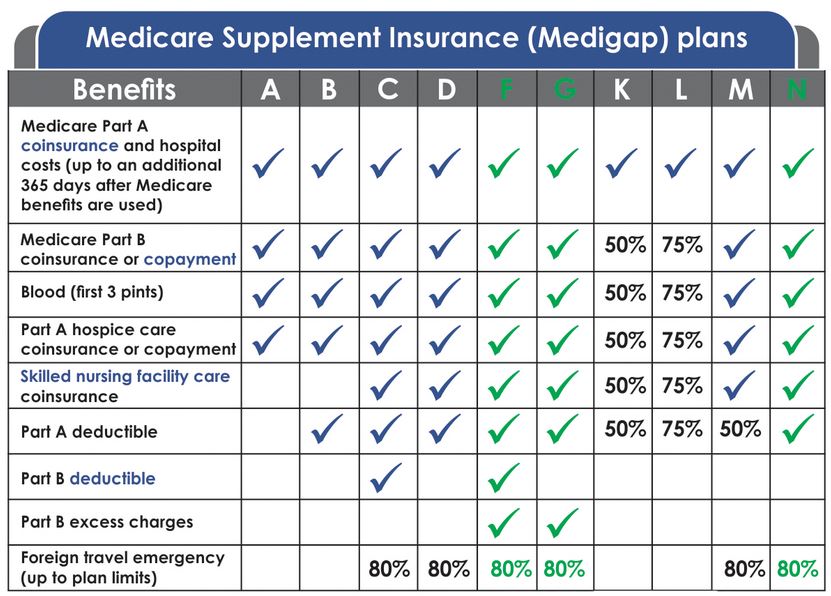

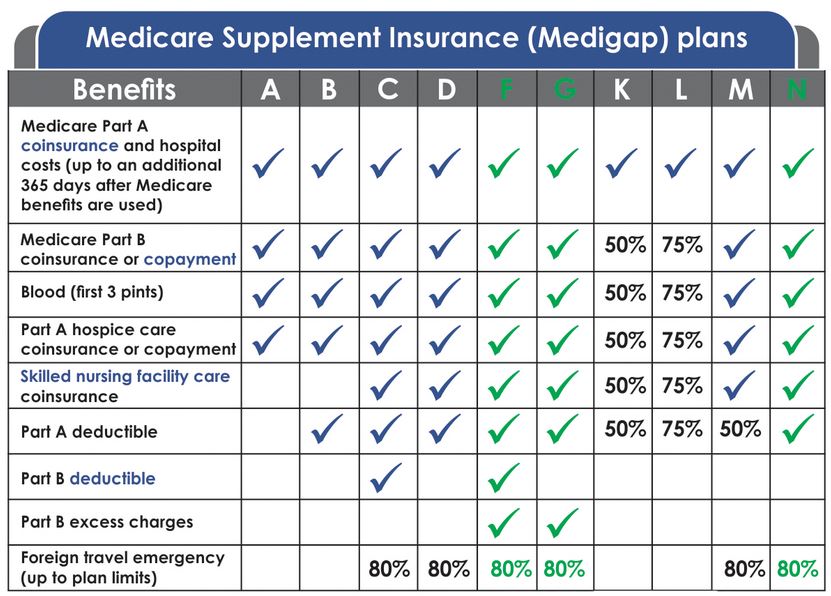

The only difference is that Plan G makes the beneficiary pay the Medicare Part B. The only cost that Medigap Plan G doesnt cover is the Part B deductible.

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

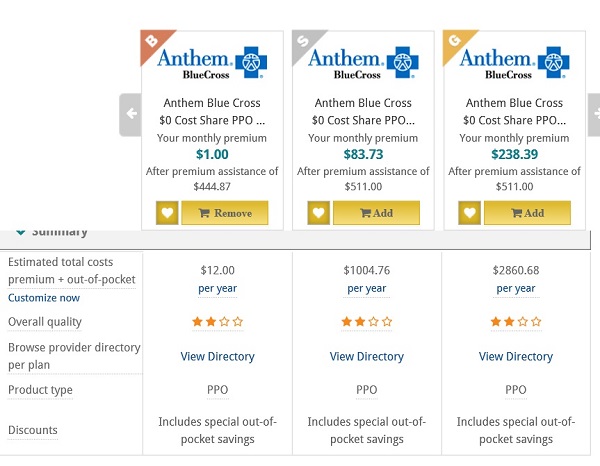

Aside from a monthly premium youll only need to meet your Original Medicare Part B deductible.

