Preferred Provider Organizations PPOs and Health Maintenance Organizations HMOs. You can further categorize health insurance by the plan type like PPO HMO EPO or POS.

Types Of Health Insurance Plans In India The Indian Wire

Types Of Health Insurance Plans In India The Indian Wire

Some plan types allow you to use almost any doctor or health care facility.

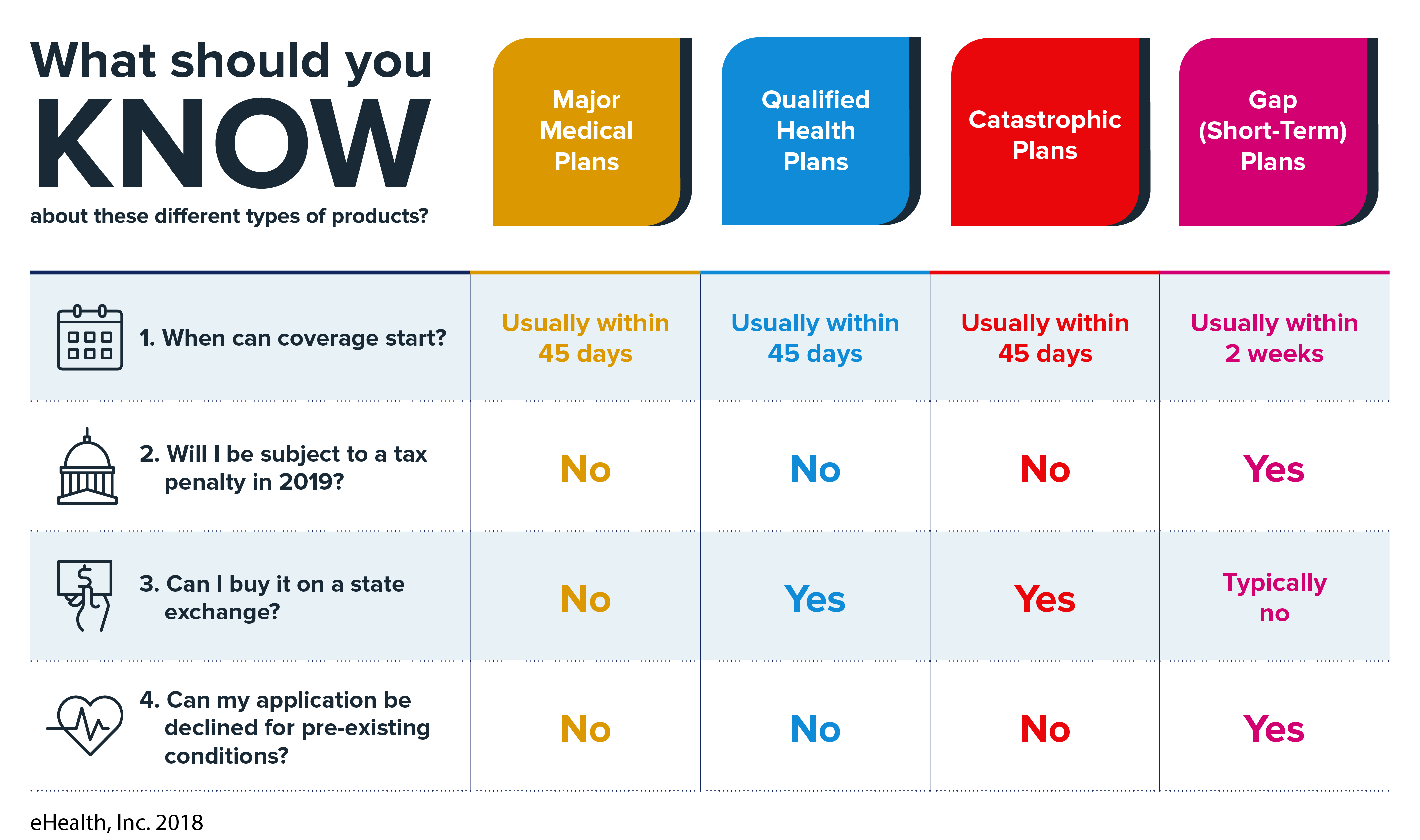

Different types of healthcare plans. Exclusive Provider Organization EPO. Some examples of plan types youll find in the Marketplace. Types of health insurance plans There are multiple different types of health insurance plans that vary depending on the copays out-of-pocket costs deductibles and which physicians take the plans.

