Retired military are required to sign up for and pay for Medicare in order to continue to receive continued medical coverage as a retired person after they turn 65. TRICARE For Life is Medicare wrap-around coverage for TRICARE beneficiaries.

Tricare For Retirees Military Com

Tricare For Retirees Military Com

They do not have to pay a monthly payment called a premium for Part A because they or a spouse paid Medicare taxes while they were working.

/retiring-without-savings-at-60-years-old-91210a08a6f24b299d75c6e31ca0b937.gif)

Do military retirees have to pay for medicare. Because Medicare normally pays first before other coverage chances are that any available retiree policy will require you to have at minimum Medicare Part A. If you do not sign up for Medicare Part B during your Initial Enrollment Period you may be subject to late enrollment penalties if you decide to sign up later on. TriCare participants are able to suspend their FEHB enrollment if they wish after retiring from federal service.

At one time retired people lost their medical coverage at the age of 65. Medicare cannot pay for the same service that was covered under the VA benefits and vice versa. Medicare Part A is paid from payroll taxes while you are working.

If youre retired but have coverage through a retiree plan from your former employer then Medicare usually serves as the primary payer. At that point they had to go on Medicare and as such they had less coverage than they had previously had. Social Security and Medicare taxes While youre in military service you pay Social Security taxes just as civilian employees do.

Security benefits because of your military retirement benefits. If you are retired military or a military spouse and have TriCare you must sign up for Medicare Part B in the 3 months before turning 65 in order to continue with TriCare for life. It is important to note that Medicare is never.

Military retirees pay the same for Medicare as anyone else both in payroll taxes and premiums when enrolled. But if a person is eligible for TRICARE can they also receive Medicare. Youll get your Social Security benefit based on your earnings and age you choose to start receiving benefits.

Tricare Standard coverage also stops at age 65 for military retirees living overseas. Your current TRICARE premiums will be halved as a result. The Part B late enrollment penalty is 10 percent of the Part B premium for each 12-month period in which you were eligible to enroll but did not.

If youre retired from the military and your spouse reaches age 65 before you do he or she must transfer from TRICARE to TFL and enroll in Part B at the same time even though youre still receiving coverage from TRICARE. You must have Medicare Part A and B in order to have TRICARE coverage when you are 65. If youre 65 but have an active duty sponsor you dont have to have Medicare Part B until your sponsor is retired.

Military insurance is currently provided as Tricare and Tricare requires most beneficiaries to enroll in Medicare Part B when eligible in order to contue to receive benefits. If you or your spouse did not pay Medicare. TFL typically covers your Medicare cost-sharing deductibles coinsurances and copayments.

If you get Social Security or Railroad Retirement Board RRB benefits your Medicare Part B Medical Insurance premium will. Sign up before your sponsor retires to avoid a gap in TRICARE coverage. Or you must have proof of your ineligibility for Medicare.

Then those living in the States are covered by Medicare Part A and are eligible for Tricare for Life coverage. Medicare will pay your covered costs first then your. TRICARE for Life is specifically for Medicare eligible military retirees.

Americans who are over 65 years old or who have a qualifying disability are eligible for Medicare the federal health insurance program. TRICARE for Life TFL a program for Medicare -eligible military retirees and their dependents acts as a supplement to Medicare. Federal employees cant suspend FEHB coverage while still working.

6 rows But its not that simple - as many retired officers will discover when they become. You must have Medicare Part A and Medicare Part B to be eligible for TRICARE For Life. For more information visit.

Older members of the military veterans and military retirees may be eligible for TRICARE which is the health care program of the United States Department of Defenses Military Health System. When a military retiree or spouse reaches 65 they are eligible for Medicare and TRICARE for Life medical coverage. Medicare Part B has a monthly premium which is based on your income.

TFL may pay when services are not covered by Medicare or when you have used up your Medicare benefits.

Six Things About Military Retirement Pay Military Com

Six Things About Military Retirement Pay Military Com

How To Save 600 Billion In Health Care While Protecting The Disadvantaged Committee For A Responsible Federal Budget

Could Medicare For All Be Financed Entirely By Cutting Defense Spending Committee For A Responsible Federal Budget