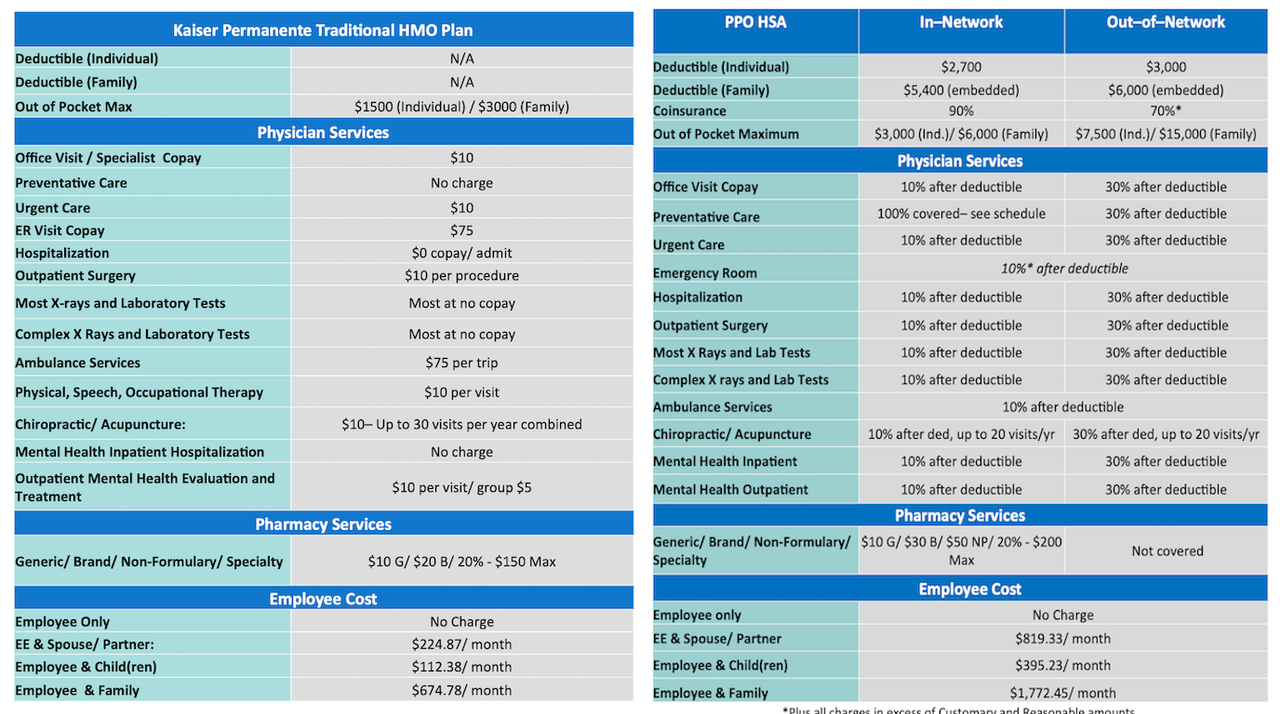

Medicare part b supplement plan g. The Part B deductible for 2021 is 203. Now Plan Ga new option for new Medicare enrollees beginning January 1 2020offers the closest available coverage to what was Plan F. Plan G does not cover the Part B deductible the Part B deductible for 2018 is 183.

