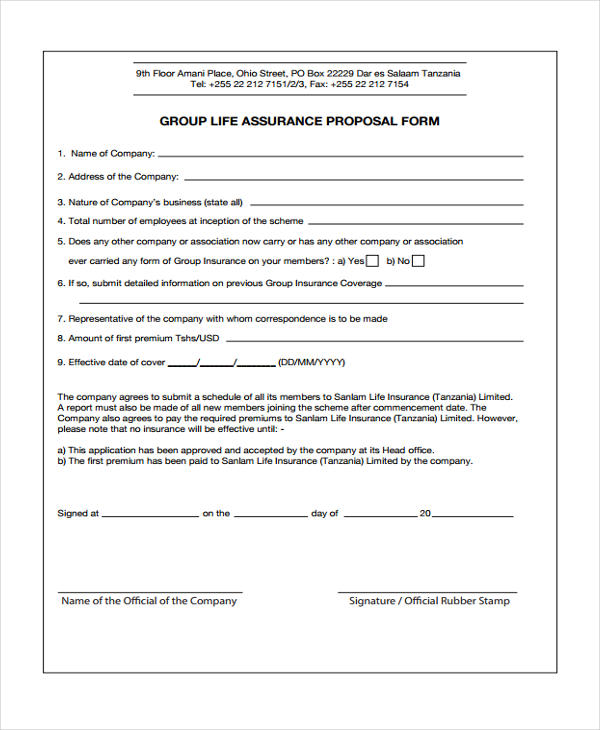

Prior authorization for the services listed below is highly recommended. Contact the Customer Care Center.

Free Anthem Blue Cross Blue Shield Prior Rx Authorization Form Pdf Eforms

Free Anthem Blue Cross Blue Shield Prior Rx Authorization Form Pdf Eforms

Blue Shield of California Promise Health Plan Medi-Cal and Cal MediConnect.

