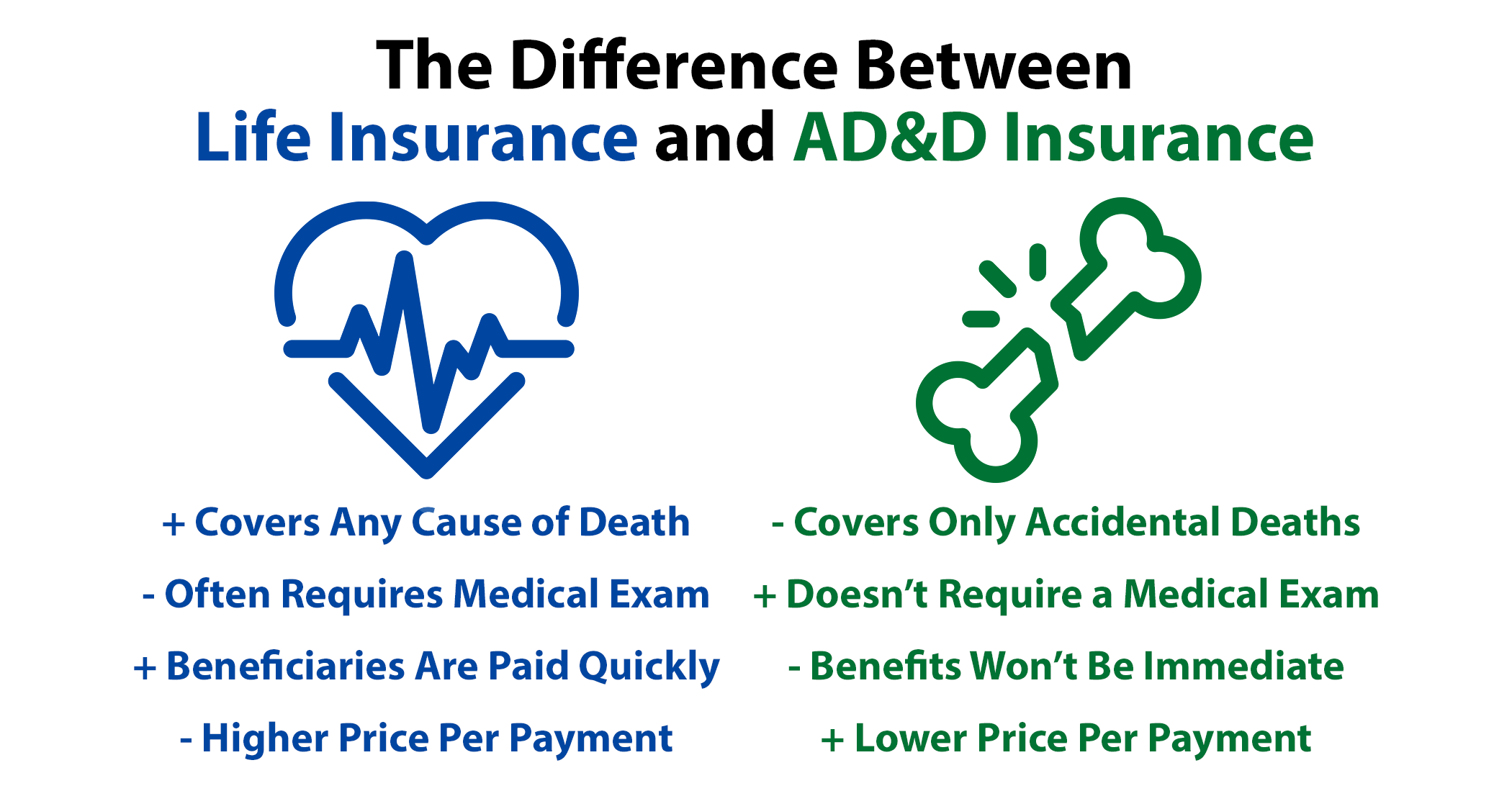

Accidental death and dismemberment ADD insurance is usually added as a rider to a life insurance policy. You shouldnt consider ADD insurance as a replacement for life insurance.

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

ADD insurance covers accidental death and dismemberment.