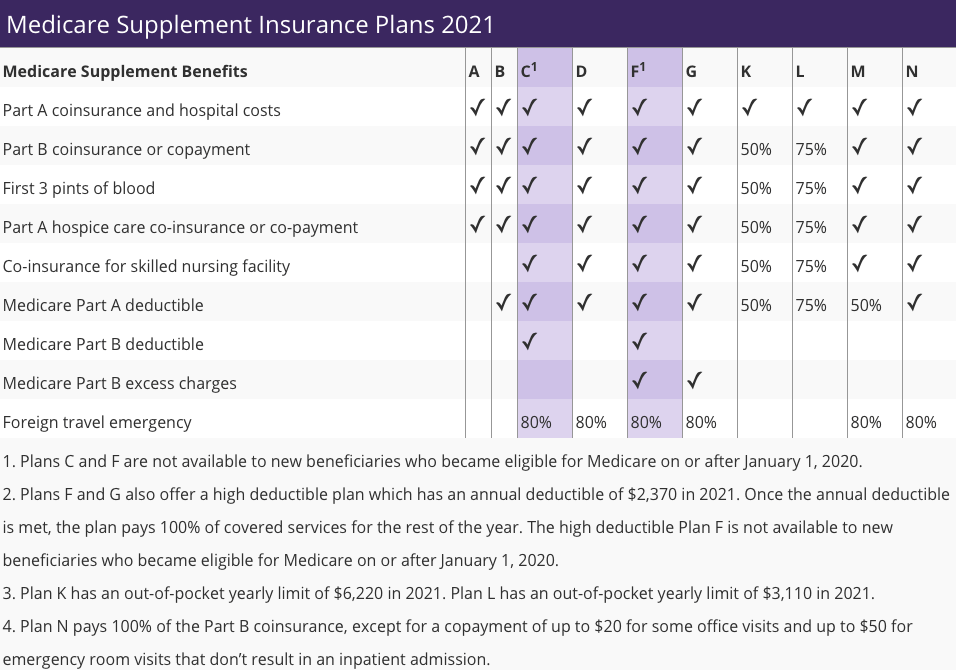

Medicare Supplement Medigap insurance Plan G benefits are the same as Medigap Plan F except that the Medicare Part B deductible must be paid out-of-pocket. Medicare supplemental Plan G is also known as Medigap Plan G. Like Medigap Plan F Plan G also covers excess charges.

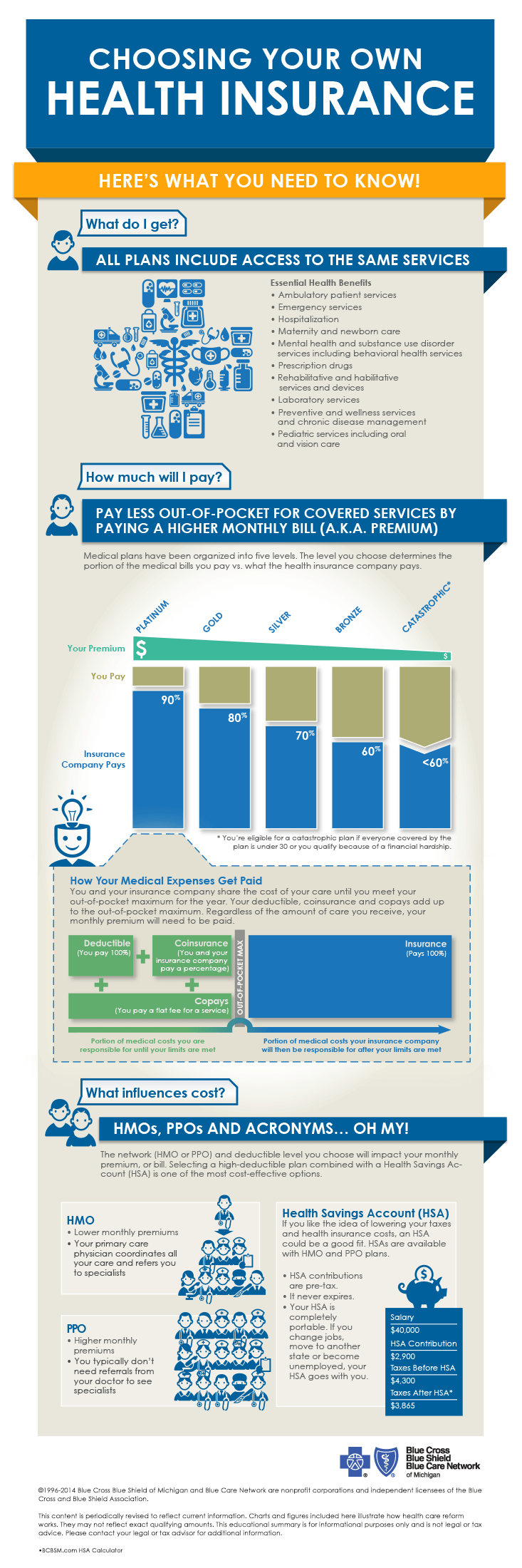

However the premiums for Plan G. Medicare Supplement Plans F and G are identical with the exception of one thing. Medicare offers an alphabet soups worth of parts and plans.

This annual deductible is only 203 for the year. With Plan G you will need to pay your Medicare Part B deductible. Plan G covers everything listed on the benefits chart with the exception of the Part B deductible.

Youll also get access to the Medicare Supplement Well-Being Program which includes. Plan G covers 80 of emergency health care costs while in another country after you pay a 250 deductible. On January 1 2020 changes to Medicare meant that Plan F and Plan C were phased out for people new to Medicare.

Decide which plan you want. However once the Part B deductible for Plan G is paid for you essentially have Plan F. People who frequently travel to foreign countries.

With Plan G youll only be responsible for the annual Part B. 3 Request a quote in your area. What is the difference between Medicare Supplement Plans F G.

Medicare Supplement Plan G is easy to understand because it covers all of the gaps in Original Medicare except one the annual Medicare Part B deductible. This deductible is 203 in 2021. Welvie SM an online surgery decision guide.

See benefits of each plan. Medigap policies are standardized and in most states are named by letters Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need.