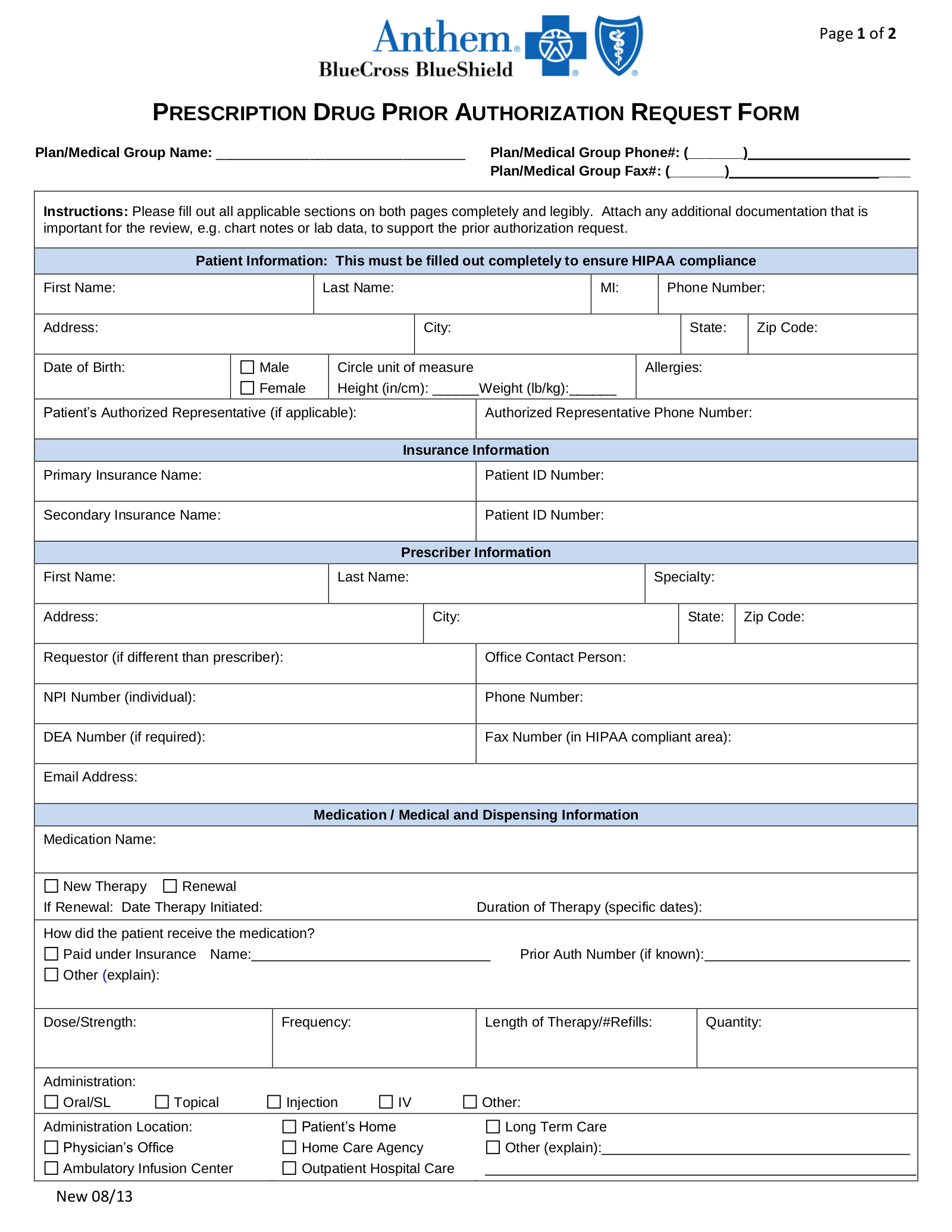

Blue cross of california prior authorization form. The Anthem Blue Cross Blue Shield prior authorization form is what physicians will use when requesting payment for a patients prescription cost. Enrollment Assistance Authorization Form - Spanish. For telephone prior authorization requests or questions please call 1-855-817-5786.

ANTHEM is a registered trademark of Anthem Insurance Companies Inc. The Blue Cross name and symbol are registered marks of the Blue Cross. Prior Authorization is a pre-approval process to determine if certain prescription drugs will be reimbursed under a members benefit planRequests will be confidentially reviewed according to payment criteria developed by Blue Cross in consultation with independent health care consultants.

Download forms guides and other related documentation that you need to do business with Anthem. If you have questions related to medical or pharmacy authorizations contact Provider Services at 800 468-9935. Anthem Blue Cross and Anthem Blue Cross Life and Health Insurance Company are independent licensees of the Blue Cross Association.

Chart notes or lab data to support the prior authorization or step-therapy exception request. ANTHEM is a registered trademark of Anthem Insurance Companies Inc. If authorization was not obtained prior to the service being rendered the service will likely be reviewed for medical necessity at the point of claim.

Providing Enrollment Assistance chevron_right. Marketing and Branding Policies chevron_right. Anthem Blue Cross and Anthem Blue Cross Life and Health Insurance Company are independent licensees of the Blue Cross Association.

Request for a Hearing to Appeal an Eligibility Determination. Blue Cross of California. Prior Authorization Health insurance can be complicatedespecially when it comes to prior authorization also referred to as pre-approval pre-authorization and pre-certification.

Inside Los Angeles County. Blue Shield of California providers. Browse commonly requested forms to find and download the one you need for various topics including pharmacy enrollment claims and more.

Important for the review eg. After hours verify member eligibility by calling the 247 NurseLine at 1-800-224-0336. Anthem Blue Cross Anthem is available by fax or Interactive Care Reviewer ICR 247 to accept prior authorization requests.

Non-Formulary Exception and Quantity Limit Exception PDF 129 KB Prior AuthorizationCoverage Determination Form PDF 136 KB Prior Authorization Generic Fax Form PDF 173 KB. For more information on obtaining prior authorization review refer to your provider manual. Submit a prior authorization Reviewed by BlueCross BlueShield.

Enrollment Assistance Authorization Form. Anthem Blue Cross and Anthem Blue Cross Life and Health Insurance Company are independent licensees of the Blue Cross Association. To find a prior authorization form visit our forms.

The Blue Cross name and symbol are registered marks of the Blue Cross Association. The form contains important information regarding the patients medical history and requested medication which Anthem will use to determine whether or not the prescription is included in the patients health care plan. Select the Drug List Search tab to access up-to-date coverage information in your drug list including details about brands and generics dosagestrength options and information about prior authorization of your drug.

Customer Care Center hours are Monday to Friday 7 am. Medical Pre-Authorization Request Anthem Blue Cross is the trade name of Blue Cross of California. Find authorization and referral forms.

Please fill out the Prescription Drug Prior Authorization Or Step Therapy Exception Request Form and fax it to 877 327-8009. Anthem Blue Cross is the trade name of Blue Cross of California. Anthem Blue Cross is the trade name of Blue Cross of California and Anthem Blue Cross Partnership Plan is the trade name of Blue Cross of California Partnership Plan Inc.

Independent licensees of the Blue Cross Association. Outside Los Angeles County. Add_circle More cancel Close.

Medication information Drug name and strength requested. The Blue Cross name and. ANTHEM is a registered trademark of Anthem Insurance Companies Inc.

Weve provided the following resources to help you understand Anthems prior authorization process and obtain authorization for your patients when its required. Anthem has also made available a series of forms. Use the Prior Authorization Lookup Tool within Availity or.

Contacting Covered California chevron_right. Our Interactive Care Reviewer ICR tool via Availity is the preferred method for submitting prior authorization requests offering a streamlined and efficient experience for providers requesting inpatient and outpatient medical or behavioral health services for our members. SIG dose frequency and duration.

To submit a medical or pharmacy authorization visit the Provider forms page and click Authorization Request request forms. Please allow Anthem Blue Cross at least 24 hours to review this request. Requests for the following services can be made by fax or mail.

Utilization Management Case Intake Forms. Fax this form to 1-844 -494 8341. Information contained in this form is Protected Health Information under HIPAA.

Patient Information First Name. Complete the form and fax the request to the fax number listed in the upper right-hand corner of the form. Independent licensees of the Blue Cross Association.

Partner Quick Links.