A type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the. Basic and major medical. Some types of health insurance include HMO EPO POS and PPO plans.

It covers some hospital services and supplies such as x-rays and prescribed medicine. HMO PPO EPO or POS Higher out-of-pocket costs than many types of plans. The two main health insurance network types are.

Basic protection pays toward the costs of a hospital room and health care while you are in the hospital. If you are waiting for your application to be processed or you are not eligible for AHCCCS medical assistance you may qualify to receive drug and alcohol and mental health treatment services through other funding sources administered by the Regional Behavioral Health. An HMO is generally cheaper than a PPO but HMOs have fewer doctors available to you.

Remember that plans also may differ in quality. A managed care plan where services are covered only if you use doctors specialists or hospitals in the plans network except in an emergency. One of these types of health plans.

There are different types of health insurance plans to fit different needs. Learn more about quality ratings. The different types of health insurance include.

There may be some issues with defining healthcare plans because some health maintenance organizations HMOs call their policies plans while other companies may call different types of health insurance. Health maintenance organizations HMOs Exclusive provider organizations EPOs. 6 rows Obamacare-compliant major medical health insurance plans come in several different formats.

There are several different types of health insurance plans on the market The most common types are PPO HMO and POS The type of health insurance you need depends on your lifestyle general health budget and personal preferences. There Are Different Types Of Universal Health Coverage Programnational Health Insurance Programs Which Are Financed And Administered In Different Ways. Others limit your choices or charge you more if you use providers outside their network.

The two main types of health insurance are private and public. The most common type of health plan in the employer-sponsored market is preferred provider organization PPO plans. Healthcare plans can be broken down into types and people who purchase health insurance should know the difference in these plans.

Physicians For A National Health Insurance Program 1989 Public Assistance welfare Model Of National. Health Maintenance Organization HMO. Match The Following Type Of Health Insurance Program Or Proposal To Its Corresponding Definition.

Like other plans if you reach the maximum out-of-pocket amount the plan pays 100. There are two kinds of fee-for-service health coverage. Public health insurance like Medicare is provided through the government while private health insurance include plans you get through an employer or the marketplace.

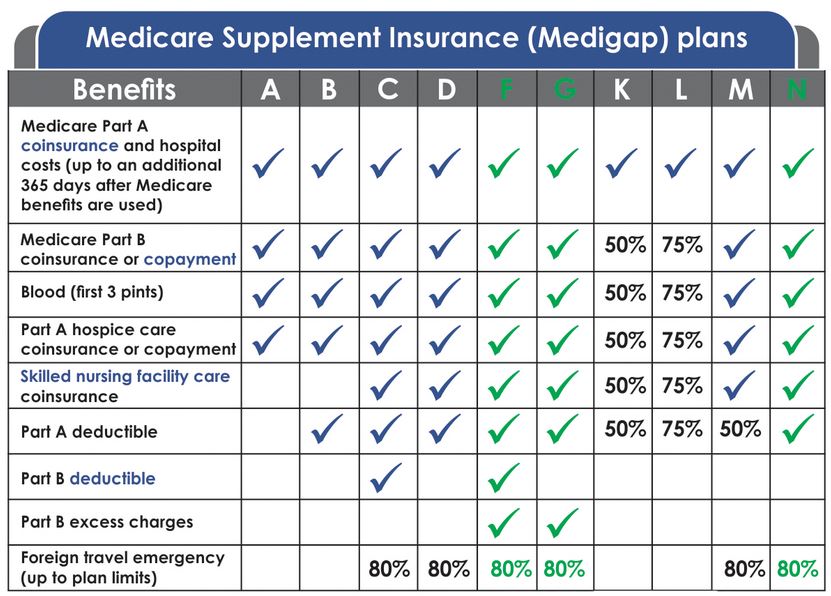

Plan and network types HMO PPO POS and EPO.