Medicare Plan G a Medigap plan pays for many of the out-of-pocket costs that Original Medicare Part A and Part B doesnt cover. Medicare Plan G also called Medigap Plan G is an increasingly popular Supplement for several reasons. The big four are.

It covers a variety of expenses that arent covered by Medicare parts A and B such as coinsurance copays and some deductibles. Both plans offer seniors comprehensive coverage and are among the most robust of all supplements sold by AARP Insured by UnitedHealthcare Insurance Company. For Plans K and L after you meet your out-of-pocket yearly limit and your yearly Part B deductible the Medigap plan pays 100 of covered services for the rest of the calendar year.

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to with one exception. Because its a Medicare supplement plan youll be able to see any doctor nationwide who accepts Original Medicare. This means that you will have to pay 183 annually before Plan G begins to cover anything.

This is the amount you pay out of pocket every year before Medicare kicks in and starts paying its 80 percent share of your doctor lab and diagnostic costs. Plan G is one of only two supplement plans that cover Part B excess charges extra charges from doctors who dont participate in Medicare. Medicare Supplement Plan G Coverage Like other plans Plan G fills in the gaps that Original Medicare leaves uncovered.

The one item that Plan G does not cover is the Medicare Part B deductible. This means that you wont pay anything out-of-pocket for covered services and treatments after you pay the deductible. Plan G covers everything that Medicare Part A and B cover at 100 except for the Part B deductible.

Medigap Plan G is a Medicare supplement insurance plan. Medicare Nationwide specialty agents are standing by to help you pocket the difference of a lower premium by switching to G plans. Medicare Plan G which is similar to Plan F can be worth the cost if you expect significant medical bills during the year.

What Does Medicare Supplement Plan G Cover. After your out-of-pocket expenses reach the Part B deductible amount you must pay 20 of the cost of Medicare-approved Part B services. In their initial research phase many people compare Plan G to Plan F which covers the Part B deductible.

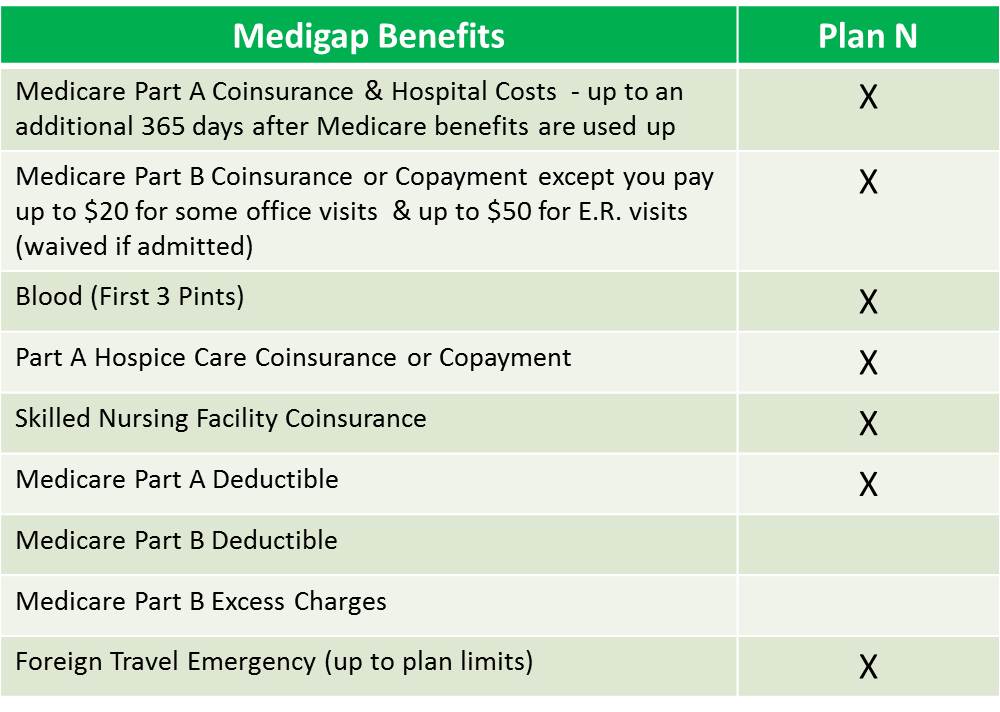

Plan N pays 100 of the Part B coinsurance except for a copayment of up to 20 for some office visits and up to a 50 copayment for emergency room visits that dont result in inpatient admission. First Plan G covers each of the gaps in Medicare except for the annual Part B deductible. Medigap Plan G is almost the same as a Plan F policy.

:max_bytes(150000):strip_icc()/ChooseAmongBronzeSilverGoldAndPlatinumHealthPlans2-d91b2944d5494cd8818e76d01230a608.png)