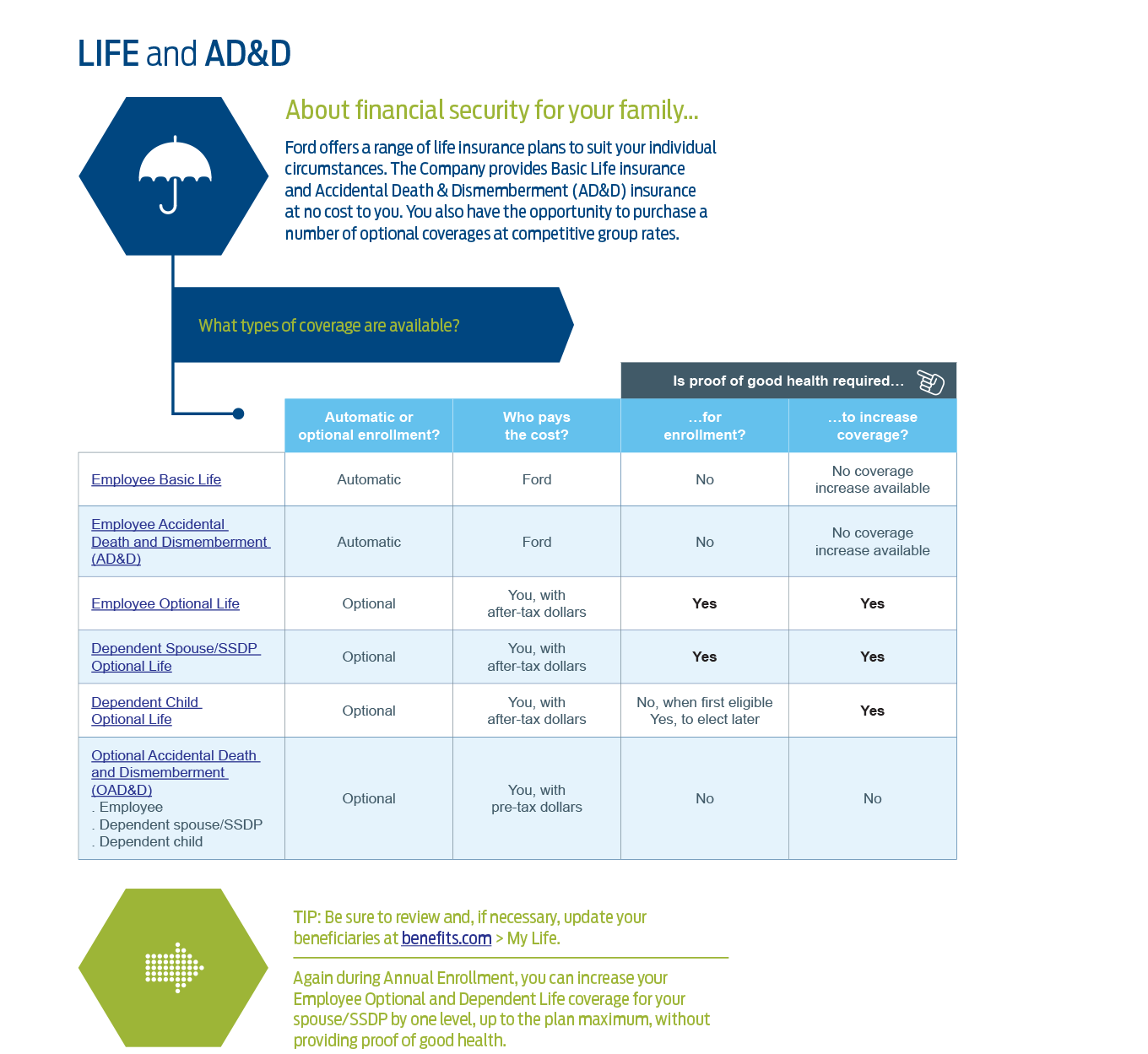

Life and ad&d. What Does ADD insurance cover. NortonLifeLock provides you with Basic Life Insurance and Accidental Death and Dismemberment ADD Insurance and the opportunity to purchase additional coverage for yourself and your dependents. An employees loved ones depend on them.