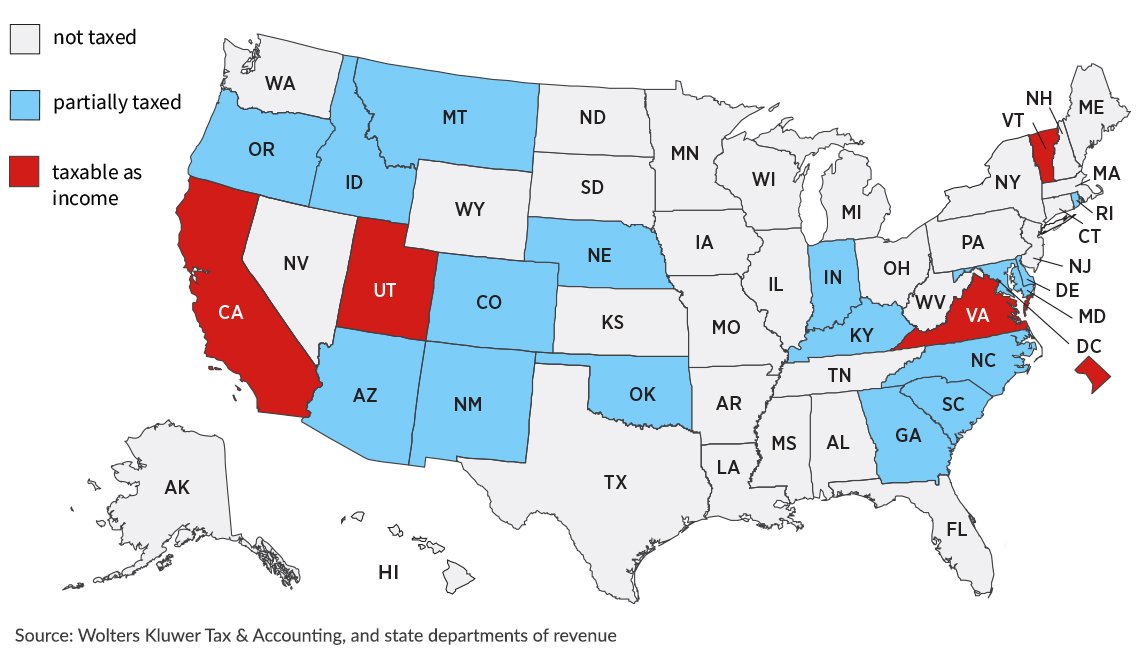

States That Won T Tax Your Military Retirement Pay

States That Won T Tax Your Military Retirement Pay

Health Care How Military Retirees Can Budget For Costs Money

Health Care How Military Retirees Can Budget For Costs Money

/retiring-without-savings-at-60-years-old-91210a08a6f24b299d75c6e31ca0b937.gif) Retirement With No Savings At 60 Years Old

Retirement With No Savings At 60 Years Old

How Much Will I Receive When I Retire From The Military Baby Boomers Us News

How Much Will I Receive When I Retire From The Military Baby Boomers Us News

Health Care For Retirees Military Com

Health Care For Retirees Military Com

Health Benefits For Medicare Eligible Military Retirees Rationalizing Tricare For Life Rand

Health Benefits For Medicare Eligible Military Retirees Rationalizing Tricare For Life Rand

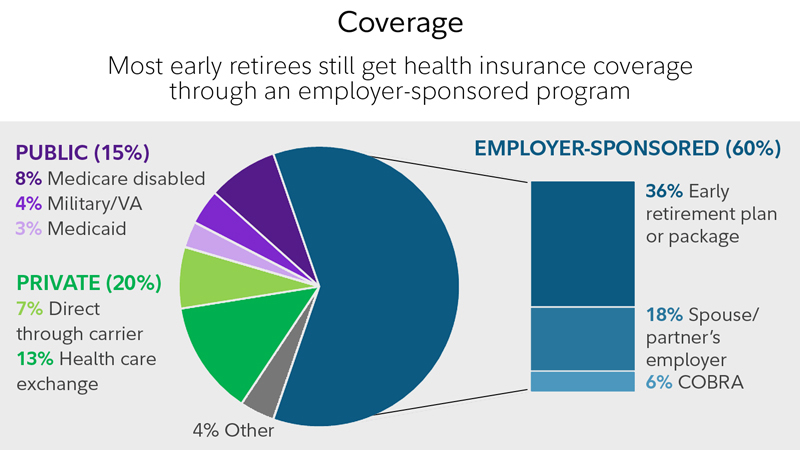

Bridging The Health Care Coverage Gap Fidelity

Bridging The Health Care Coverage Gap Fidelity

How To Optimize Medicare For Those Who Have Served In The Military Investmentnews

How To Optimize Medicare For Those Who Have Served In The Military Investmentnews

Here S The List Of Military Clinics That Will No Longer Serve Retirees Families Military Com

Here S The List Of Military Clinics That Will No Longer Serve Retirees Families Military Com

States That Won T Tax Your Military Retirement Pay

States That Won T Tax Your Military Retirement Pay

Can A Veteran With Va Benefits Safely Quit Paying For Medicare Part B

Can A Veteran With Va Benefits Safely Quit Paying For Medicare Part B

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.