Life insurance and Accidental Death and Dismemberment ADD insurance will help financially protect you and your family in the case of death or serious injury. Life and ADD Insurance Life and accident insurance plans offer financial protection for you and your family. Life and Accidental Death and Dismemberment ADD insurance through Cigna provide financial security to you and your family if you become seriously injured or pass away.

While insured under this provision your beneficiary will be paid a sum of one and a half 15 times your salary to a max of 300000. This also applies for Basic ADD Insurance and Voluntary ADD Insurance in the event of your death due to a covered accidental injury. This also helps our claim analysts recognize when beneficiaries need more support such as a referral for grief counseling.

You can name anyone you want as the beneficiary for your Life Insurance in the event of your death. The life benefit is paid to your designated beneficiary in the event of your death. Life insurance pays funds to a beneficiary after death while ADD pays an amount equal to your life insurance benefit in the event of an accidental death or various benefit amounts for certain injuries.

It doesnt provide the kind of coverage you find in life insurance. These ADD benefits can help you and your family pay for things like special care and modified living. They take part in specialized grief training every year.

The policy coverage amount is 1x your annual salary 50000 minimum 200000 maximum. ADD based on what each actually covers how much they cost and how easy they are to get. A term life insurance policy is better coverage than ADD insurance because it provides a payout for any cause of death except suicide generally within the first two years of having the policy.

No charge to employees. Basic ADD insurance is provided as part of your Basic Life coverage and provides a benefit for death or for certain severe injuries resulting from an accident. What does this mean.

With Life and Accidental Death and Dismemberment ADD Insurance you can help them prepare for the unexpected and give them the confidence to live life to its fullest knowing their loved ones will be protected. At age 75 benefits further reduce to 50 of the original amount. Optional Life and ADD Coverage.

We provide you with basic life and ADD coverage through Cigna at no cost. Basic Life and ADD Insurance As an eligible colleague you receive Basic Life and ADD insurance equal to your annual earnings to a maximum of 300000. ADD insurance pays benefits in the case of a persons accidental death or dismemberment.

An employee is best protected when they have access to both Life and ADD. If you name more than one beneficiary. ADD is also not a replacement for disability insurance.

ADD Helps After a Severe Accident. Premium for Basic Life and ADD is paid by the Company. Accidental Death and Dismemberment.

Anthem Life and ADD - company paid All full-timeregular teammates US locations only are automatically enrolled in a company paid Life and ADD insurance policy through Anthem. Accidental Death and Dismemberment insurance known as ADD pays an amount specified in the policy if a covered accident results in your death. Once coverage is reduced due to age it cannot increase even if the employees annual earnings increase.

At age 70 benefits reduce to 65 of the original amount of coverage. Life insurance and ADD insurance overlap slightly and cover similar instances of death but its important to know the difference between the two to understand when ADD coverage may not protect you. Triangle provides all full-time employees Basic Life insurance.

We weighed the pros and cons of life insurance vs. Basic life ADD and any applicable supplemental life and ADD for you or your dependents is provided at no cost to you. ADD coverage is limited to accidents.

It may also pay benefits for a severe physical loss such as a hand a foot or your eyesight. You can purchase additional coverage for yourself spouse or children at the premiums below. Our Life and ADD team members know how to listen and offer compassionate support.

Life insurance and accidental death and dismemberment ADD insurance protect your family financially if you die or are seriously injured.

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Micsc Accidental Death And Dismemberment Ad D

Micsc Accidental Death And Dismemberment Ad D

Life Insurance Human Resources Academic Personnel Services

Life Insurance Human Resources Academic Personnel Services

What To Know About Ad D Insurance Forbes Advisor

What To Know About Ad D Insurance Forbes Advisor

Basic Voluntary Group Life Benefits Direct

Life Insurance Accidental Death And Dismemberment Ad D Quest Insurance The Best Value For Your Insurance Dollars

Life Insurance Accidental Death And Dismemberment Ad D Quest Insurance The Best Value For Your Insurance Dollars

What Is Accidental Death And Dismemberment Coverage Quotacy

What Is Accidental Death And Dismemberment Coverage Quotacy

Get To Know Your Group Term Life And Ad D Insurance Hub

Get To Know Your Group Term Life And Ad D Insurance Hub

Group Basic Life And Ad D Benefits New Mexico State University

Group Basic Life And Ad D Benefits New Mexico State University

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.